Sadaqah is a voluntary act of charity in Islam that encompasses giving wealth, time, or kindness to others without expecting anything in return. It plays a significant role in fostering compassion, social justice, and spiritual growth by helping those in need and purifying one's soul. Discover how practicing sadaqah can transform your life and strengthen your community by reading the rest of this article.

Table of Comparison

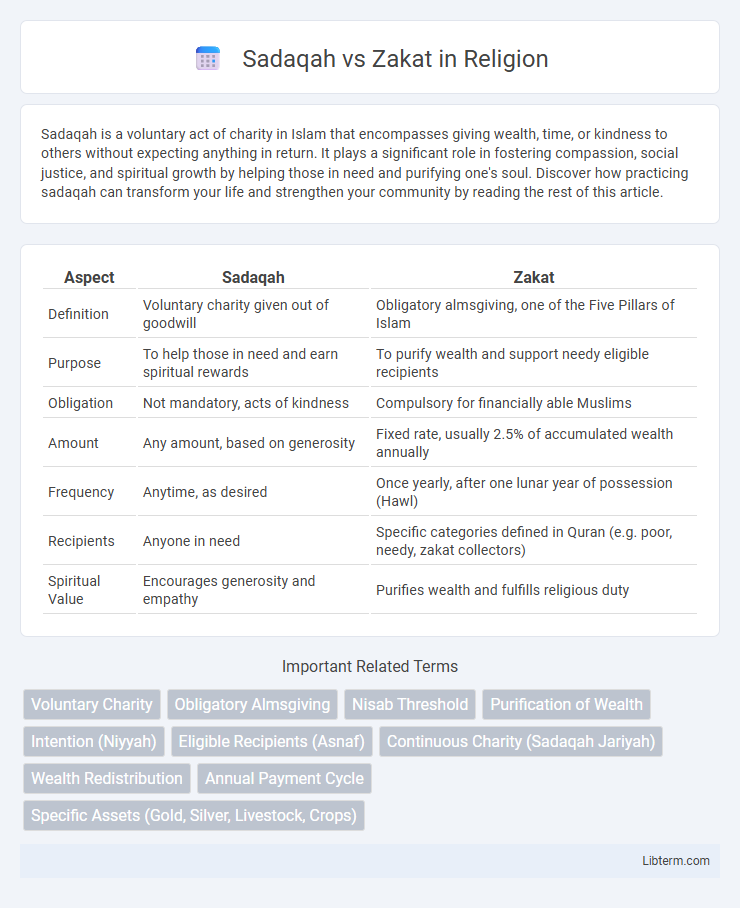

| Aspect | Sadaqah | Zakat |

|---|---|---|

| Definition | Voluntary charity given out of goodwill | Obligatory almsgiving, one of the Five Pillars of Islam |

| Purpose | To help those in need and earn spiritual rewards | To purify wealth and support needy eligible recipients |

| Obligation | Not mandatory, acts of kindness | Compulsory for financially able Muslims |

| Amount | Any amount, based on generosity | Fixed rate, usually 2.5% of accumulated wealth annually |

| Frequency | Anytime, as desired | Once yearly, after one lunar year of possession (Hawl) |

| Recipients | Anyone in need | Specific categories defined in Quran (e.g. poor, needy, zakat collectors) |

| Spiritual Value | Encourages generosity and empathy | Purifies wealth and fulfills religious duty |

Understanding Sadaqah and Zakat: Key Definitions

Sadaqah refers to voluntary charity given out of compassion, love, or generosity without any fixed amount or time, serving as a means to purify wealth and support those in need. Zakat is an obligatory almsgiving in Islam, calculated as a fixed percentage (usually 2.5%) of accumulated wealth that meets a minimum threshold (nisab), intended to redistribute wealth and promote social equity. Understanding these definitions highlights Sadaqah as flexible and discretionary, while Zakat is a mandatory, structured financial duty for eligible Muslims.

Quranic Basis: Sadaqah vs Zakat in Islamic Texts

Sadaqah and Zakat are distinct forms of charity emphasized in the Quran, with Zakat being a mandatory almsgiving explicitly prescribed in verses such as Surah At-Tawbah (9:60), which outlines its recipients and obligations. Sadaqah, mentioned broadly in numerous Quranic passages including Surah Al-Baqarah (2:261), represents voluntary charity aimed at spiritual purification and societal welfare beyond the compulsory nature of Zakat. The Quranic foundation establishes Zakat as an obligatory pillar of Islam with specific legal injunctions, while Sadaqah remains a recommended, flexible act of kindness fostering community support.

Obligatory vs Voluntary: The Major Difference

Zakat is an obligatory form of almsgiving mandated by Islamic law, requiring Muslims to give a fixed percentage of their wealth annually to eligible recipients, typically 2.5% of savings and assets. Sadaqah, in contrast, is a voluntary charity that can be given at any time, in any amount, and for a variety of purposes beyond the prescribed categories of zakat. The major difference lies in zakat's compulsory nature as one of the Five Pillars of Islam, while sadaqah serves as a flexible, supplementary act of kindness and social support.

Who is Eligible: Recipients of Sadaqah and Zakat

Recipients of Zakat are specifically defined and include eligible categories such as the poor (fuqara), the needy (masakin), Zakat collectors, those whose hearts are to be reconciled, freeing captives, debtors, those striving in the cause of Allah, and stranded travelers. Sadaqah recipients, however, have no strict eligibility restrictions and can include anyone in need, extending beyond the traditional eight categories of Zakat. Zakat requires recipients to meet certain criteria based on financial and social status, whereas Sadaqah is more flexible, allowing voluntary giving to any deserving individual or cause.

Calculation and Amount: How Much to Give

Zakat requires giving 2.5% of a Muslim's qualifying wealth, including savings, gold, and investments, once the nisab threshold is met annually. Sadaqah, in contrast, has no fixed amount or calculation, allowing individuals to give any voluntary sum or material goods at any time. The calculation of Zakat is precise and obligatory, while Sadaqah is flexible and driven by personal capacity and intention.

Timing and Frequency: When to Give Sadaqah and Zakat

Zakat is an obligatory financial duty paid once annually upon reaching the Nisab threshold, typically calculated on wealth held for a full lunar year, ensuring consistent redistribution of wealth in the Muslim community. Sadaqah, by contrast, is a voluntary act of charity given at any time without fixed amounts or intervals, allowing flexibility to respond to urgent needs or personal capacity. The timing of Zakat aligns with an individual's lunar calendar year, while Sadaqah can be given repeatedly or spontaneously throughout the year based on intention and opportunity.

Spiritual Rewards and Benefits

Sadaqah offers immediate spiritual rewards by fostering compassion and selflessness, enhancing personal growth and divine closeness beyond obligatory worship. Zakat, as a mandatory act of worship, purifies wealth and secures long-term spiritual benefits by fulfilling Allah's prescribed rights and ensuring social justice. Both practices strengthen faith and community bonds, but Zakat carries a higher status due to its obligation and direct impact on socio-economic balance.

Common Misconceptions

Sadaqah is often mistakenly considered a substitute for Zakat, but while both are forms of charity in Islam, Zakat is a mandatory annual almsgiving with specific calculations based on wealth, whereas Sadaqah is voluntary and can be given at any time in any amount. Many people erroneously believe that paying Zakat exempts them from giving Sadaqah, though both serve distinct spiritual and social purposes. Confusion also arises around the recipients eligible for Zakat, which is strictly defined, compared to the wider range of beneficiaries for Sadaqah.

Practical Examples: Giving Sadaqah and Zakat Today

Zakat requires giving 2.5% of one's accumulated wealth annually, such as money, gold, or business inventory, directly to eligible recipients like the poor or needy. Sadaqah, however, can be given any time, in any amount, including acts like donating food, sponsoring education, or helping during disasters, reflecting voluntary charity beyond obligatory zakat. Modern practices show zakat payments through digital platforms targeting verified beneficiaries, while sadaqah often involves personal, immediate acts of kindness or community support initiatives.

Conclusion: Integrating Charity into Daily Life

Sadaqah and Zakat both emphasize the importance of charity in Islam, with Zakat being a mandatory almsgiving and Sadaqah representing voluntary acts of kindness. Integrating these forms of charity into daily life fosters a continuous cycle of generosity and social welfare, promoting equitable resource distribution. Regular practice of Sadaqah alongside the obligatory Zakat strengthens community bonds and encourages ongoing spiritual growth.

Sadaqah Infographic

libterm.com

libterm.com