Private ownership grants individuals exclusive rights to possess, use, and control property or assets, fostering personal investment and economic freedom. It plays a crucial role in driving innovation and wealth creation within markets by encouraging responsibility and efficient resource management. Explore the article to understand how private ownership impacts your financial opportunities and societal growth.

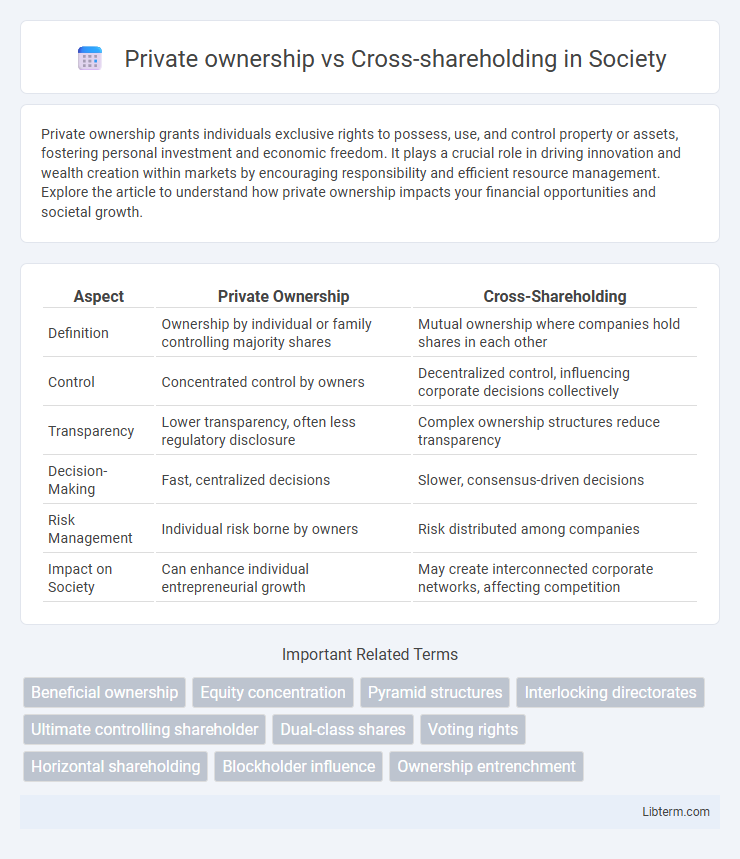

Table of Comparison

| Aspect | Private Ownership | Cross-Shareholding |

|---|---|---|

| Definition | Ownership by individual or family controlling majority shares | Mutual ownership where companies hold shares in each other |

| Control | Concentrated control by owners | Decentralized control, influencing corporate decisions collectively |

| Transparency | Lower transparency, often less regulatory disclosure | Complex ownership structures reduce transparency |

| Decision-Making | Fast, centralized decisions | Slower, consensus-driven decisions |

| Risk Management | Individual risk borne by owners | Risk distributed among companies |

| Impact on Society | Can enhance individual entrepreneurial growth | May create interconnected corporate networks, affecting competition |

Introduction to Private Ownership and Cross-Shareholding

Private ownership refers to individuals or entities holding majority shares in a company, granting direct control over management and decision-making processes. Cross-shareholding occurs when companies hold shares in each other, creating a network of mutual ownership that can stabilize business alliances and reduce hostile takeovers. Understanding these ownership structures is crucial for analyzing corporate governance and strategic influence in business environments.

Defining Private Ownership

Private ownership refers to the control and possession of assets or businesses by individuals, families, or non-governmental entities, emphasizing exclusive decision-making power and direct financial interest. It contrasts with cross-shareholding, where multiple companies hold equity stakes in each other, creating interlocking ownership structures that dilute individual control. Defining private ownership highlights autonomy and the ability to freely transfer or manage assets without influence from complex corporate networks.

Understanding Cross-Shareholding Structures

Cross-shareholding structures involve companies holding shares in one another, creating a network of intertwined ownership that can enhance corporate control and stability but may reduce transparency and shareholder influence. This interconnected ownership often leads to complex decision-making processes and potential conflicts of interest, as well as challenges in evaluating true company performance. Understanding these dynamics is crucial for investors and regulators to assess risks related to governance, market competition, and financial disclosure within cross-shareholding ecosystems.

Key Differences Between Ownership Models

Private ownership involves individuals or entities holding majority stakes in a single company, offering clear control and decision-making authority. Cross-shareholding refers to companies owning shares in each other, creating complex interdependencies that may dilute control and influence governance structures. Key differences include the degree of control, transparency levels, and the potential impact on corporate strategy and financial performance.

Financial Implications of Each Structure

Private ownership allows for streamlined decision-making and potentially higher returns due to concentrated control, but it also bears increased financial risk and limited access to capital markets. Cross-shareholding dilutes individual control but fosters financial stability through reciprocal equity stakes, reducing vulnerability to hostile takeovers and enhancing long-term investment horizons. Each structure influences cash flow management, dividend policies, and capital raising strategies, impacting overall corporate financial health and shareholder value.

Governance and Control Issues

Private ownership concentrates decision-making power in the hands of individual or family owners, resulting in streamlined governance but potentially limited oversight and accountability. Cross-shareholding creates interlocking ownership structures among companies, complicating control dynamics and often reducing transparency in corporate governance. These arrangements can lead to conflicts of interest and challenges in monitoring management, affecting overall corporate control and shareholder rights.

Impact on Corporate Transparency

Private ownership typically enhances corporate transparency by consolidating decision-making and facilitating direct accountability, while cross-shareholding often obscures ownership structures and complicates financial disclosures. Companies with significant cross-shareholding arrangements can experience reduced transparency due to intertwined interests and potential conflicts, making it harder for stakeholders to assess true control and performance. Transparency levels significantly affect investor confidence and market efficiency, highlighting the importance of clear governance in ownership frameworks.

Risk Management and Liability Concerns

Private ownership centralizes control, enabling streamlined decision-making but exposing owners to greater personal liability and concentrated risk. Cross-shareholding disperses ownership among entities, reducing individual exposure and facilitating risk diversification, yet it may obscure liability boundaries and complicate accountability. Effective risk management requires balancing concentration risks of private ownership with the potential opacity and interdependencies inherent in cross-shareholding structures.

Market Performance Comparison

Private ownership often results in clearer, more centralized decision-making, which can enhance firm efficiency and market responsiveness, thereby improving stock performance. Cross-shareholding, where firms hold shares in each other, may stabilize market fluctuations but can also lead to reduced transparency and diluted accountability, potentially dampening stock returns. Empirical studies suggest companies with concentrated private ownership typically experience higher market valuation and profitability compared to those engaged in extensive cross-shareholding networks.

Future Trends in Ownership Structures

Future trends in ownership structures reveal a shift from traditional private ownership toward more complex cross-shareholding arrangements, driven by the need for strategic alliances and risk diversification. Emerging markets demonstrate increased adoption of cross-shareholding to enhance corporate governance and influence market positioning. Advanced technologies and regulatory changes are expected to further promote transparency and flexibility within these interconnected ownership models.

Private ownership Infographic

libterm.com

libterm.com