Territorial taxation limits tax liability to income earned within a country's borders, exempting foreign-sourced income from domestic taxation. This system benefits multinational corporations by avoiding double taxation and simplifying compliance with cross-border operations. Discover how territorial taxation impacts your business strategy and international tax planning in the rest of this article.

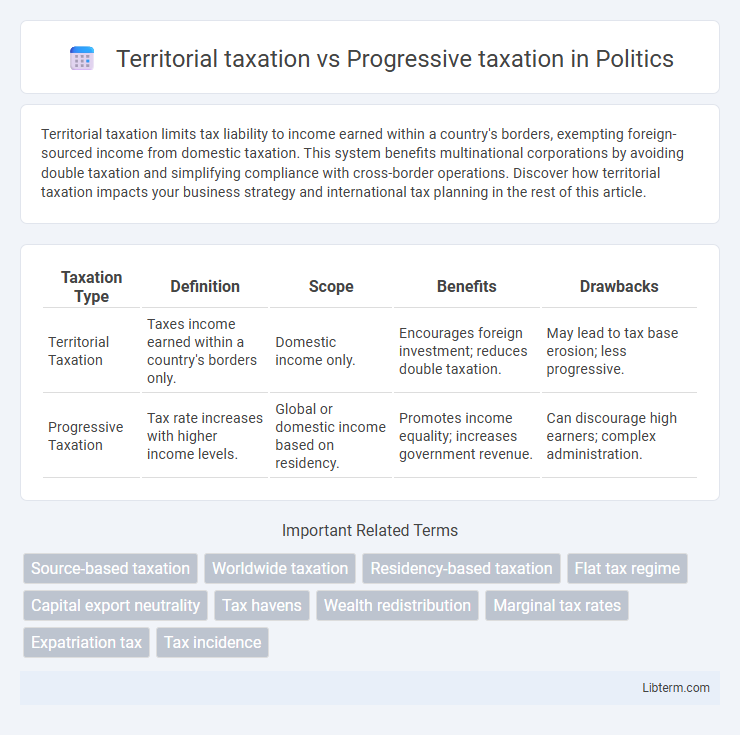

Table of Comparison

| Taxation Type | Definition | Scope | Benefits | Drawbacks |

|---|---|---|---|---|

| Territorial Taxation | Taxes income earned within a country's borders only. | Domestic income only. | Encourages foreign investment; reduces double taxation. | May lead to tax base erosion; less progressive. |

| Progressive Taxation | Tax rate increases with higher income levels. | Global or domestic income based on residency. | Promotes income equality; increases government revenue. | Can discourage high earners; complex administration. |

Understanding Territorial Taxation: Definition and Key Features

Territorial taxation is a tax system where a country taxes only the income earned within its borders, exempting foreign-sourced income from domestic taxation. This system incentivizes international business expansion by reducing the tax burden on foreign profits and preventing double taxation. Key features include tax neutrality on foreign income, simplified tax reporting for multinational corporations, and alignment with global tax treaties.

What Is Progressive Taxation? Core Principles Explained

Progressive taxation imposes higher tax rates on increased income levels, ensuring that individuals with greater earnings contribute a larger share to public revenues. This system is designed to promote economic equity by redistributing wealth through graduated tax brackets, where rates escalate as taxable income rises. Core principles of progressive taxation include ability to pay, tax fairness, and reducing income inequality, which contrast with territorial taxation that taxes only domestic income regardless of the taxpayer's global earnings.

Comparing Tax Base: Source-Based vs. Worldwide Income

Territorial taxation imposes tax only on income earned within a country's borders, focusing on a source-based tax base, which excludes foreign income from domestic taxation. Progressive taxation applies tax rates that increase with income levels and typically targets worldwide income, requiring residents to report and pay taxes on global earnings. This distinction influences taxpayer obligations, administrative complexity, and the potential for double taxation or tax avoidance strategies.

Economic Impacts: Growth, Investment, and Revenues

Territorial taxation encourages foreign investment by taxing only domestic income, which can stimulate economic growth and increase capital inflows. Progressive taxation, by imposing higher rates on increased income, aims to redistribute wealth but may deter high earners from investing or expanding businesses, potentially slowing growth. The balance between these systems affects government revenues and investment levels, with territorial systems often boosting competitiveness and progressive structures enhancing fiscal equity.

Effects on Individuals and Businesses

Territorial taxation limits taxation to income earned within a country's borders, benefiting multinational businesses by avoiding double taxation and encouraging foreign investment, while individuals with foreign income often face lower tax burdens. Progressive taxation imposes higher tax rates on increasing income brackets, impacting high earners with greater tax liabilities and potentially reducing disposable income for both individuals and businesses. This system can influence business decisions on wage distribution and expansion, as well as individuals' work incentives and spending power.

Administrative Simplicity vs. Complexity

Territorial taxation systems simplify administration by taxing only domestic income, reducing cross-border compliance and reporting requirements, which lowers costs for tax authorities and taxpayers. Progressive taxation, based on increasing tax rates as income rises, introduces complexity through multiple tax brackets, detailed income categorization, and varied deductions, requiring more extensive record-keeping and enforcement resources. The simpler framework of territorial taxation contrasts with the intricate structure of progressive taxation, influencing administrative efficiency and compliance burden in fiscal policy design.

International Competitiveness and Capital Flows

Territorial taxation systems enhance international competitiveness by taxing only domestic income, attracting multinational corporations seeking to repatriate foreign earnings without double taxation. Progressive taxation, with higher rates on increased income, may deter capital flows as investors and businesses face greater tax burdens on global profits. Countries employing territorial taxation structures often experience increased foreign direct investment and improved capital mobility compared to those relying heavily on progressive tax rates.

Social Equity: Wealth Distribution and Income Inequality

Territorial taxation limits tax liability to income earned within a country, which can reduce government revenue needed for social programs aimed at wealth redistribution. Progressive taxation levies higher tax rates on higher income brackets, effectively addressing income inequality by funding social equity initiatives. Countries using progressive tax systems tend to have lower income disparities and better social welfare outcomes compared to those relying primarily on territorial taxation.

Real-World Examples: Countries Using Territorial and Progressive Taxation

Countries like Singapore and Hong Kong employ territorial taxation, taxing only income earned within their borders, which attracts multinational corporations by avoiding double taxation on foreign earnings. In contrast, the United States and Germany use progressive taxation systems where tax rates increase with income levels, ensuring wealthier individuals and corporations contribute a larger share to public finances. These models reflect varying approaches to balancing tax competitiveness and social equity on a global scale.

Choosing the Right System: Policy Considerations and Future Trends

Territorial taxation limits tax liability to income earned within a country's borders, promoting foreign investment and economic competitiveness, while progressive taxation imposes higher rates on increased income levels to enhance equity and fund social programs. Policymakers must balance economic growth incentives with social equity goals when choosing between these systems, considering factors such as domestic revenue needs, international tax harmonization, and income distribution. Future trends indicate a hybrid approach, integrating elements of both systems alongside digital economy tax measures, to address globalization challenges and evolving fiscal priorities.

Territorial taxation Infographic

libterm.com

libterm.com