Donations play a vital role in supporting charitable organizations and driving meaningful change in communities worldwide. By contributing your resources, you help fund essential programs and provide assistance to those in need. Discover how your generosity can make a lasting impact by reading the rest of this article.

Table of Comparison

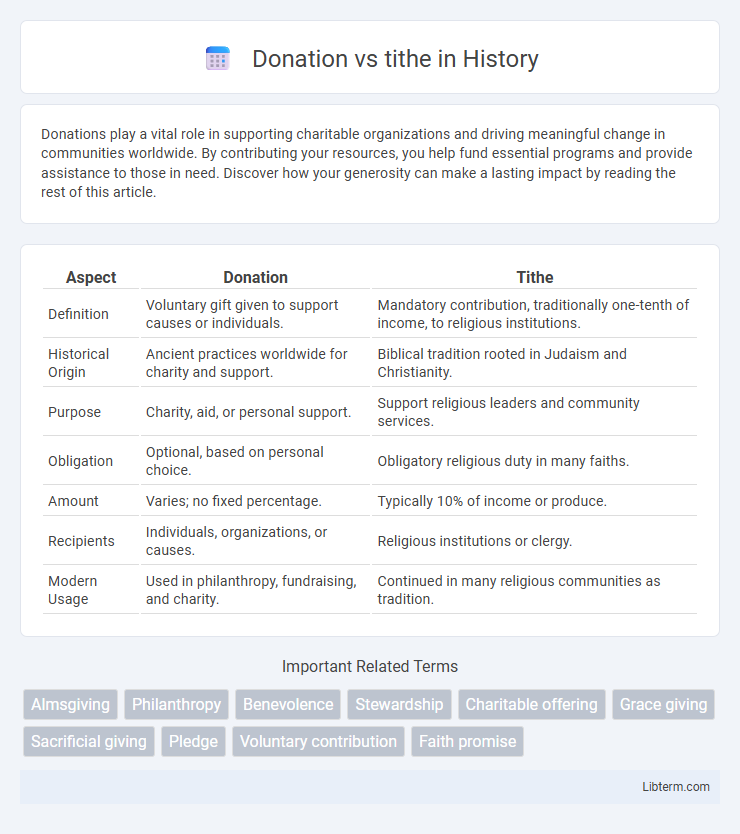

| Aspect | Donation | Tithe |

|---|---|---|

| Definition | Voluntary gift given to support causes or individuals. | Mandatory contribution, traditionally one-tenth of income, to religious institutions. |

| Historical Origin | Ancient practices worldwide for charity and support. | Biblical tradition rooted in Judaism and Christianity. |

| Purpose | Charity, aid, or personal support. | Support religious leaders and community services. |

| Obligation | Optional, based on personal choice. | Obligatory religious duty in many faiths. |

| Amount | Varies; no fixed percentage. | Typically 10% of income or produce. |

| Recipients | Individuals, organizations, or causes. | Religious institutions or clergy. |

| Modern Usage | Used in philanthropy, fundraising, and charity. | Continued in many religious communities as tradition. |

Understanding the Concept of Tithing

Tithing is the practice of giving a fixed percentage, usually 10%, of one's income to a religious organization, emphasizing commitment and faithfulness in spiritual stewardship. Donations, by contrast, are voluntary contributions that vary in amount and frequency, reflecting personal choice and generosity beyond obligatory giving. Understanding tithing involves recognizing its biblical roots and role in supporting clergy, church operations, and charitable efforts within faith communities.

What Constitutes a Donation?

A donation constitutes a voluntary gift of money, goods, or services given without expecting anything in return, often aimed at supporting charitable organizations, causes, or individuals in need. Unlike tithes, which are traditionally a fixed percentage (usually 10%) of one's income given as a religious obligation, donations are flexible in amount and frequency. Donations are recognized for their role in philanthropy and can be tax-deductible depending on the recipient organization and jurisdiction.

Historical Origins of Tithes

Tithing traces back to ancient agrarian societies where giving one-tenth of harvests served as a legal and religious obligation to support temples and priests. Historically rooted in the Old Testament, tithes were mandated as a covenantal practice among Israelites to ensure community welfare and religious sustainability. Unlike general donations, tithes functioned as a structured, compulsory contribution integral to societal and ecclesiastical systems for centuries.

Donations in Modern Society

Donations in modern society serve as a vital resource for funding nonprofit organizations, humanitarian aid, and community development projects, reflecting a broader and more flexible approach than traditional tithing. Unlike tithes, which are typically fixed at a religiously mandated percentage, donations vary widely in amount and frequency, allowing individuals to contribute according to personal capacity and social causes. The rise of digital platforms and crowdfunding has further expanded the accessibility and impact of donations, enabling global participation in charitable giving.

Key Differences Between Tithes and Donations

Tithes typically refer to a fixed percentage, usually 10% of a person's income, given as a religious obligation to support the church, while donations are voluntary contributions with no set amount or frequency. Tithes are often designated for specific church functions such as clergy support and building maintenance, whereas donations can be directed toward various causes including outreach programs, charity, and special projects. The key difference lies in the mandatory nature of tithing based on faith tradition compared to the discretionary nature of donations guided by individual choice.

Religious Significance of Tithing

Tithing holds deep religious significance as a divinely mandated practice rooted in biblical commandments, symbolizing obedience, faith, and gratitude towards God. Unlike general donations, tithes are traditionally set at a fixed 10% of income, representing a sacred covenant and a structured commitment within many religious communities. This act fosters spiritual discipline, supports religious institutions, and is considered essential for sustaining communal worship and charitable activities.

Secular Perspectives on Donations

Donations in secular contexts are voluntary financial gifts or contributions given without religious obligation, often directed towards charities, nonprofits, or social causes. Unlike tithes, which traditionally require giving a fixed percentage of income to a religious institution, secular donations emphasize personal choice, altruism, and civic responsibility. These contributions support community development, disaster relief, education, and medical research, reflecting diverse motivations beyond religious duty.

Financial Impact: Tithing vs. Donating

Tithing typically involves giving a fixed percentage, often 10%, of one's income to religious organizations, ensuring consistent financial support and budget predictability for these institutions. Donations vary in amount and frequency, creating unpredictable cash flow but allowing more flexibility for donors to support diverse causes. Financial impact of tithing stabilizes religious funding, while donations can rapidly respond to urgent needs but may fluctuate significantly.

Motivations Behind Giving

Motivations behind donation often stem from altruism, personal values, or a desire to support specific causes without obligatory constraints. Tithing is typically driven by religious commitment, adherence to faith teachings, and a sense of spiritual duty to contribute a fixed percentage of income. Both forms of giving foster community support, yet donations emphasize voluntary generosity while tithes reflect structured religious obligation.

Choosing the Right Way to Give

Donation and tithe represent distinct approaches to charitable giving, with tithing traditionally involving a set percentage of income, typically 10%, given regularly to religious institutions. Donations offer flexibility, allowing donors to distribute funds to various causes based on personal values and needs. Evaluating financial capacity, spiritual beliefs, and the desired impact are key factors in choosing the right way to give effectively.

Donation Infographic

libterm.com

libterm.com