Oligopoly is a market structure characterized by a few dominant firms that hold significant market power, influencing prices and output levels. These companies often engage in strategic decision-making, where the actions of one firm directly impact the others, leading to interdependent competition. Discover how oligopolies shape markets and affect your economic environment by exploring the detailed analysis in the rest of this article.

Table of Comparison

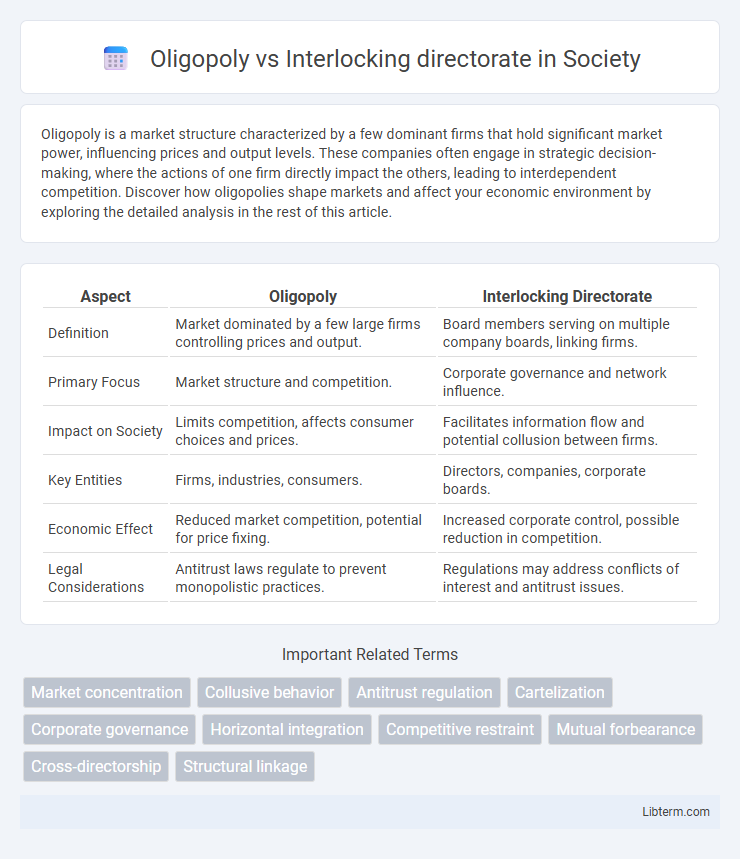

| Aspect | Oligopoly | Interlocking Directorate |

|---|---|---|

| Definition | Market dominated by a few large firms controlling prices and output. | Board members serving on multiple company boards, linking firms. |

| Primary Focus | Market structure and competition. | Corporate governance and network influence. |

| Impact on Society | Limits competition, affects consumer choices and prices. | Facilitates information flow and potential collusion between firms. |

| Key Entities | Firms, industries, consumers. | Directors, companies, corporate boards. |

| Economic Effect | Reduced market competition, potential for price fixing. | Increased corporate control, possible reduction in competition. |

| Legal Considerations | Antitrust laws regulate to prevent monopolistic practices. | Regulations may address conflicts of interest and antitrust issues. |

Understanding Oligopoly: Definition and Characteristics

Oligopoly is a market structure dominated by a few firms that hold significant market power, resulting in limited competition and high entry barriers. Characteristics include interdependent decision-making among firms, potential for collusion, and product differentiation or homogeneity. In contrast, an interlocking directorate involves shared board members between competing firms, which can influence strategic decisions and exacerbate oligopolistic behaviors.

What Is an Interlocking Directorate?

An interlocking directorate occurs when a member of a company's board of directors simultaneously serves on the board of another company, creating a network of interconnected firms. This practice often links companies within an oligopoly, where a few dominant firms control a significant market share, facilitating coordination and reducing competition. Interlocking directorates can influence strategic decisions, market behavior, and corporate governance across the connected corporations.

Key Differences Between Oligopoly and Interlocking Directorate

Oligopoly refers to a market structure dominated by a few firms that control most of the industry's supply and influence prices, while interlocking directorate involves individuals serving on the boards of directors of multiple corporations, facilitating influence across companies. The key difference lies in that oligopoly focuses on competitive market dynamics and firm behavior, whereas interlocking directorate centers on corporate governance and overlapping leadership. Oligopolies impact market competition directly, whereas interlocking directorates primarily affect decision-making and potential collusion among firms through shared board members.

Market Power: How Oligopolies Influence Competition

Oligopolies exert significant market power by controlling a substantial share of industry output, leading to reduced competition and higher prices for consumers. Interlocking directorates, where board members serve on multiple competing firms, facilitate tacit collusion, stabilizing oligopolistic firms' market dominance. These overlapping directorships enable coordinated strategies that limit competitive rivalry and maintain elevated profit margins within oligopolistic markets.

Corporate Governance: The Role of Interlocking Directorates

Interlocking directorates significantly impact corporate governance by creating networks of shared board members among firms, leading to potential coordinated strategies in oligopolistic markets. These connections enhance information flow and strategic alignment but can also reduce competition and increase risks of collusive behavior. Understanding the influence of interlocking directorates is crucial for regulators aiming to balance competitive markets with effective corporate oversight.

Regulatory Frameworks for Oligopolies and Interlocks

Regulatory frameworks addressing oligopolies and interlocking directorates primarily aim to prevent anti-competitive practices and concentration of market power. Antitrust laws such as the Sherman Act and the Clayton Act in the United States restrict interlocks that can reduce competition by limiting board overlaps among competing firms. Agencies like the Federal Trade Commission and the Department of Justice enforce rules that monitor oligopolistic behaviors, ensuring market transparency and fair competition by scrutinizing mergers, acquisitions, and directorate interlocks.

Case Studies: Oligopolistic Markets vs. Interlocking Boards

Oligopolistic markets are characterized by a few firms dominating industry sectors, as seen in the airline and telecommunications industries, where competitive behavior is influenced by mutual interdependence rather than price wars. Interlocking directorates, often observed in financial sectors and large conglomerates like General Electric and JPMorgan Chase, involve shared board members facilitating strategic coordination and information flow across firms. Case studies reveal that while oligopolies impact market competition and pricing strategies, interlocking boards can foster tacit collusion and control over market dynamics through governance networks.

Economic and Social Impacts of Oligopolies

Oligopolies concentrate market power among a few firms, often leading to higher prices, reduced innovation, and limited consumer choice, which can hinder economic efficiency and growth. Interlocking directorates, where board members serve on multiple competing firms, reinforce oligopolistic control by facilitating collusion and reducing competition, thereby exacerbating economic inequalities. Socially, oligopolies can increase income disparity by empowering large corporations at the expense of smaller businesses and consumers, weakening democratic market structures.

Risks and Concerns of Interlocking Directorates

Interlocking directorates pose significant risks by potentially facilitating collusion and reducing competition among firms within an oligopoly, leading to higher prices and reduced innovation. These board connections can create conflicts of interest, impairing independent decision-making and allowing dominant firms to coordinate strategies illicitly. Regulatory concerns also arise from the potential erosion of market competition and the threat to shareholder and consumer interests due to diminished corporate governance transparency.

Strategies for Addressing Market Concentration and Board Interlocks

Oligopoly strategies for addressing market concentration include regulatory oversight, antitrust enforcement, and promoting competition through market entry incentives. Interlocking directorates are managed by implementing strict governance policies, conflict of interest regulations, and mandatory disclosure requirements to reduce collusion risks. Both approaches aim to enhance market fairness and prevent undue influence by limiting coordinated control over market or board power.

Oligopoly Infographic

libterm.com

libterm.com