Employer-sponsored benefits provide employees with essential perks such as health insurance, retirement plans, and paid time off, enhancing overall job satisfaction and financial security. These benefits help reduce personal expenses and create a more stable work-life balance. Explore the article to discover how your employer-sponsored benefits can maximize your well-being and career growth.

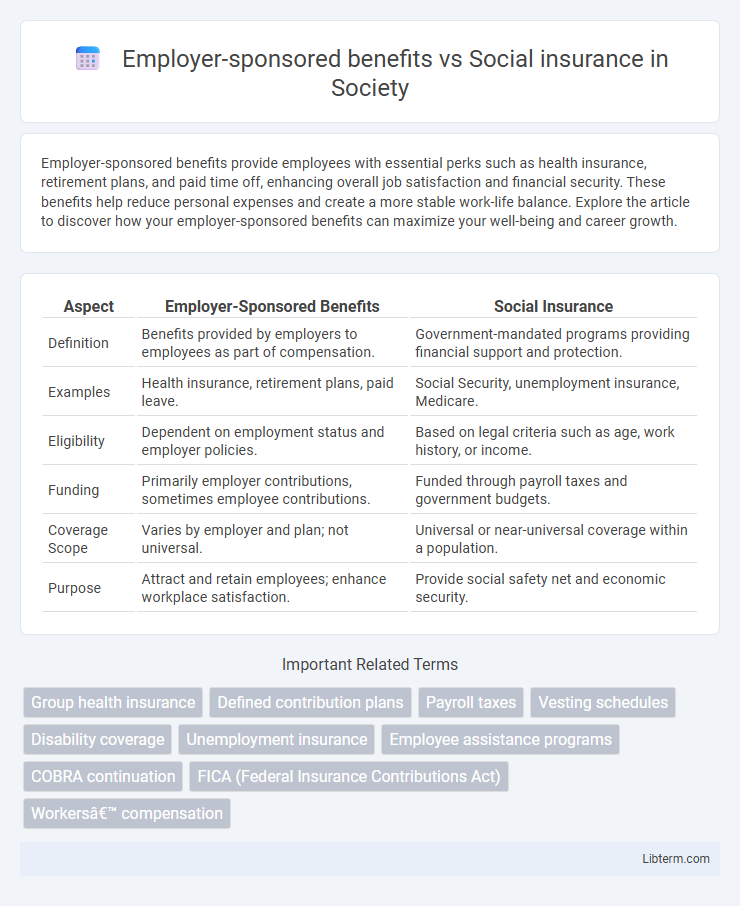

Table of Comparison

| Aspect | Employer-Sponsored Benefits | Social Insurance |

|---|---|---|

| Definition | Benefits provided by employers to employees as part of compensation. | Government-mandated programs providing financial support and protection. |

| Examples | Health insurance, retirement plans, paid leave. | Social Security, unemployment insurance, Medicare. |

| Eligibility | Dependent on employment status and employer policies. | Based on legal criteria such as age, work history, or income. |

| Funding | Primarily employer contributions, sometimes employee contributions. | Funded through payroll taxes and government budgets. |

| Coverage Scope | Varies by employer and plan; not universal. | Universal or near-universal coverage within a population. |

| Purpose | Attract and retain employees; enhance workplace satisfaction. | Provide social safety net and economic security. |

Introduction to Employer-Sponsored Benefits and Social Insurance

Employer-sponsored benefits are voluntary programs provided by employers to enhance employee compensation, including health insurance, retirement plans, and paid leave. Social insurance consists of government-mandated programs such as Social Security, Medicare, and unemployment insurance designed to provide financial protection against life's risks. Both systems play crucial roles in financial security but differ significantly in funding, eligibility, and coverage scope.

Key Definitions: Employer-Sponsored vs Social Insurance

Employer-sponsored benefits are private programs provided by employers to offer health insurance, retirement plans, and paid leave as part of an employee compensation package, often tailored to company policies. Social insurance refers to government-mandated programs like Social Security, Medicare, and unemployment insurance designed to provide financial protection and social welfare against risks such as old age, disability, or job loss. Understanding the key differences highlights that employer-sponsored benefits are voluntary and supplemental, while social insurance is compulsory and universally accessible through public funding.

Types of Employer-Sponsored Benefits

Employer-sponsored benefits primarily include health insurance, retirement plans such as 401(k)s, life and disability insurance, and paid time off, which are offered directly by employers to enhance employee compensation packages. These benefits contrast with social insurance programs like Social Security and Medicare, which are government-mandated and provide basic financial and health protections to all eligible citizens. Employer-sponsored benefits often exceed the coverage of social insurance by providing more comprehensive healthcare options, additional income security, and other perks tied to employment status.

Common Social Insurance Programs

Employer-sponsored benefits typically include health insurance, retirement plans, and paid leave, directly provided by employers to enhance employee welfare. Common social insurance programs, such as Social Security, Medicare, and Unemployment Insurance, are government-mandated systems designed to provide financial support and healthcare coverage to citizens. Social insurance programs ensure a safety net by offering benefits funded through payroll taxes, while employer-sponsored benefits offer additional voluntary protections tailored to workforce needs.

Eligibility Criteria: Who Qualifies for Each?

Employer-sponsored benefits typically require active employment with a specific company, with eligibility often based on job status, length of service, and hours worked; full-time employees usually qualify, while part-time or temporary workers may not. Social insurance programs, such as Social Security or unemployment insurance, generally base eligibility on meeting work credits or contribution requirements through payroll taxes, making these benefits accessible to broad populations including self-employed and unemployed individuals. Eligibility for employer-sponsored benefits is more discretionary and tied to the employer's policies, whereas social insurance eligibility is mandated by government regulations and designed to cover workers across various employment types.

Funding Sources: Who Pays for the Benefits?

Employer-sponsored benefits are primarily funded through contributions from employers and, often, employees via payroll deductions, allowing companies to customize coverage based on workforce needs and budgets. Social insurance programs, such as Social Security and Medicare, rely on mandatory payroll taxes collected from both employers and employees, as legislated by federal and state governments to provide broad, standardized coverage for the population. The key distinction lies in the voluntary nature and funding flexibility of employer-sponsored plans versus the compulsory, government-managed funding mechanisms supporting social insurance benefits.

Coverage and Scope: What Do They Provide?

Employer-sponsored benefits typically offer personalized coverage such as health insurance, dental, vision, disability, and retirement plans tailored to an employee's job and employer's policies. Social insurance programs provide broader public coverage, including Social Security, Medicare, unemployment insurance, and workers' compensation, designed to offer financial and health security to eligible individuals across society. The scope of employer-sponsored benefits is often more comprehensive and specific to employment conditions, while social insurance ensures baseline protection for all contributing members of the workforce.

Advantages of Employer-Sponsored Benefits

Employer-sponsored benefits provide employees with customizable and often more comprehensive options such as health insurance, retirement plans, and wellness programs, tailored to meet individual needs. These benefits typically offer greater flexibility and faster access compared to social insurance programs like Social Security or Medicare, which are standardized and government-managed. Enhanced employee satisfaction and retention are also significant advantages due to the direct link between employer-sponsored benefits and workplace incentives.

Benefits of Social Insurance Programs

Social insurance programs provide essential financial protection against risks such as unemployment, disability, and retirement, ensuring a safety net for a broad population regardless of employment status. These programs deliver standardized coverage, reducing disparities by mandating participation and pooling risks across diverse groups. Funded primarily through payroll taxes, social insurance benefits offer stability and predictability that often surpass employer-sponsored benefits limited by company resources and eligibility criteria.

Comparing Employer-Sponsored Benefits and Social Insurance

Employer-sponsored benefits typically include health insurance, retirement plans, and paid leave provided voluntarily by employers to attract and retain employees, whereas social insurance programs like Social Security, Medicare, and Unemployment Insurance are government-mandated and funded through payroll taxes to provide income security and healthcare coverage. Employer-sponsored benefits offer customized options that may vary by company size and industry, while social insurance programs provide standardized protection to all eligible workers regardless of their employer. The key distinction lies in employer control and funding sources, with employer-sponsored benefits often supplementing the baseline coverage guaranteed by social insurance.

Employer-sponsored benefits Infographic

libterm.com

libterm.com