External regulation refers to rules and controls imposed by an outside authority to guide behavior and ensure compliance. This form of regulation can influence your decisions by setting clear boundaries and consequences. Explore the rest of the article to understand how external regulation impacts various industries and your daily life.

Table of Comparison

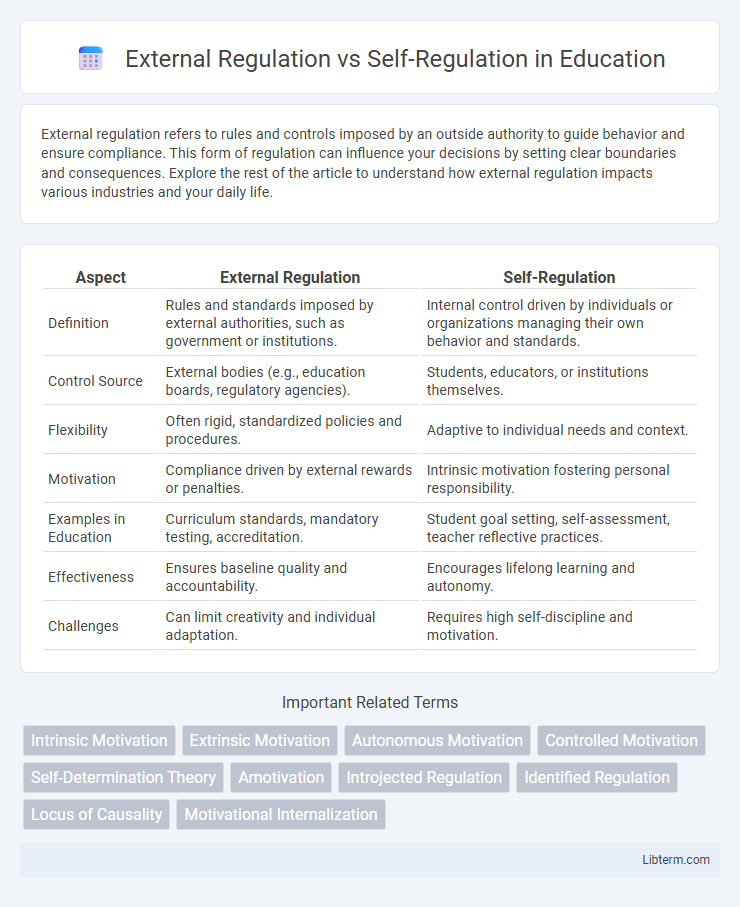

| Aspect | External Regulation | Self-Regulation |

|---|---|---|

| Definition | Rules and standards imposed by external authorities, such as government or institutions. | Internal control driven by individuals or organizations managing their own behavior and standards. |

| Control Source | External bodies (e.g., education boards, regulatory agencies). | Students, educators, or institutions themselves. |

| Flexibility | Often rigid, standardized policies and procedures. | Adaptive to individual needs and context. |

| Motivation | Compliance driven by external rewards or penalties. | Intrinsic motivation fostering personal responsibility. |

| Examples in Education | Curriculum standards, mandatory testing, accreditation. | Student goal setting, self-assessment, teacher reflective practices. |

| Effectiveness | Ensures baseline quality and accountability. | Encourages lifelong learning and autonomy. |

| Challenges | Can limit creativity and individual adaptation. | Requires high self-discipline and motivation. |

Understanding External Regulation

External regulation involves rules and oversight imposed by governmental or independent authorities to ensure compliance with standards across industries. It typically mandates strict adherence to laws, with penalties for violations serving as deterrents to non-compliance. Organizations under external regulation benefit from clear guidelines and accountability frameworks that enhance transparency and protect public interests.

Defining Self-Regulation

Self-regulation refers to the ability of individuals or organizations to control their own behavior and processes without the need for external oversight or enforcement. It involves setting internal standards, monitoring compliance, and making necessary adjustments to align with ethical, legal, or industry-specific requirements. This form of governance promotes autonomy, accountability, and often leads to more flexible and adaptive management compared to external regulation.

Key Differences Between External and Self-Regulation

External regulation involves oversight by authoritative bodies such as government agencies or regulatory commissions, ensuring compliance through legally enforceable rules and penalties. Self-regulation, by contrast, relies on organizations or industries to create and enforce their own standards and codes of conduct, promoting ethical behavior without direct legal enforcement. Key differences include the source of authority, enforcement mechanisms, and the level of flexibility and adaptability in responding to industry-specific challenges.

Advantages of External Regulation

External regulation ensures consistent compliance with established laws and standards, reducing risks related to unethical practices and legal penalties. It enhances public trust by providing transparent oversight through independent authorities or government agencies. Moreover, external regulation drives industry-wide accountability and fosters a level playing field, promoting fair competition and consumer protection.

Benefits of Self-Regulation

Self-regulation fosters adaptability by allowing organizations to tailor rules to their specific industry needs, promoting innovation and responsiveness. It enhances trust and credibility with stakeholders through proactive ethical standards and accountability measures. Cost efficiency is achieved by minimizing the need for external enforcement and reducing compliance-related delays.

Challenges and Limitations of External Regulation

External regulation faces challenges such as rigidity and delayed response to market changes, often resulting in compliance burdens that stifle innovation. Limited resources and expertise can hinder effective enforcement, leading to inconsistent application and potential regulatory gaps. External regulation may struggle with adaptability in fast-evolving industries, causing outdated rules that fail to address emerging risks and technologies.

Obstacles and Weaknesses of Self-Regulation

Self-regulation often faces obstacles such as insufficient enforcement mechanisms, leading to inconsistent compliance and accountability gaps within industries. Its reliance on voluntary adherence can result in conflicts of interest where businesses prioritize profit over ethical standards or public welfare. Limited transparency and lack of external oversight further undermine its effectiveness compared to external regulation frameworks.

Sector-Specific Case Studies and Examples

External regulation often imposes mandatory standards and compliance requirements on industries such as tobacco, pharmaceuticals, and finance, ensuring public safety and market stability through government agencies like the FDA and SEC. Self-regulation allows sectors like advertising and technology to develop industry-specific codes of conduct and best practices, exemplified by the Interactive Advertising Bureau's guidelines and the Internet Advertising Bureau's efforts to combat misinformation. Case studies reveal that while external regulation offers strong enforcement mechanisms, self-regulation provides flexibility and rapid adaptation in emerging markets like digital media and blockchain technologies.

Choosing Between External and Self-Regulation

Choosing between external regulation and self-regulation hinges on factors such as industry complexity, risk level, and stakeholder trust. External regulation often suits sectors with significant public impact or safety concerns, ensuring compliance through formal oversight and enforcement mechanisms. Self-regulation can be effective in dynamic industries where flexible standards and rapid innovation require internal accountability and peer-driven enforcement.

The Future of Regulation: Trends and Predictions

The future of regulation is shifting towards a hybrid model that balances external regulation with self-regulation, emphasizing adaptive frameworks and real-time compliance monitoring powered by AI technologies. Industries such as finance and technology are progressively adopting self-regulatory measures to foster innovation while maintaining accountability, supported by regulatory sandboxes and collaborative governance structures. Predictive analytics and blockchain integration are expected to enhance transparency and trust, enabling regulators and organizations to respond proactively to emerging risks and evolving market dynamics.

External Regulation Infographic

libterm.com

libterm.com