Corvee refers to a form of unpaid, forced labor historically imposed by governments or feudal lords on peasants or lower-class citizens, often for public works or agricultural tasks. This system played a significant role in shaping social and economic structures in many societies throughout history. Discover how corvee impacted communities and its legacy by reading further in the article.

Table of Comparison

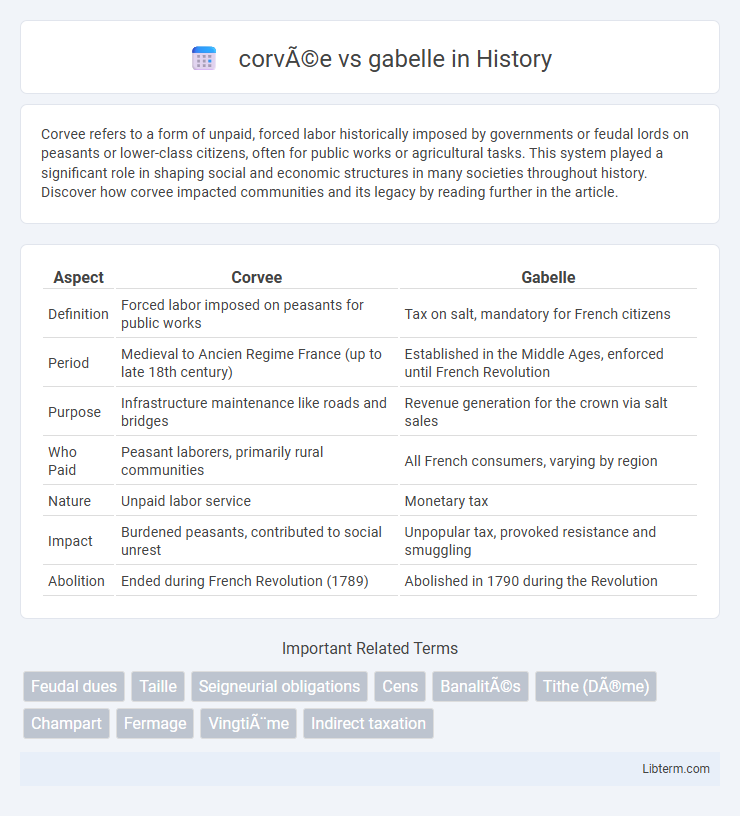

| Aspect | Corvee | Gabelle |

|---|---|---|

| Definition | Forced labor imposed on peasants for public works | Tax on salt, mandatory for French citizens |

| Period | Medieval to Ancien Regime France (up to late 18th century) | Established in the Middle Ages, enforced until French Revolution |

| Purpose | Infrastructure maintenance like roads and bridges | Revenue generation for the crown via salt sales |

| Who Paid | Peasant laborers, primarily rural communities | All French consumers, varying by region |

| Nature | Unpaid labor service | Monetary tax |

| Impact | Burdened peasants, contributed to social unrest | Unpopular tax, provoked resistance and smuggling |

| Abolition | Ended during French Revolution (1789) | Abolished in 1790 during the Revolution |

Introduction to Corvée and Gabelle

Corvee was a form of labor tax requiring peasants to provide unpaid work on public projects such as road maintenance, primarily imposed in France until the French Revolution. The Gabelle was a salt tax levied on the population, particularly burdensome because it was mandatory and enforced strict regional monopolies. Both corvee and gabelle exemplify pre-revolutionary fiscal pressures that fueled social unrest due to their heavy demands on common citizens.

Historical Origins of Corvée

Corvee labor originated in ancient civilizations such as Egypt and Mesopotamia, where it functioned as a mandatory, unpaid public service imposed on peasants to maintain infrastructure like roads and canals. Unlike the gabelle, a tax specifically on salt introduced in medieval France, corvee was rooted in feudal systems requiring physical labor rather than monetary payment. Its historical implementation reflects early forms of state control and resource management, emphasizing compulsory labor to support agricultural and infrastructural development.

The Emergence of the Gabelle Tax

The Gabelle tax emerged in medieval France as a state-imposed duty on salt, reflecting the monarchy's efforts to centralize revenue collection through monopolized commodities. Unlike corvee labor, which obligated peasants to provide unpaid service to the crown or nobility, the Gabelle directly targeted economic transactions, making salt--an essential preservative and seasoning--a lucrative source of taxation. Its implementation intensified social tensions due to regional disparities in tax rates and enforcement, contributing to widespread dissent that played a role in the lead-up to the French Revolution.

Corvée: Purpose and Implementation

Corvee was a form of unpaid labor imposed by European feudal states, primarily intended to maintain roads, bridges, and public infrastructure critical for military and economic purposes. It required peasants to provide a certain number of days of manual labor annually, reducing the need for monetary taxation. The implementation of corvee varied regionally but consistently served as a tool for central authorities to mobilize labor without direct financial expenditure.

Gabelle: Structure and Enforcement

The Gabelle was a highly structured and rigorously enforced tax on salt in pre-revolutionary France, pivotal in financing the royal treasury. It operated through a network of regional tax officers and salt warehouses, where salt prices were fixed by the state, compelling all citizens to buy from official sources at mandated rates. Enforcement involved severe penalties for smuggling or illegal salt trading, reflecting the crown's strict control over this essential commodity and the economic burden it placed on the population.

Social Impact of Corvée

The corvee system imposed forced labor on peasants, significantly exacerbating social inequality and fueling widespread resentment against feudal authorities. Unlike the gabelle, a tax on salt that financially burdened all social classes, the corvee disproportionately targeted lower-class rural populations, reinforcing socioeconomic disparities. This exploitation contributed to social unrest and was a catalyst for revolutionary movements challenging feudal hierarchies.

Economic Consequences of the Gabelle

The gabelle, a notorious salt tax imposed in pre-revolutionary France, significantly strained the economy by inflating salt prices and burdening the lower classes, thereby stifling consumption and economic mobility. Unlike the corvee, which required unpaid labor primarily on infrastructure projects, the gabelle directly affected market transactions and disproportionately impacted rural and urban poor populations. Its economic consequences contributed to widespread tax evasion, black market salt trade, and social unrest, undermining state revenue and fueling revolutionary sentiments.

Regional Differences Between Corvée and Gabelle

Corvee and gabelle exhibited distinct regional variations in pre-revolutionary France, with corvee serving as unpaid labor imposed predominantly in northern rural areas, particularly in regions like Normandy and Ile-de-France, while the gabelle was a salt tax that varied widely, being most burdensome in salt-rich eastern and central provinces such as Burgundy and the Franche-Comte. The intensity and enforcement of corvee depended on local seigneurial rights, creating patchy obligations, whereas gabelle rates differed significantly, with some provinces enjoying exemptions and others facing heavy taxation, reflecting economic disparities and geographic salt access. These regional disparities fueled resentment and contributed to varied local responses during the French Revolution, highlighting the socio-economic complexities embedded in both fiscal and labor obligations.

Reforms and Abolition: Corvée vs Gabelle

The corvee, a forced labor tax primarily used for infrastructure projects like road construction, was officially abolished during the French Revolution in 1789 as part of widespread reforms aimed at ending feudal privileges. The gabelle, a highly unpopular salt tax, faced a gradual dismantling; it was partially reformed and restricted before its complete abolition in 1946 following decades of resistance and economic inefficiency. These reforms marked significant shifts in tax policy, reflecting evolving attitudes toward equitable taxation and state authority in France.

Lasting Legacy and Modern Interpretations

The corvee, an unpaid labor tax primarily on rural peasants, shaped infrastructure development in pre-revolutionary France through forced public works, leaving a legacy of social unrest and highlighting class inequities that influenced modern labor laws. The gabelle, a tax on salt consumption, became infamous for its economic burden and regional disparities, contributing to widespread smuggling and resistance that informed the evolution of progressive taxation principles. Contemporary analyses view these systems as early examples of fiscal policies that underscored the necessity for equitable tax reforms and citizen representation in governance.

corvée Infographic

libterm.com

libterm.com