Direct ownership grants you full control and legal rights over property or assets, allowing you to make decisions without intermediaries. This form of ownership is often preferred for its transparency and simplicity in transactions. Explore the rest of the article to understand the benefits and challenges associated with direct ownership.

Table of Comparison

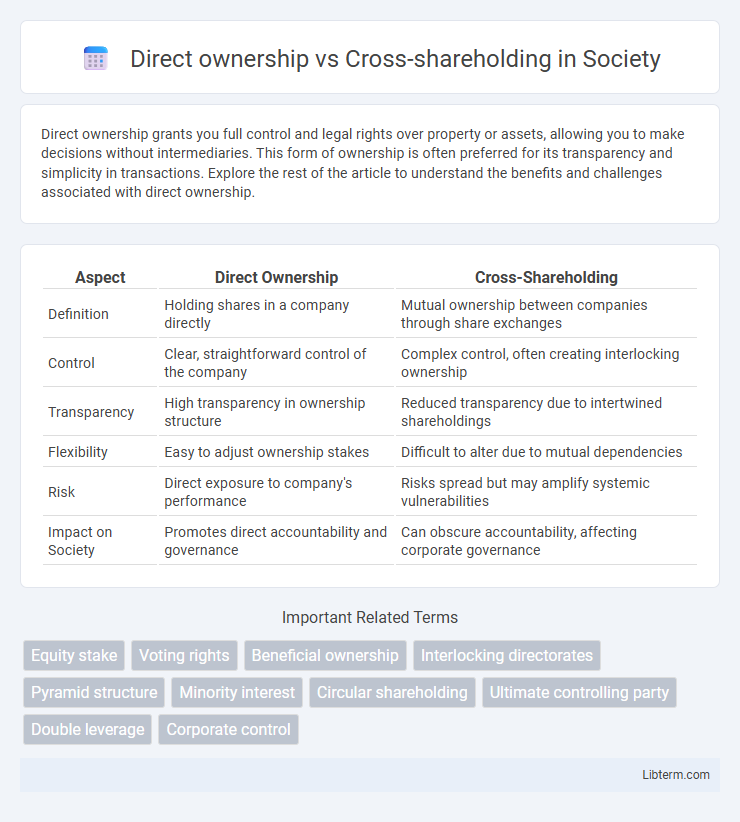

| Aspect | Direct Ownership | Cross-Shareholding |

|---|---|---|

| Definition | Holding shares in a company directly | Mutual ownership between companies through share exchanges |

| Control | Clear, straightforward control of the company | Complex control, often creating interlocking ownership |

| Transparency | High transparency in ownership structure | Reduced transparency due to intertwined shareholdings |

| Flexibility | Easy to adjust ownership stakes | Difficult to alter due to mutual dependencies |

| Risk | Direct exposure to company's performance | Risks spread but may amplify systemic vulnerabilities |

| Impact on Society | Promotes direct accountability and governance | Can obscure accountability, affecting corporate governance |

Introduction to Direct Ownership and Cross-Shareholding

Direct ownership refers to an investor holding shares in a company outright, establishing clear control and straightforward profit rights. Cross-shareholding involves two or more companies holding significant shares in each other, creating intertwined ownership structures that can influence corporate governance and reduce market volatility. Understanding the distinctions between these ownership models is crucial for analyzing control dynamics and strategic alliances within business networks.

Defining Direct Ownership

Direct ownership refers to the straightforward possession of shares or assets by an individual or entity, granting clear legal rights and control over the investment. This form of ownership allows shareholders to exercise voting power and receive dividends directly from the company. Direct ownership contrasts with cross-shareholding, where companies hold shares in one another, creating complex ownership structures that can obscure control and influence.

Understanding Cross-Shareholding

Cross-shareholding occurs when two or more companies hold shares in each other, creating a network of mutual ownership that can strengthen business alliances and deter hostile takeovers. This structure often leads to complex control dynamics and may reduce transparency in corporate governance compared to direct ownership, where an investor holds shares outright in a single company. Understanding cross-shareholding is crucial for analyzing corporate influence, shareholder rights, and the potential for conflict of interest within interconnected business groups.

Key Differences Between Direct Ownership and Cross-Shareholding

Direct ownership involves holding shares of a company outright, granting clear voting rights and straightforward control over the asset, whereas cross-shareholding occurs when two or more companies hold shares in each other, creating a network of mutual ownership. This arrangement can lead to complex governance structures, influencing decision-making processes and potentially reducing market transparency. Key differences include clarity of control, impact on corporate governance, and the risk of entrenchment or defense against hostile takeovers in cross-shareholding scenarios.

Advantages of Direct Ownership

Direct ownership provides clearer control and transparency over assets, enabling shareholders to exercise voting rights and management decisions more effectively. It reduces complexity and potential conflicts associated with cross-shareholding structures, ensuring a straightforward allocation of profits and accountability. This form of ownership also facilitates simpler regulatory compliance and financial reporting, enhancing investor confidence.

Benefits of Cross-Shareholding

Cross-shareholding fosters stronger strategic alliances between companies, enhancing stability by reducing market volatility and hostile takeovers. It promotes long-term collaboration, facilitating resource sharing and joint ventures that drive innovation and competitive advantage. This interconnected ownership structure often leads to improved financial performance through synchronized decision-making and mutual support during economic fluctuations.

Potential Risks and Challenges

Direct ownership in companies concentrates control but exposes investors to concentrated risk and potential conflicts in decision-making. Cross-shareholding creates complex interdependencies between firms, increasing opacity and complicating governance structures, which can mask underlying financial weaknesses. Both arrangements may lead to reduced transparency, hinder market liquidity, and pose challenges to regulatory oversight, thereby elevating systemic risks.

Impact on Corporate Governance

Direct ownership allows shareholders to exercise clear control and voting rights, enhancing accountability and transparency in corporate governance. Cross-shareholding, where firms hold shares in each other, can dilute control and create conflicts of interest, complicating decision-making and potentially weakening board independence. This structure often leads to entangled relationships that obscure true ownership and reduce shareholder influence on management oversight.

Legal and Regulatory Considerations

Direct ownership grants shareholders clear legal rights and straightforward regulatory compliance, simplifying voting rights and dividend claims under corporate law. Cross-shareholding complicates legal accountability and regulatory oversight due to intertwined equity stakes, potentially obscuring control and triggering antitrust or securities law scrutiny. Regulatory frameworks often impose disclosure requirements and limits on cross-shareholding to prevent market manipulation and ensure transparency in corporate governance.

Choosing the Right Ownership Structure

Choosing the right ownership structure involves evaluating the benefits of direct ownership, which offers clear control and straightforward decision-making, against cross-shareholding, which creates strategic alliances and mutual interests among companies. Direct ownership enables transparent asset management and simplifies profit distribution, while cross-shareholding can stabilize partnerships and reduce hostile takeovers through shared equity stakes. Companies must consider governance complexity, financial flexibility, and long-term strategic goals when deciding between direct ownership and cross-shareholding arrangements.

Direct ownership Infographic

libterm.com

libterm.com