Stability is crucial for maintaining balance in both physical structures and emotional well-being, providing a foundation that supports growth and resilience. Ensuring stability in your environment helps reduce stress and promotes a sense of security essential for thriving in daily life. Explore the rest of this article to discover effective strategies for enhancing stability in various aspects of your life.

Table of Comparison

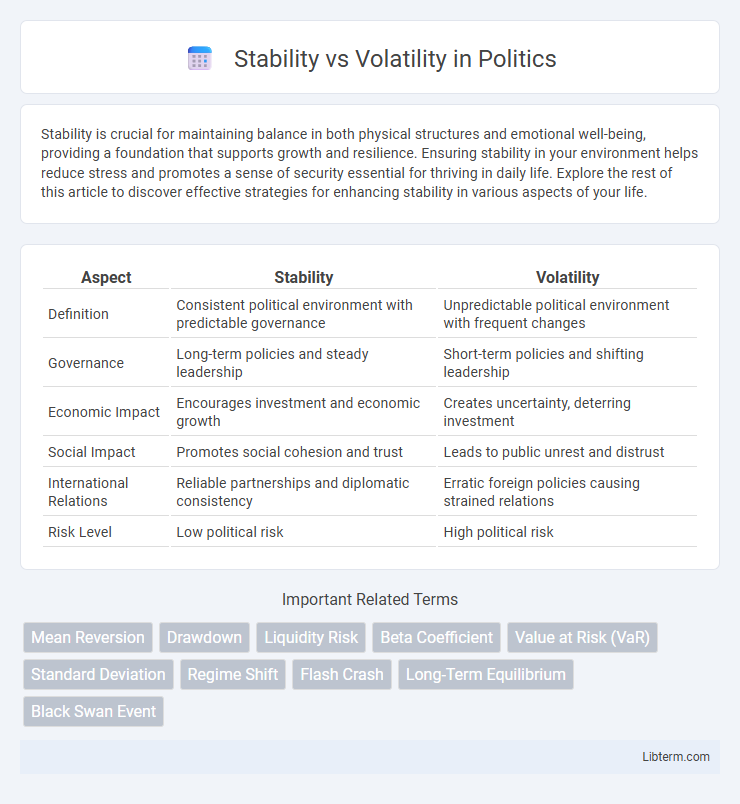

| Aspect | Stability | Volatility |

|---|---|---|

| Definition | Consistent political environment with predictable governance | Unpredictable political environment with frequent changes |

| Governance | Long-term policies and steady leadership | Short-term policies and shifting leadership |

| Economic Impact | Encourages investment and economic growth | Creates uncertainty, deterring investment |

| Social Impact | Promotes social cohesion and trust | Leads to public unrest and distrust |

| International Relations | Reliable partnerships and diplomatic consistency | Erratic foreign policies causing strained relations |

| Risk Level | Low political risk | High political risk |

Understanding Stability and Volatility

Stability refers to the consistency and predictability of a system, asset, or environment, where variables remain relatively constant over time, minimizing unexpected fluctuations. Volatility indicates the degree of variation or unpredictability in value or behavior, often measured by statistical metrics like standard deviation or beta in financial markets. Understanding stability and volatility is crucial for risk management, as stable conditions favor long-term planning while high volatility demands adaptive strategies to mitigate potential losses.

Key Differences Between Stability and Volatility

Stability refers to a state of consistency and predictability in systems, markets, or environments, characterized by minimal fluctuations and steady conditions. Volatility denotes the degree of variation or unpredictability, often marked by rapid and significant changes in value or behavior over short periods. Key differences include that stability supports long-term planning and reduces risk, while volatility increases uncertainty and potential for both high gains and losses.

The Role of Stability in Economic Growth

Stability in economic growth fosters a predictable environment that encourages investment, innovation, and long-term planning by businesses and governments. Low inflation rates, steady employment levels, and consistent fiscal policies reduce uncertainty, enabling efficient allocation of resources and promoting sustainable development. Countries with stable economic conditions tend to exhibit higher GDP growth rates, improved capital flows, and greater resilience to external shocks compared to volatile economies.

Why Volatility Occurs in Markets

Volatility in markets occurs due to rapid changes in supply and demand, driven by factors such as economic data releases, geopolitical events, and investor sentiment shifts. Market participants react quickly to new information, causing price fluctuations that reflect uncertainty and risk perceptions. High volatility often indicates increased market nervousness and potential for larger profit or loss swings.

Stability: Benefits and Potential Drawbacks

Stability in economic and financial contexts fosters predictable market conditions, which encourage investment and long-term planning by reducing uncertainty. It supports steady growth, mitigates risks of abrupt shocks, and enhances consumer and investor confidence. However, excessive stability can lead to complacency, reduced innovation, and the potential buildup of hidden risks that may cause systemic disruptions in the future.

Volatility: Risks and Opportunities

Volatility in financial markets represents rapid and significant price fluctuations, posing risks such as market uncertainty and potential losses for investors. However, volatility also creates opportunities for traders to capitalize on price swings through strategies like options trading and arbitrage. Understanding volatility metrics like the VIX index is crucial for managing risk and optimizing investment returns in volatile environments.

How to Measure Stability and Volatility

Stability and volatility are measured using statistical tools such as standard deviation, variance, and beta coefficient to quantify consistency and risk in financial data or systems. Standard deviation assesses the dispersion of a set of values around the mean, indicating the degree of variability, while variance provides the average of the squared deviations from the mean, offering insight into data spread. The beta coefficient compares the volatility of an asset relative to the market, helping investors gauge systematic risk and make informed decisions.

Strategies for Managing Volatility

Effective strategies for managing volatility include diversification across asset classes and sectors to reduce risk exposure, employing hedging techniques such as options and futures to protect investments, and maintaining a disciplined investment approach with regular portfolio rebalancing. Implementing stop-loss orders can limit potential losses during market downturns, while focusing on high-quality, low-volatility stocks helps enhance portfolio stability. Monitoring macroeconomic indicators and adjusting asset allocation based on changing market conditions further supports resilience against volatility.

Real-world Examples of Stability vs Volatility

Stable economies such as Switzerland consistently showcase low inflation rates, strong currency values, and reliable legal systems, attracting long-term investments and fostering sustainable growth. In contrast, countries like Venezuela experience extreme volatility characterized by hyperinflation, currency devaluation, and political instability, leading to fluctuating market confidence and economic uncertainty. Stock markets also illustrate this dynamic: the S&P 500 offers relative stability with diversified, blue-chip companies, while cryptocurrencies like Bitcoin demonstrate high volatility with rapid price swings influenced by speculative trading and regulatory news.

Choosing Between Stability and Volatility: What Matters Most?

Choosing between stability and volatility hinges on risk tolerance and long-term goals, as stability offers predictable growth and low risk, while volatility presents opportunities for higher returns at increased uncertainty. Investors prioritizing capital preservation and steady income often favor stable assets like bonds or blue-chip stocks. Conversely, those seeking rapid growth may opt for volatile markets such as emerging stocks or cryptocurrencies, balancing potential rewards against significant fluctuations.

Stability Infographic

libterm.com

libterm.com