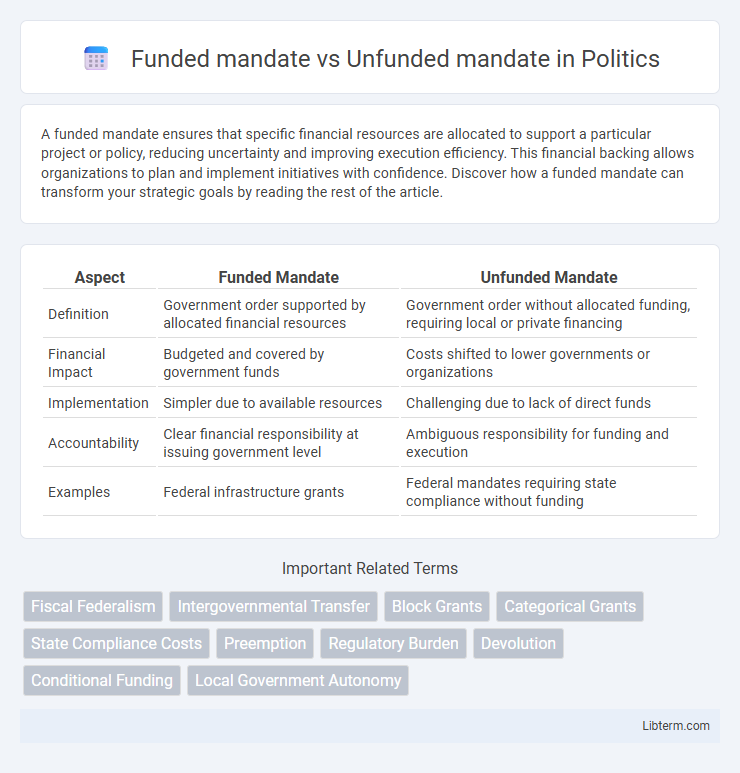

A funded mandate ensures that specific financial resources are allocated to support a particular project or policy, reducing uncertainty and improving execution efficiency. This financial backing allows organizations to plan and implement initiatives with confidence. Discover how a funded mandate can transform your strategic goals by reading the rest of the article.

Table of Comparison

| Aspect | Funded Mandate | Unfunded Mandate |

|---|---|---|

| Definition | Government order supported by allocated financial resources | Government order without allocated funding, requiring local or private financing |

| Financial Impact | Budgeted and covered by government funds | Costs shifted to lower governments or organizations |

| Implementation | Simpler due to available resources | Challenging due to lack of direct funds |

| Accountability | Clear financial responsibility at issuing government level | Ambiguous responsibility for funding and execution |

| Examples | Federal infrastructure grants | Federal mandates requiring state compliance without funding |

Understanding Mandates: Definitions and Differences

A funded mandate requires the federal government to provide financial resources to state or local governments to implement specific programs, ensuring that the assigned responsibilities have allocated budgets. An unfunded mandate obligates lower levels of government to comply with federal directives without accompanying funding, often creating financial strain on state or local agencies. Understanding the distinction between funded and unfunded mandates is crucial for assessing the fiscal impact and administrative feasibility of government policies.

What Is a Funded Mandate?

A funded mandate refers to a government directive that requires states or localities to perform certain actions while providing the necessary financial resources to cover the associated costs. This contrasts with an unfunded mandate, where the government imposes obligations without offering funding, leaving local entities responsible for expenses. Funded mandates ensure compliance and reduce financial strain on subordinate jurisdictions by allocating budgeted funds specifically for mandated programs or services.

What Is an Unfunded Mandate?

An unfunded mandate requires state or local governments to perform certain actions with no provided federal funding to cover the associated costs, often leading to budget strain. These mandates compel compliance without financial assistance, such as the Americans with Disabilities Act regulations imposed on public facilities. The lack of allocated funds forces governments to divert resources from other programs or raise taxes to meet federal requirements.

Historical Context of Mandates in Legislation

Funded mandates trace back to the New Deal era when the federal government provided financial assistance to states for implementing national policies, ensuring compliance through allocated resources. Unfunded mandates emerged prominently after the 1970s, particularly with the Unfunded Mandates Reform Act of 1995, addressing concerns over federal requirements imposed on states without accompanying funding. Historically, the shift from funded to unfunded mandates reflects tensions between federal authority and state autonomy in legislative policymaking.

Key Examples of Funded Mandates

Funded mandates require the federal government to provide financial resources to states or local governments to implement specific programs, ensuring compliance without straining local budgets. Key examples of funded mandates include Medicaid expansion under the Affordable Care Act, highway construction funded by federal transportation grants, and the Individuals with Disabilities Education Act (IDEA), which allocates federal funds to support special education services. These mandates contrast with unfunded mandates, which impose obligations without accompanying financial support, often creating fiscal challenges for subnational governments.

Notable Cases of Unfunded Mandates

Unfunded mandates often impose financial burdens on state and local governments without providing corresponding federal funds, leading to significant budgetary challenges. Notable cases include the Americans with Disabilities Act (ADA) and the Clean Air Act Amendments, where compliance costs were substantial for municipalities and states, sparking debates over federalism and fiscal autonomy. Courts and policymakers have frequently grappled with the balance between enforcing federal standards and respecting local fiscal capacity in these landmark instances.

Impact on State and Local Governments

Funded mandates require the federal government to provide financial resources to state and local governments to implement specific programs or regulations, reducing fiscal stress and enabling more effective compliance with federal directives. Unfunded mandates, conversely, impose obligations on state and local governments without accompanying funding, often leading to budget reallocations, strained resources, and potential reductions in local services. The financial burden of unfunded mandates can hinder the ability of state and local governments to meet federal requirements while maintaining essential public services.

Advantages and Disadvantages of Funded Mandates

Funded mandates provide financial resources to cover the costs of compliance, reducing fiscal pressure on state and local governments and enabling more effective implementation of federally required programs. However, these mandates may limit local flexibility by imposing specific federal standards and can increase dependency on federal funding, potentially reducing innovation in addressing unique community needs. The guaranteed funding helps ensure accountability and consistent service delivery but might lead to budgetary constraints if funds are insufficient or delayed.

Challenges Posed by Unfunded Mandates

Unfunded mandates impose significant financial burdens on local governments by requiring them to implement federal or state regulations without providing sufficient funding, straining already limited budgets and resources. These mandates often lead to reduced public services, deferred infrastructure maintenance, and increased local taxes or fees to cover costs. The uncertainty and variability in funding create challenges in long-term planning, compliance, and equitable service delivery.

Policy Recommendations and Future Outlook

Funded mandates provide state and local governments with federal financial support to implement policies, enabling more effective program execution and reducing the fiscal burden on local entities. Unfunded mandates impose requirements without allocated funds, often resulting in budgetary strain and challenges in compliance, which can hinder policy outcomes and lead to calls for legislative reform. Future policy recommendations emphasize increasing federal funding for mandates and enhancing intergovernmental collaboration to ensure sustainable implementation and improved service delivery.

Funded mandate Infographic

libterm.com

libterm.com