Gold is a highly sought-after precious metal known for its exceptional conductivity, malleability, and resistance to corrosion. Its unique properties make it invaluable in electronics, jewelry, and as a stable store of value in global markets. Discover how gold's intrinsic qualities and market dynamics can impact your investment strategy in the full article.

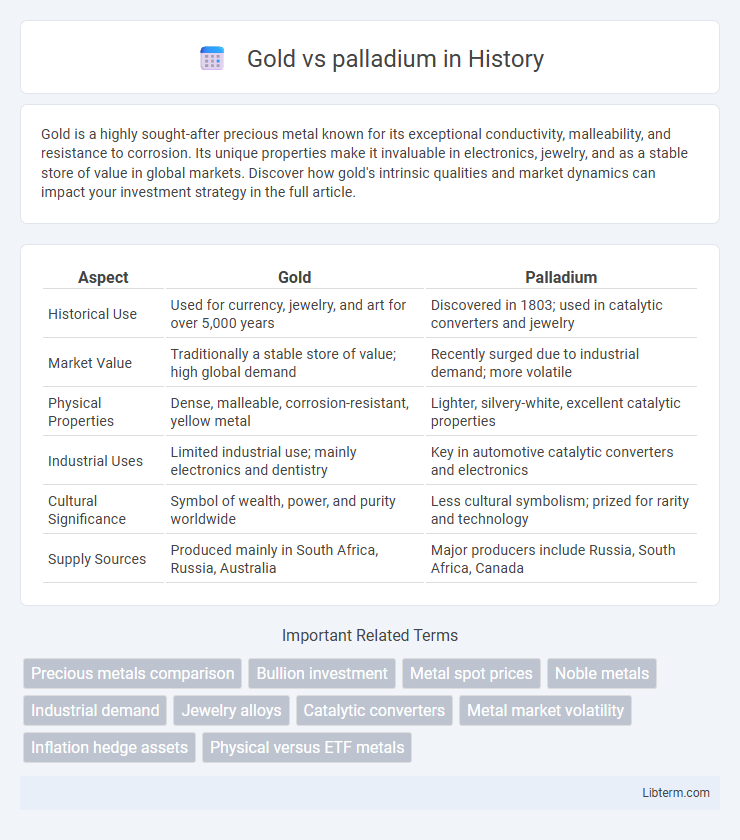

Table of Comparison

| Aspect | Gold | Palladium |

|---|---|---|

| Historical Use | Used for currency, jewelry, and art for over 5,000 years | Discovered in 1803; used in catalytic converters and jewelry |

| Market Value | Traditionally a stable store of value; high global demand | Recently surged due to industrial demand; more volatile |

| Physical Properties | Dense, malleable, corrosion-resistant, yellow metal | Lighter, silvery-white, excellent catalytic properties |

| Industrial Uses | Limited industrial use; mainly electronics and dentistry | Key in automotive catalytic converters and electronics |

| Cultural Significance | Symbol of wealth, power, and purity worldwide | Less cultural symbolism; prized for rarity and technology |

| Supply Sources | Produced mainly in South Africa, Russia, Australia | Major producers include Russia, South Africa, Canada |

Introduction to Gold and Palladium

Gold, a dense yellow metal with atomic number 79, is highly valued for its rarity, malleability, and resistance to corrosion, making it a prime choice in jewelry, electronics, and investment. Palladium, a rare silvery-white metal with atomic number 46, is part of the platinum group metals and is primarily used in catalytic converters, electronics, and dental materials due to its excellent catalytic properties and resistance to oxidation. Both metals are critical in various industrial applications, with gold widely recognized as a stable store of value and palladium essential for environmental technologies.

Historical Significance and Use Cases

Gold has been historically valued for its rarity and use in currency, jewelry, and religious artifacts dating back thousands of years, symbolizing wealth and power across civilizations. Palladium, discovered in the 19th century, gained prominence in industrial applications such as catalytic converters, electronics, and dental materials due to its corrosion resistance and catalytic properties. While gold remains a preferred asset for investment and ornamental purposes, palladium's significance has surged in modern technology and automotive industries.

Physical and Chemical Properties

Gold (Au) is a dense, malleable, and ductile metal with a distinctive yellow color, exhibiting excellent corrosion resistance and high electrical conductivity. Palladium (Pd) is lighter and harder than gold, has a silvery-white appearance, and is part of the platinum group metals known for its superior catalytic properties and ability to absorb hydrogen. Chemically, gold is highly inert and resists oxidation, whereas palladium actively participates in catalytic reactions and can form various compounds, especially with sulfur and oxygen.

Industrial Applications

Gold exhibits exceptional electrical conductivity and corrosion resistance, making it indispensable in high-precision electronic components and connectors in aerospace and telecommunications. Palladium's superior hydrogen absorption and catalytic properties drive its extensive use in automotive catalytic converters and fuel cell technology, enhancing emission control and energy efficiency. Both metals offer unique industrial advantages, with gold excelling in electronics and palladium dominating environmental and energy applications.

Investment Potential: Gold vs Palladium

Gold maintains a dominant position in investment portfolios due to its historical stability, liquidity, and status as a safe-haven asset during economic uncertainty. Palladium, while more volatile, offers substantial upside potential driven by increasing demand in the automotive industry for catalytic converters and limited supply sources. Investors seeking diversification may consider palladium for growth prospects, but gold remains the preferred choice for long-term wealth preservation and risk mitigation.

Market Trends and Price Volatility

Gold and palladium exhibit distinct market trends, with gold often regarded as a stable safe-haven asset during economic uncertainty, while palladium's price is more influenced by industrial demand, especially in the automotive sector for catalytic converters. Palladium prices have experienced sharper volatility due to supply constraints and fluctuating automotive industry needs, contrasting with gold's relatively steadier price movements driven by geopolitical tensions and inflation concerns. Trends show increasing palladium demand amid stricter emissions regulations, whereas gold's market is primarily swayed by investor sentiment and central bank policies.

Supply, Demand, and Mining Locations

Gold and palladium show distinct supply and demand dynamics, with gold having a more stable supply due to extensive mining operations in countries such as China, Australia, and Russia, while palladium supply is concentrated mainly in Russia and South Africa, making it more vulnerable to geopolitical risks. Demand for gold is driven primarily by jewelry, investment, and central bank reserves, whereas palladium is largely sought after for automotive catalytic converters and industrial applications. Palladium's supply constraints and growing demand in the automotive sector have resulted in higher price volatility compared to gold's more balanced market fundamentals.

Environmental and Ethical Considerations

Gold mining often involves significant environmental degradation, including deforestation, habitat destruction, and toxic waste production, posing serious ethical concerns regarding ecosystem damage and community health. Palladium extraction, while less widespread, also results in ecological disruption and often occurs in regions with weak environmental regulations, raising questions about sustainable sourcing. Ethical considerations in both metals stress the importance of responsible mining practices, transparency, and adherence to international environmental standards to minimize negative impacts.

Portfolio Diversification with Precious Metals

Gold and palladium serve distinct roles in portfolio diversification due to their unique market dynamics and industrial applications. Gold acts as a traditional safe-haven asset with strong liquidity and widespread investment demand, while palladium benefits from its critical use in automotive catalytic converters, driving industrial demand and price volatility. Incorporating both metals balances the portfolio by combining gold's stability with palladium's growth potential and supply constraints.

Future Prospects and Expert Predictions

Gold and palladium are both poised for significant shifts as market dynamics evolve; experts predict gold will maintain its role as a stable hedge against inflation with steady demand from central banks and investors. Palladium's future hinges on automotive industry trends, especially with stricter emissions standards driving demand for catalytic converters, though the rise of electric vehicles could limit long-term growth. Price forecasts indicate gold's steady appreciation, while palladium may experience more volatility due to supply constraints and technological changes in fuel alternatives.

Gold Infographic

libterm.com

libterm.com