Social insurance provides financial protection against life's uncertainties such as illness, unemployment, or retirement by pooling resources and risks among a community. This system ensures that You receive essential support during times of need, fostering economic stability and social welfare. Discover how social insurance can safeguard Your future by reading the full article.

Table of Comparison

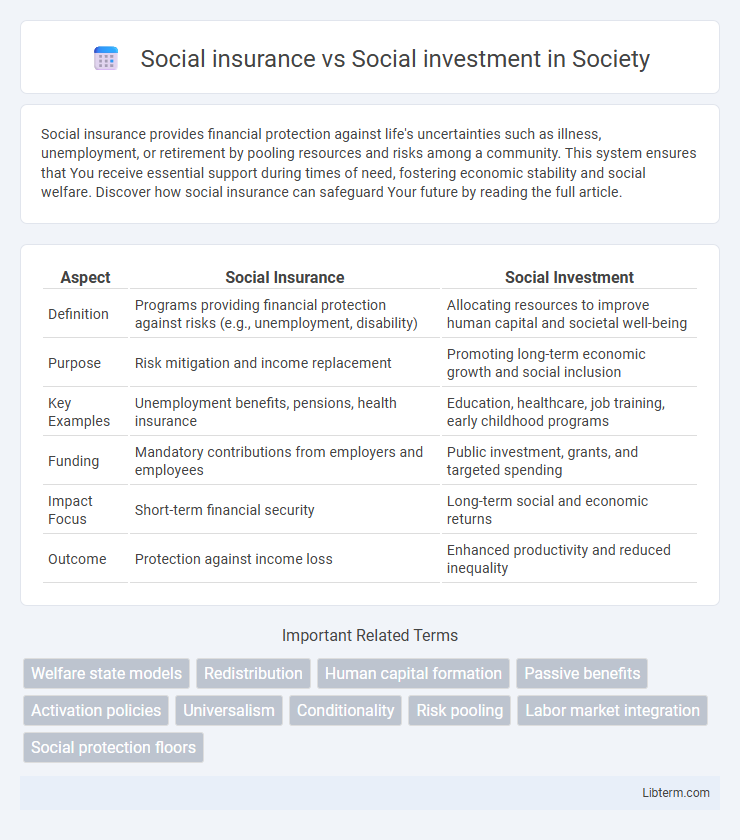

| Aspect | Social Insurance | Social Investment |

|---|---|---|

| Definition | Programs providing financial protection against risks (e.g., unemployment, disability) | Allocating resources to improve human capital and societal well-being |

| Purpose | Risk mitigation and income replacement | Promoting long-term economic growth and social inclusion |

| Key Examples | Unemployment benefits, pensions, health insurance | Education, healthcare, job training, early childhood programs |

| Funding | Mandatory contributions from employers and employees | Public investment, grants, and targeted spending |

| Impact Focus | Short-term financial security | Long-term social and economic returns |

| Outcome | Protection against income loss | Enhanced productivity and reduced inequality |

Defining Social Insurance and Social Investment

Social insurance refers to government-run programs designed to provide financial protection against life's risks, such as unemployment, disability, retirement, or illness, by pooling resources through mandatory contributions. Social investment involves strategic spending on education, healthcare, and social services aimed at enhancing human capital and promoting long-term economic growth. Both concepts play crucial roles in social policy, with social insurance addressing immediate financial security and social investment focusing on future societal benefits.

Historical Evolution of Both Concepts

Social insurance originated in the late 19th century as governments introduced compulsory programs like Germany's 1883 health insurance to provide financial protection against risks such as illness and unemployment. Social investment emerged in the late 20th century, particularly after the 1990s, emphasizing proactive human capital development through education, training, and preventive health measures to enhance economic productivity. The historical evolution reflects a shift from reactive risk compensation in social insurance to forward-looking strategies in social investment aimed at fostering long-term societal resilience.

Key Objectives: Protection vs Empowerment

Social insurance primarily aims to provide financial protection and risk mitigation by offering benefits such as unemployment, disability, and retirement pensions, ensuring economic security during adverse events. Social investment focuses on empowerment by investing in education, healthcare, and skill development to enhance individuals' capabilities and long-term economic productivity. Both approaches address social welfare but differ in targeting immediate protection versus fostering sustainable human capital growth.

Policy Mechanisms and Implementation

Social insurance operates through mandatory payroll contributions and actuarial management to provide risk protection against unemployment, disability, and retirement, ensuring financial stability for eligible individuals. Social investment emphasizes proactive policy mechanisms such as skills training, early childhood education, and active labor market programs designed to enhance human capital and long-term economic productivity. Implementation of social insurance relies on established legal frameworks and institutional infrastructure for benefit disbursement, while social investment requires cross-sector collaboration and targeted funding to adapt policies to shifting socio-economic needs.

Funding Models and Sustainability

Social insurance primarily relies on contributory funding models where employees and employers pay into payroll taxes or social security funds, ensuring sustainability through consistent revenue streams linked to the labor market. Social investment models often involve government budgets, private sector partnerships, and impact investments aimed at generating long-term social and economic returns, with funding sourced from taxes, grants, and capital markets. Sustainability in social insurance depends on demographic factors such as workforce size and life expectancy, while social investment sustainability hinges on measurable social outcomes and reinvestment of returns.

Impact on Economic Inequality

Social insurance programs, such as unemployment benefits and pensions, provide immediate financial support that reduces poverty and cushions the economic impact on disadvantaged groups, thereby mitigating economic inequality. Social investment strategies focus on long-term human capital development through education, healthcare, and childcare, aiming to enhance productivity and upward mobility, which lowers inequality over generations. Combining social insurance and social investment creates a more comprehensive approach to reducing economic disparities by addressing both short-term needs and long-term structural factors.

Role in Modern Welfare States

Social insurance provides a safety net through contributory schemes like unemployment benefits, pensions, and healthcare, ensuring income security during life's risks in modern welfare states. Social investment prioritizes long-term human capital development by funding education, training, and family support to enhance employability and social inclusion. Together, these approaches balance immediate protection with future economic growth and social cohesion in advanced welfare systems.

Case Studies: Global Approaches

Case studies from countries like Germany and Sweden illustrate social insurance systems that provide income security through mandatory contributions and benefits during unemployment, sickness, or retirement. In contrast, Singapore's social investment model prioritizes human capital development by promoting education, training, and healthcare to enhance workforce productivity and long-term economic growth. These global approaches highlight the trade-offs between guaranteed social protection mechanisms and proactive investment in individuals' capabilities for sustainable societal well-being.

Challenges and Criticisms

Social insurance faces challenges such as sustainability concerns due to aging populations and rising healthcare costs, undermining its long-term financial viability. Criticisms of social investment center on the difficulty in measuring social returns and the risk of prioritizing market-based solutions over public welfare. Both approaches struggle with balancing equitable access and effective resource allocation in complex socio-economic landscapes.

Future Trends in Social Policy

Future trends in social policy emphasize a shift from traditional social insurance models, which provide safety nets through pensions and unemployment benefits, to social investment strategies that focus on human capital development and proactive support like education and skills training. Policymakers are increasingly prioritizing social investments to enhance long-term economic productivity and social inclusion, leveraging data analytics and behavioral insights. Digital transformation and demographic changes also drive innovation in social policy design, promoting personalized services and adaptive welfare systems.

Social insurance Infographic

libterm.com

libterm.com