A poll tax is a fixed tax levied on every adult, regardless of income or wealth, historically used to fund government services. This tax often sparked controversy due to its regressive nature, disproportionately affecting lower-income individuals. Discover how poll taxes have shaped fiscal policies and social movements in the detailed article ahead.

Table of Comparison

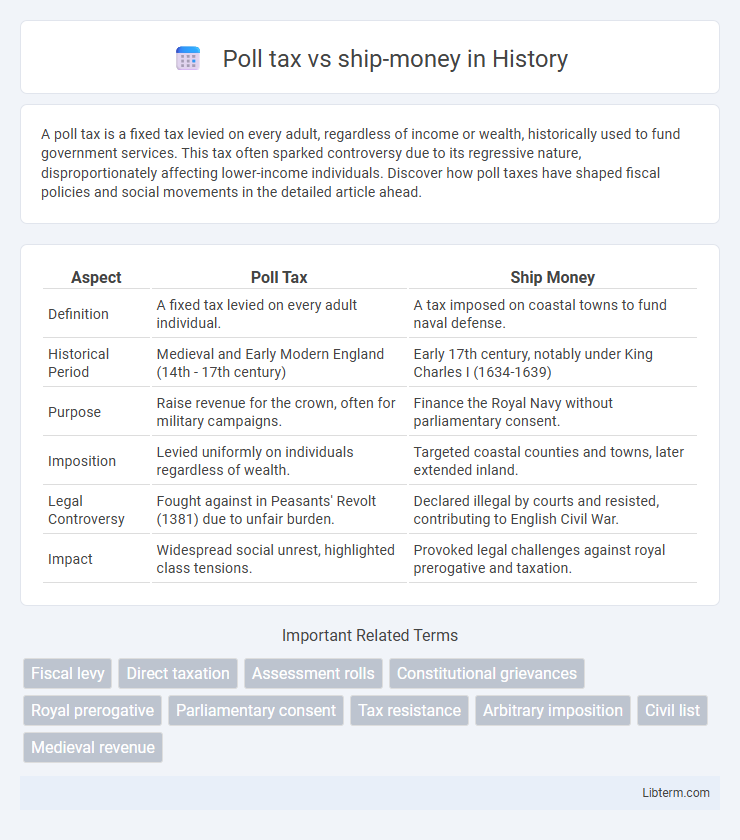

| Aspect | Poll Tax | Ship Money |

|---|---|---|

| Definition | A fixed tax levied on every adult individual. | A tax imposed on coastal towns to fund naval defense. |

| Historical Period | Medieval and Early Modern England (14th - 17th century) | Early 17th century, notably under King Charles I (1634-1639) |

| Purpose | Raise revenue for the crown, often for military campaigns. | Finance the Royal Navy without parliamentary consent. |

| Imposition | Levied uniformly on individuals regardless of wealth. | Targeted coastal counties and towns, later extended inland. |

| Legal Controversy | Fought against in Peasants' Revolt (1381) due to unfair burden. | Declared illegal by courts and resisted, contributing to English Civil War. |

| Impact | Widespread social unrest, highlighted class tensions. | Provoked legal challenges against royal prerogative and taxation. |

Introduction to Poll Tax and Ship-Money

Poll tax was a fixed tax levied on every adult individual, regardless of income or property, historically implemented in England to raise revenue for the crown. Ship-money was a medieval levy imposed on coastal towns to fund naval defense, later extended by Charles I to inland counties without parliamentary consent, sparking legal and political controversy. Both poll tax and ship-money highlight tensions between royal authority and taxpayer rights in 16th and 17th century England.

Historical Origins of Poll Tax

The poll tax originated in medieval England as a fixed per-person levy imposed on all adults to fund royal expenditures, notably during the 14th century under King Richard II. Contrastingly, ship money emerged in the 17th century as a naval tax levied on coastal towns to finance the Royal Navy without parliamentary consent. The poll tax's historical significance lies in its role in sparking widespread resistance, including the Peasants' Revolt of 1381, highlighting early tensions between taxation and representative authority.

Historical Background of Ship-Money

Ship-money originated in medieval England as a royal prerogative to fund naval defense by levying taxes on coastal towns, evolving from a feudal obligation requiring ship service or payment. Unlike poll tax, which was a fixed tax per individual regardless of property or income, ship-money targeted maritime regions and later expanded inland under Charles I to finance the navy without parliamentary consent. This controversial extension of ship-money in the 17th century contributed significantly to tensions between the monarchy and Parliament, playing a crucial role in the events leading up to the English Civil War.

Legal Foundations and Authority

Poll tax relied on parliamentary statutes asserting direct taxation authority over subjects, establishing a legal foundation based on representative governance. Ship-money derived its authority from the Crown's prerogative powers, historically used for naval defense, invoked without parliamentary consent, creating tension over executive overreach. The contrasting legal foundations highlight the conflict between statutory law and royal prerogative in early modern English constitutional development.

Economic Impact on Society

Poll tax and ship-money imposed different economic burdens on society, with poll tax directly levying individuals regardless of income, leading to widespread financial strain and social unrest among lower classes. Ship-money, while initially targeting coastal regions for naval defense funding, expanded to inland areas, increasing royal revenues but causing resentment due to perceived unfair taxation without parliamentary consent. Both levies disrupted local economies by reducing disposable incomes and fueling resistance movements that challenged fiscal policies in pre-modern England.

Public Reaction and Resistance

The imposition of the Poll Tax in 14th-century England sparked widespread public outrage, leading to violent uprisings such as the Peasants' Revolt of 1381, reflecting deep resistance against what was seen as an unfair and burdensome levy. In contrast, Ship Money, primarily levied during Charles I's reign without parliamentary consent, provoked legal challenges and dissent among both the gentry and commoners, with figures like John Hampden symbolizing the challenge to royal authority. Both taxes underscored tensions between monarchy and subjects, catalyzing resistance that contributed to the broader political conflicts culminating in the English Civil War.

Political Implications and Controversies

Poll tax and ship money sparked significant political controversies in 17th-century England by challenging the authority of the monarchy to levy taxes without parliamentary consent. Poll tax incited widespread resistance due to its regressive nature, disproportionately affecting the poor and fueling social unrest. Ship money, imposed by King Charles I, intensified conflicts over royal prerogative and parliamentary rights, contributing to the erosion of trust that led to the English Civil War.

Key Figures and Leadership Roles

Poll tax, imposed under King Richard II, sparked widespread resistance led by figures like Wat Tyler during the 1381 Peasants' Revolt, highlighting the tension between monarchy and commoners. Ship-money was expanded by King Charles I in the 1630s as a non-parliamentary tax, facing opposition from notable leaders such as John Hampden, whose legal challenge became a significant act of defiance against royal authority. Both taxes exemplified the struggle for fiscal control and contributed to key conflicts that shaped English governance.

Long-Term Consequences in English History

The imposition of the Poll Tax in England led to widespread social unrest culminating in the Peasants' Revolt of 1381, weakening the feudal system and accelerating shifts toward a more modern tax structure. Ship-money, controversially expanded by Charles I, intensified tensions between the monarchy and Parliament, contributing directly to the outbreak of the English Civil War (1642-1651). Both fiscal policies underscored the growing resistance to royal authority and played pivotal roles in the evolution of constitutional governance in England.

Comparative Analysis: Poll Tax vs Ship-Money

Poll tax imposed a uniform financial burden on all adult males, triggering widespread resistance due to its perceived inequality and harsh enforcement. Ship-money, originally a levy for naval defense applied mainly to coastal counties, expanded under Charles I to inland regions, causing constitutional disputes over royal prerogative and taxation without Parliament. Both fiscal policies fueled public unrest and contributed significantly to the tensions leading up to the English Civil War.

Poll tax Infographic

libterm.com

libterm.com