Khums, an important Islamic tax, requires Muslims to pay one-fifth of certain types of income or savings to support religious leaders and community welfare. This practice helps maintain social justice by redistributing wealth and supporting charitable causes. Discover how Khums can impact Your financial obligations and spiritual responsibilities by reading the full article.

Table of Comparison

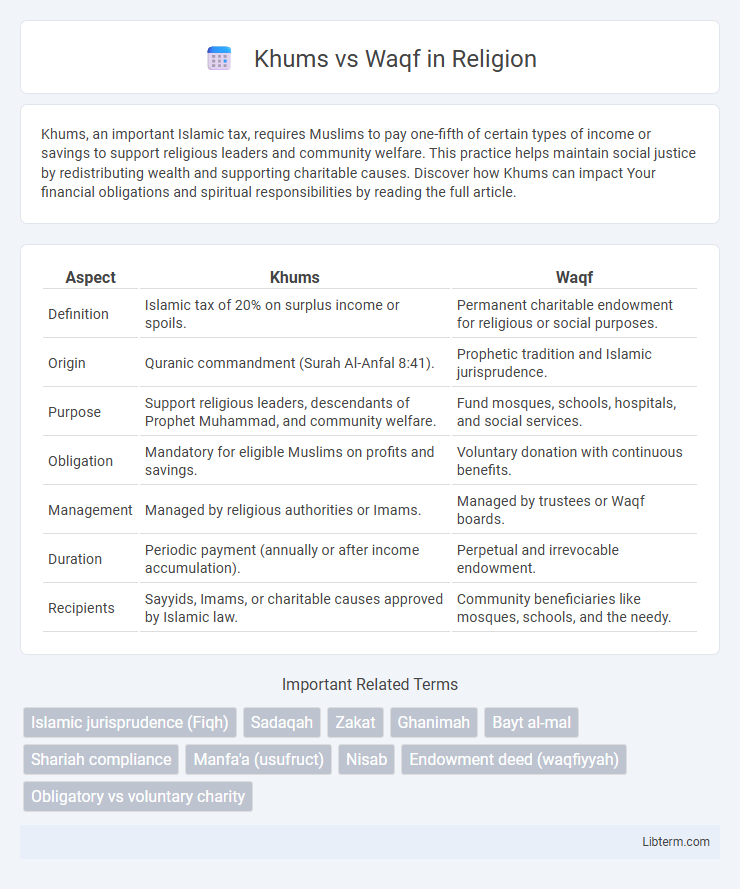

| Aspect | Khums | Waqf |

|---|---|---|

| Definition | Islamic tax of 20% on surplus income or spoils. | Permanent charitable endowment for religious or social purposes. |

| Origin | Quranic commandment (Surah Al-Anfal 8:41). | Prophetic tradition and Islamic jurisprudence. |

| Purpose | Support religious leaders, descendants of Prophet Muhammad, and community welfare. | Fund mosques, schools, hospitals, and social services. |

| Obligation | Mandatory for eligible Muslims on profits and savings. | Voluntary donation with continuous benefits. |

| Management | Managed by religious authorities or Imams. | Managed by trustees or Waqf boards. |

| Duration | Periodic payment (annually or after income accumulation). | Perpetual and irrevocable endowment. |

| Recipients | Sayyids, Imams, or charitable causes approved by Islamic law. | Community beneficiaries like mosques, schools, and the needy. |

Introduction to Khums and Waqf

Khums is a religious almsgiving in Islam, specifically requiring 20% of certain types of surplus income or wealth to be paid annually, primarily observed by Shia Muslims. Waqf refers to an Islamic endowment where assets are donated permanently for charitable purposes, generating ongoing benefits for communities, such as schools, mosques, or hospitals. Both Khums and Waqf serve as financial mechanisms to support social welfare and religious obligations within Islamic traditions.

Definition and Historical Background

Khums, an Islamic tax constituting one-fifth of certain types of income and spoils, originates from Quranic injunctions and has been historically significant in Shia jurisprudence for funding religious and social welfare. Waqf refers to a voluntary, perpetual endowment of property or assets dedicated for religious, educational, or charitable purposes, with deep roots tracing back to early Islamic history where it institutionalized community support and public welfare. Both Khums and Waqf have shaped Islamic financial and social systems by redistributing wealth and sustaining communal institutions since the era of the Prophet Muhammad and the formative periods of Islamic civilization.

Quranic and Hadith References

Khums, derived from Quranic instruction in Surah Al-Anfal (8:41), mandates Muslims to allocate one-fifth of certain types of wealth for specific religious purposes, including support for the Prophet's family and charitable causes. Waqf, rooted in Prophetic traditions and Hadith, refers to a voluntary, perpetual endowment of property or assets dedicated to pious and social welfare objectives, such as education and healthcare. Both practices emphasize communal benefit, with Khums enforced as a fixed religious duty and Waqf functioning as a flexible philanthropic institution based on individual intention and societal needs.

Purpose and Spiritual Significance

Khums is an Islamic tax imposed on surplus income, primarily aimed at supporting religious scholars, orphans, and the needy, reinforcing social justice and community welfare. Waqf represents a dedicated endowment of property or assets for charitable purposes, such as maintaining mosques, schools, and hospitals, ensuring long-term community benefit and spiritual rewards. Both practices enhance spiritual growth by promoting generosity, social responsibility, and continuous support for Islamic institutions and vulnerable groups.

Eligibility and Recipients

Khums is a Shia Islamic tax imposed on surplus income, where only eligible Shia Muslims who earn beyond their needs must pay it, and its recipients include religious leaders (Sayyids) and charitable causes authorized by Shia jurisprudence. Waqf is an endowment established by any Muslim individual who can dedicate property or assets for public benefit, with recipients being the community or specified beneficiaries like schools, mosques, or the poor. Eligibility for Khums is limited to surplus income after annual expenses, while Waqf eligibility depends on ownership and the intention to contribute permanently to communal welfare.

Calculation and Distribution Methods

Khums is calculated as 20% of surplus income after deducting essential expenses and debts, primarily distributed among religious scholars, descendants of the Prophet, and charitable causes. Waqf involves dedicating a specific asset or property permanently for religious, educational, or social welfare purposes, with its benefits managed and distributed by a trustee or waqf board. While Khums distribution follows strict Shia jurisprudential guidelines, Waqf allocation depends on the founder's stipulations and local waqf administration rules.

Role in Islamic Economic System

Khums and Waqf serve distinct yet complementary roles in the Islamic economic system, with Khums functioning as a mandatory levy on surplus income to support religious scholars, charitable causes, and community welfare, thereby redistributing wealth and reducing economic disparities. Waqf, as an enduring endowment, invests assets in infrastructure, education, and social services, fostering sustainable economic development and long-term community resilience. Together, these mechanisms promote equitable wealth distribution, social justice, and economic stability within the framework of Islamic finance.

Impact on Community Development

Khums, a mandatory Islamic tax on surplus income, directly supports community development by funding religious institutions, social welfare, and educational projects, thereby enhancing social cohesion and economic stability. Waqf, a voluntary endowment of property or assets, creates sustainable income streams for long-term community benefits such as schools, hospitals, and public infrastructure. Both Khums and Waqf contribute to socio-economic growth by redistributing wealth and ensuring continuous financial support for communal services.

Common Misconceptions

Many people mistakenly believe Khums and Waqf serve the same purpose, but Khums is a religious tax on surplus income specifically in Shia Islam, while Waqf refers to a charitable endowment for public welfare. Another common misconception is that Khums funds personal expenses, whereas it is strictly designated for religious scholars and needy groups. People also often confuse Waqf with donations, but Waqf involves permanent asset dedication, ensuring long-term community benefits.

Comparative Summary: Khums vs Waqf

Khums and Waqf serve distinct purposes in Islamic finance and charity; Khums is a religious tax amounting to 20% on specific gains, primarily distributed to religious leaders and needy Muslims, while Waqf refers to the endowment of property or assets for public welfare and religious causes. Khums operates annually on surplus income and certain gains as mandated by Shariah, whereas Waqf involves a one-time dedication of assets intended for perpetual benefit, such as building schools or mosques. The key difference lies in Khums being a fixed fiscal duty targeting wealth redistribution, while Waqf acts as a long-term investment in community development and social infrastructure.

Khums Infographic

libterm.com

libterm.com