Economic risk refers to the potential financial losses that businesses or investors may face due to changes in the economic environment, such as inflation, recession, or currency fluctuations. This risk can impact profitability, investment returns, and overall business stability, making it essential to assess and manage appropriately. Explore the rest of the article to understand how economic risk affects your financial decisions and strategies.

Table of Comparison

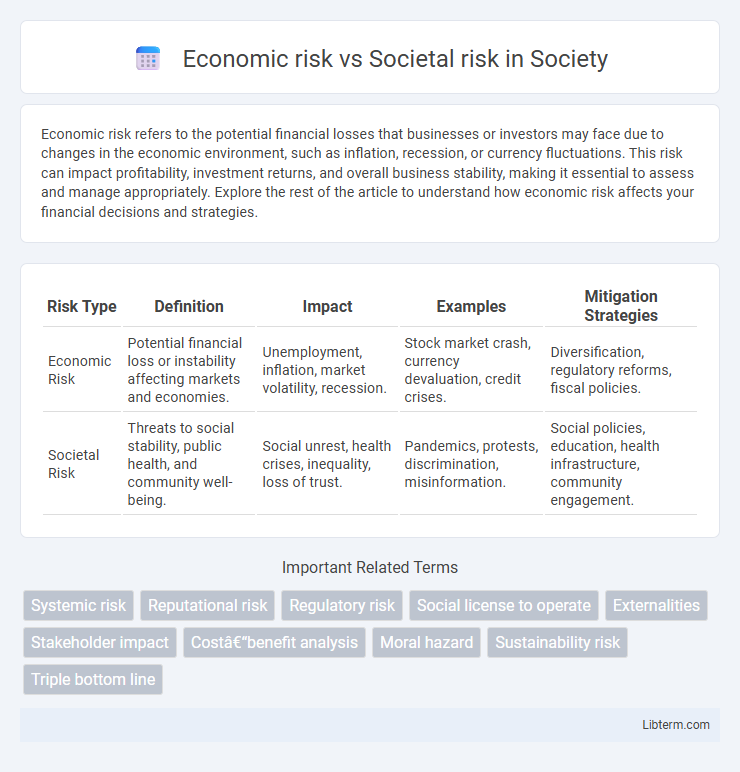

| Risk Type | Definition | Impact | Examples | Mitigation Strategies |

|---|---|---|---|---|

| Economic Risk | Potential financial loss or instability affecting markets and economies. | Unemployment, inflation, market volatility, recession. | Stock market crash, currency devaluation, credit crises. | Diversification, regulatory reforms, fiscal policies. |

| Societal Risk | Threats to social stability, public health, and community well-being. | Social unrest, health crises, inequality, loss of trust. | Pandemics, protests, discrimination, misinformation. | Social policies, education, health infrastructure, community engagement. |

Introduction to Economic Risk and Societal Risk

Economic risk encompasses potential financial losses arising from market fluctuations, inflation, unemployment, and changes in regulatory policies, directly impacting businesses and governments. Societal risk involves threats to social stability and public welfare, including factors such as social unrest, health crises, and inequality, which can disrupt communities and economic systems. Understanding both risks is crucial for developing resilient strategies that mitigate financial damage while maintaining social cohesion.

Defining Economic Risk: Scope and Impact

Economic risk encompasses potential financial losses arising from market fluctuations, policy changes, or economic downturns, affecting investments, businesses, and national economies. This risk impacts GDP growth, unemployment rates, inflation, and corporate profitability, influencing both microeconomic and macroeconomic stability. Understanding economic risk requires analyzing factors such as currency volatility, credit defaults, and supply chain disruptions that contribute to economic uncertainty.

Understanding Societal Risk: Key Dimensions

Societal risk encompasses threats to public health, social stability, and community well-being, distinct from economic risk which primarily involves financial losses and market fluctuations. Key dimensions of societal risk include vulnerability and exposure of populations, social cohesion, and governance capacity to manage crises. Understanding these factors enables more effective risk assessment and development of resilient policies to protect society beyond purely economic impacts.

Comparing Economic and Societal Risks: Core Differences

Economic risk primarily involves financial uncertainties such as market volatility, inflation, and credit defaults that impact wealth, investments, and business stability. Societal risk encompasses threats to social structures, including public health crises, social unrest, and inequality, which can disrupt community cohesion and social order. Comparing these risks highlights that economic risk focuses on monetary loss and economic performance, while societal risk addresses broader impacts on societal well-being and collective safety.

Causes and Drivers of Economic Risk

Economic risk primarily stems from factors such as market volatility, inflation, and geopolitical instability, which disrupt financial systems and investment flows. Supply chain disruptions, currency fluctuations, and changes in regulatory policies further drive economic uncertainty and impact business operations. These causes undermine economic growth, creating challenges in employment, capital availability, and consumer confidence.

Causes and Drivers of Societal Risk

Societal risk arises primarily from factors including demographic shifts, social inequality, and cultural conflicts, which destabilize community cohesion and increase vulnerability. Economic risk, by contrast, is driven by market volatility, financial crises, and regulatory changes that impact economic stability and growth. Understanding the root causes of societal risk requires analyzing systemic social issues such as poverty, political unrest, and public health crises that amplify social stress and potential unrest.

Interrelationship Between Economic and Societal Risks

Economic risks such as market volatility, inflation, and unemployment significantly influence societal risks including social unrest, public health crises, and inequality. The interrelationship between economic and societal risks highlights how economic downturns exacerbate social vulnerabilities, leading to increased poverty and diminished social cohesion. Effective risk management requires integrated strategies that address both economic stability and societal resilience to mitigate cascading effects.

Measuring and Assessing Each Type of Risk

Economic risk is measured through quantitative indicators such as GDP volatility, unemployment rates, inflation trends, and financial market stability, using models like Value at Risk (VaR) and econometric analyses. Societal risk assessment involves evaluating social well-being factors, including public health statistics, education levels, social inequality indices, and crime rates, often utilizing surveys, social impact assessments, and qualitative data analysis. Both risk types require distinct but complementary methodologies to ensure comprehensive understanding and effective mitigation strategies.

Strategies for Mitigating Economic and Societal Risks

Strategies for mitigating economic and societal risks include fostering diversified economic structures to reduce dependency on single industries and investing in social safety nets such as unemployment benefits and healthcare access to enhance community resilience. Implementing robust regulatory frameworks can curb financial volatility and prevent systemic failures, while promoting inclusive policies that address inequality helps stabilize social cohesion. Emphasizing proactive risk assessment and crisis response planning enables both economic stability and social well-being in the face of unforeseen disruptions.

Future Trends and Challenges in Managing Risks

Economic risk increasingly intertwines with technological advancements and global market volatility, demanding sophisticated predictive models and real-time data analytics to mitigate financial losses. Societal risk, influenced by demographic shifts, climate change, and social unrest, requires adaptive governance frameworks and community resilience strategies to address evolving vulnerabilities. Future challenges include integrating economic and societal risk management through interdisciplinary approaches and enhancing collaboration between public and private sectors to foster sustainable risk reduction.

Economic risk Infographic

libterm.com

libterm.com