Consistency builds trust and strengthens your personal or professional brand by demonstrating reliability and commitment over time. Maintaining steady effort and clear communication helps achieve long-term goals and fosters positive relationships. Discover practical strategies to enhance your consistency by reading the rest of this article.

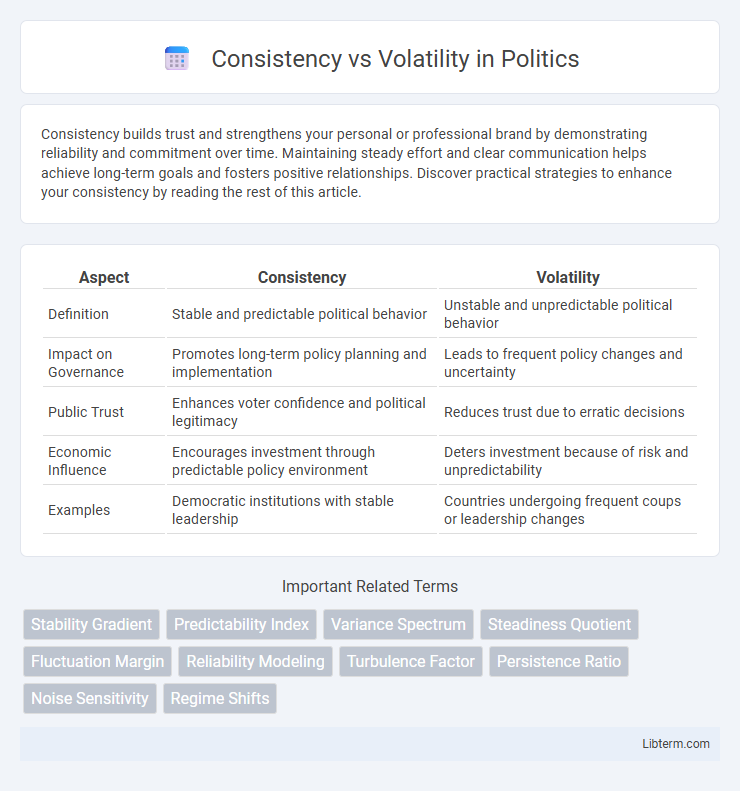

Table of Comparison

| Aspect | Consistency | Volatility |

|---|---|---|

| Definition | Stable and predictable political behavior | Unstable and unpredictable political behavior |

| Impact on Governance | Promotes long-term policy planning and implementation | Leads to frequent policy changes and uncertainty |

| Public Trust | Enhances voter confidence and political legitimacy | Reduces trust due to erratic decisions |

| Economic Influence | Encourages investment through predictable policy environment | Deters investment because of risk and unpredictability |

| Examples | Democratic institutions with stable leadership | Countries undergoing frequent coups or leadership changes |

Understanding Consistency and Volatility

Consistency refers to the stability and predictability of data, processes, or behaviors over time, ensuring reliable outcomes and reducing the risk of unexpected changes. Volatility, on the other hand, characterizes the degree of fluctuation and unpredictability within a system or dataset, often leading to sudden shifts and increased uncertainty. Understanding consistency and volatility is crucial for effective decision-making, risk management, and optimizing performance in dynamic environments.

The Psychology Behind Consistent Performance

Consistent performance stems from psychological traits such as discipline, resilience, and a growth mindset, which enable individuals to maintain focus and manage stress effectively. Unlike volatility driven by impulsivity and emotional reactivity, consistency is often linked to goal-setting, self-regulation, and motivation that fosters long-term success. Research in cognitive psychology highlights that habitual routines and positive reinforcement strengthen neural pathways, promoting sustained, reliable performance outcomes.

Volatility: Risks and Rewards

Volatility represents the frequency and magnitude of price fluctuations in financial markets, signaling increased risk but also potential for higher returns. Investors embracing volatility must manage the possibility of sharp losses while capitalizing on opportunities for rapid gains through strategic timing and diversified portfolios. Understanding volatility metrics such as the VIX index aids in assessing market uncertainty and tailoring risk management approaches.

Comparing Long-term Outcomes

Consistency in investments generally leads to more stable long-term outcomes with steady growth and lower risk, while volatility can result in higher short-term gains but increased uncertainty and potential losses. Long-term consistency supports compound growth by minimizing drastic fluctuations, making it easier to plan and achieve financial goals. In contrast, volatile markets may yield unpredictable returns, requiring a higher risk tolerance and active management to capitalize on temporary opportunities.

Key Factors Influencing Consistency

Key factors influencing consistency include stable processes, reliable input data, and clear operational standards that minimize variability. Consistency improves when organizations implement rigorous quality control protocols and maintain uniform performance metrics across all activities. Moreover, employee training and effective communication play crucial roles in sustaining consistent outcomes despite external changes.

When Volatility Becomes an Advantage

Volatility becomes an advantage in markets where rapid price fluctuations create opportunities for higher short-term gains through strategic trading. Traders leveraging volatility capitalize on price swings by employing techniques like momentum trading, arbitrage, and risk-adjusted portfolio rebalancing. Consistent volatility metrics, such as the VIX index, help investors identify optimal entry and exit points to maximize returns during turbulent market conditions.

Industries Where Consistency Matters Most

Industries such as healthcare, finance, and manufacturing prioritize consistency to ensure safety, compliance, and quality control, reducing operational risks and maintaining stakeholder trust. In these sectors, consistent processes and outcomes are critical for regulatory adherence and long-term customer satisfaction. Volatility in these environments can lead to costly errors, legal penalties, and damage to reputation, making stability and predictability essential for sustained success.

Strategies for Managing Volatility

Effective strategies for managing volatility revolve around maintaining consistency in risk assessment and decision-making processes. Employing diversified investment portfolios, setting predefined stop-loss orders, and adhering to disciplined rebalancing routines reduce exposure to unpredictable market fluctuations. Leveraging quantitative models and real-time data analytics enhances the ability to identify volatility patterns and adjust strategies proactively.

Striking the Balance: Consistency vs Volatility

Striking the balance between consistency and volatility is key for effective decision-making in dynamic environments. Maintaining consistency ensures reliable performance and trust, while managing volatility allows for adaptability and innovation during market fluctuations or operational changes. Achieving this equilibrium involves strategic risk management and agile processes that sustain steady outcomes without stifling growth opportunities.

Making the Right Choice for Your Goals

Choosing between consistency and volatility depends on your financial goals and risk tolerance; consistent investments provide steady growth with lower risk, ideal for long-term stability. Volatile options may offer higher returns but come with greater unpredictability, suitable for those willing to accept potential losses for rapid gains. Balancing these strategies ensures alignment with your objectives, whether prioritizing capital preservation or aggressive growth.

Consistency Infographic

libterm.com

libterm.com