Line-item budgeting breaks down expenses into specific categories, allowing for detailed tracking and control of financial resources. It simplifies monitoring by assigning set amounts to each item, ensuring clarity in how funds are allocated and spent. Explore the rest of the article to understand how this method can enhance Your financial planning.

Table of Comparison

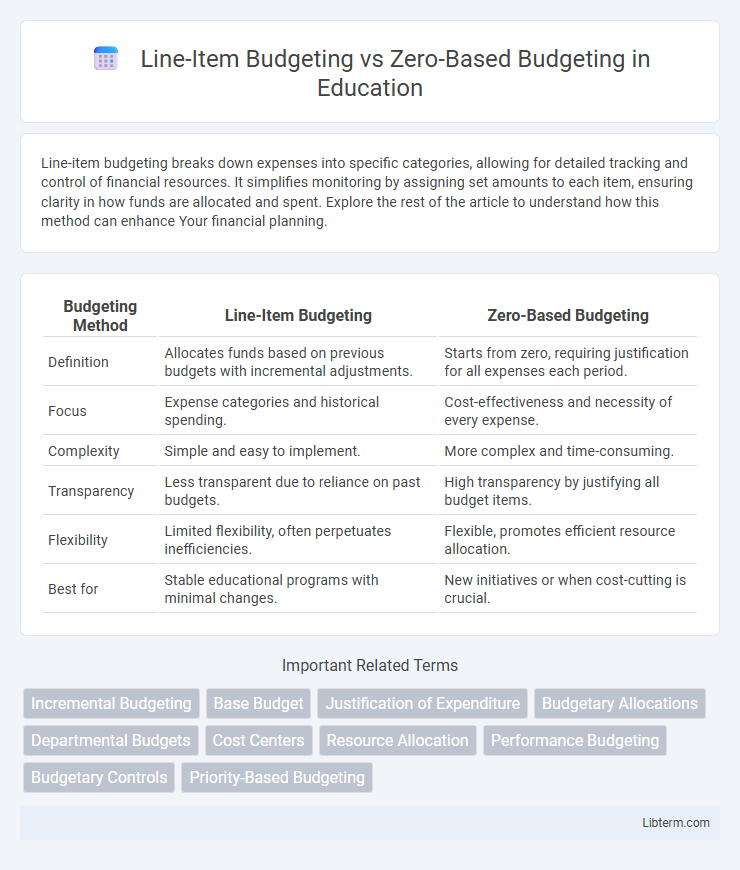

| Budgeting Method | Line-Item Budgeting | Zero-Based Budgeting |

|---|---|---|

| Definition | Allocates funds based on previous budgets with incremental adjustments. | Starts from zero, requiring justification for all expenses each period. |

| Focus | Expense categories and historical spending. | Cost-effectiveness and necessity of every expense. |

| Complexity | Simple and easy to implement. | More complex and time-consuming. |

| Transparency | Less transparent due to reliance on past budgets. | High transparency by justifying all budget items. |

| Flexibility | Limited flexibility, often perpetuates inefficiencies. | Flexible, promotes efficient resource allocation. |

| Best for | Stable educational programs with minimal changes. | New initiatives or when cost-cutting is crucial. |

Introduction to Budgeting Methods

Line-item budgeting organizes expenses by specific categories, providing clarity in tracking individual costs and simplifying comparison with previous periods. Zero-based budgeting requires every expense to be justified from scratch, enhancing cost-efficiency and aligning resource allocation with current priorities. Both methods serve distinct financial planning purposes, with line-item budgeting emphasizing routine control and zero-based budgeting promoting strategic evaluation.

What is Line-Item Budgeting?

Line-item budgeting is a traditional budgeting method that organizes expenses into specific categories such as salaries, office supplies, and utilities, allowing for straightforward tracking and control of costs. This approach simplifies financial management by allocating fixed amounts to each line item based on historical data. It is widely used in government and nonprofit organizations due to its clarity and ease of implementation.

What is Zero-Based Budgeting?

Zero-Based Budgeting (ZBB) is a budgeting method where every expense must be justified from scratch for each new period, starting from a "zero base." Unlike Line-Item Budgeting, which adjusts previous budgets by adding or subtracting amounts, ZBB requires detailed analysis of all activities and expenses, promoting efficient resource allocation. This approach enhances cost control by prioritizing needs and eliminating unnecessary expenditures based on current organizational goals.

Key Differences Between Line-Item and Zero-Based Budgeting

Line-item budgeting allocates funds based on historical expenditures with fixed categories, simplifying tracking but potentially perpetuating inefficiencies. Zero-based budgeting requires justifying every expense from scratch, promoting resource optimization and strategic alignment by focusing on activities and outcomes. The key difference lies in line-item budgeting's reliance on past budgets versus zero-based budgeting's emphasis on proactive evaluation and allocation of resources each cycle.

Advantages of Line-Item Budgeting

Line-item budgeting offers clear advantages such as simplicity and ease of implementation, making it ideal for organizations with stable financial patterns. This method provides precise control over specific expense categories, enhancing accountability and facilitating straightforward tracking of expenditures. Its structured approach supports efficient compliance with regulatory requirements and simplifies the auditing process.

Advantages of Zero-Based Budgeting

Zero-based budgeting enhances resource allocation by requiring all expenses to be justified from scratch, leading to more efficient and cost-effective budgeting decisions. It fosters a strategic approach that aligns spending with organizational goals, eliminating unnecessary expenditures inherent in traditional line-item budgets. This method promotes accountability and transparency, encouraging managers to critically evaluate every budget component, ultimately optimizing financial performance.

Disadvantages of Line-Item Budgeting

Line-item budgeting often lacks flexibility, making it difficult to adjust allocations based on changing organizational priorities or unexpected expenses. This method can lead to inefficiencies by promoting a focus on spending within predefined categories rather than outcomes or value. Furthermore, line-item budgeting does not encourage critical evaluation of all expenses, potentially perpetuating outdated or unnecessary costs absent in zero-based budgeting practices.

Disadvantages of Zero-Based Budgeting

Zero-Based Budgeting (ZBB) requires extensive time and resources due to its need for detailed justification of all expenses each budgeting cycle, making it less efficient for large organizations. It can lead to employee resistance and lower morale as departments must continuously defend their budgets, potentially causing internal conflicts. Moreover, ZBB may overlook long-term strategic priorities in favor of immediate cost reductions, risking underfunding of essential initiatives.

Choosing the Right Budgeting Method for Your Organization

Choosing the right budgeting method depends on your organization's financial goals and operational complexity. Line-item budgeting provides simplicity and control by allocating fixed amounts to specific categories, ideal for organizations seeking clear expense tracking and predictability. Zero-based budgeting requires justifying every expense from scratch, fostering cost-efficiency and strategic resource allocation in dynamic environments with frequent operational changes.

Conclusion: Which Budgeting Approach is Best?

Zero-based budgeting offers a thorough evaluation of every expense, promoting resource optimization and cost efficiency by requiring justification of all budget items from scratch. Line-item budgeting provides simplicity and ease of tracking by allocating fixed amounts to specific categories, making it suitable for organizations with stable financial needs. The best budgeting approach depends on organizational goals: zero-based budgeting excels in dynamic environments demanding financial scrutiny, while line-item budgeting suits entities favoring straightforward, predictable budgeting processes.

Line-Item Budgeting Infographic

libterm.com

libterm.com