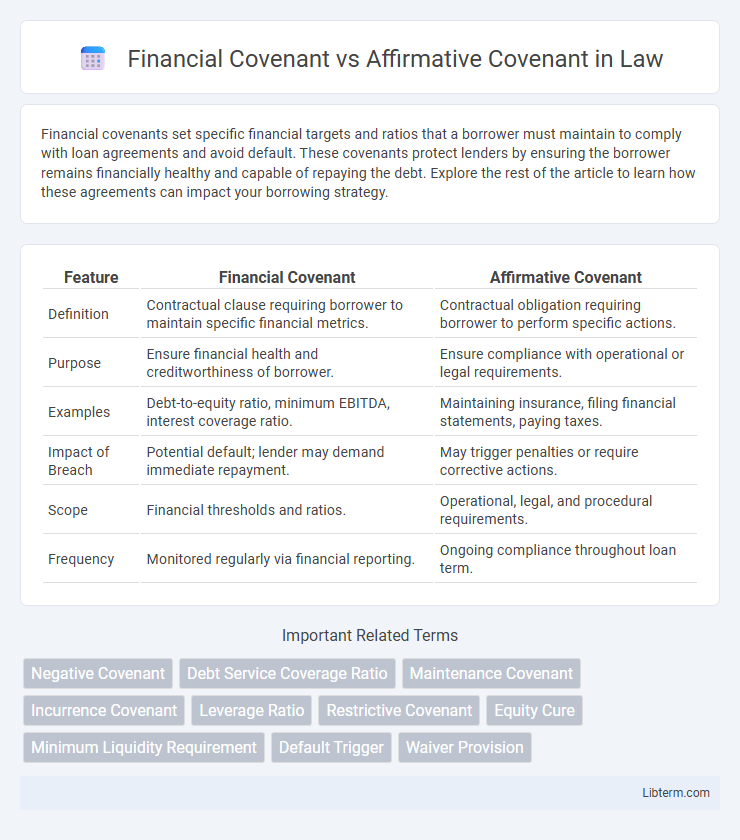

Financial covenants set specific financial targets and ratios that a borrower must maintain to comply with loan agreements and avoid default. These covenants protect lenders by ensuring the borrower remains financially healthy and capable of repaying the debt. Explore the rest of the article to learn how these agreements can impact your borrowing strategy.

Table of Comparison

| Feature | Financial Covenant | Affirmative Covenant |

|---|---|---|

| Definition | Contractual clause requiring borrower to maintain specific financial metrics. | Contractual obligation requiring borrower to perform specific actions. |

| Purpose | Ensure financial health and creditworthiness of borrower. | Ensure compliance with operational or legal requirements. |

| Examples | Debt-to-equity ratio, minimum EBITDA, interest coverage ratio. | Maintaining insurance, filing financial statements, paying taxes. |

| Impact of Breach | Potential default; lender may demand immediate repayment. | May trigger penalties or require corrective actions. |

| Scope | Financial thresholds and ratios. | Operational, legal, and procedural requirements. |

| Frequency | Monitored regularly via financial reporting. | Ongoing compliance throughout loan term. |

Understanding Financial Covenants

Financial covenants are binding agreements within loan contracts requiring borrowers to maintain specific financial metrics such as debt-to-equity ratios, interest coverage, or minimum net worth levels to ensure creditworthiness. In contrast, affirmative covenants mandate specific actions or behaviors borrowers must perform, like providing regular financial statements or maintaining insured assets. Understanding financial covenants is crucial for managing lender requirements, mitigating default risks, and maintaining operational flexibility within debt agreements.

Defining Affirmative Covenants

Affirmative covenants are legally binding clauses within loan agreements that require borrowers to perform specific actions, such as maintaining adequate insurance, providing regular financial statements, or complying with applicable laws. These covenants ensure continued operational and financial transparency, protecting lender interests by mandating proactive borrower conduct. Financial covenants, contrastingly, focus on maintaining certain financial ratios or metrics, like debt-to-equity or interest coverage ratios, to monitor the borrower's fiscal health.

Key Differences Between Financial and Affirmative Covenants

Financial covenants primarily impose specific financial metrics and ratios, such as debt-to-equity ratio or minimum net worth, that borrowers must maintain to ensure fiscal responsibility. Affirmative covenants require borrowers to perform certain actions, like maintaining insurance, providing financial statements, or complying with laws, to support ongoing operational compliance. The key difference lies in financial covenants focusing on quantitative financial thresholds, while affirmative covenants emphasize mandatory operational or administrative tasks.

Common Types of Financial Covenants

Financial covenants typically include debt-to-equity ratios, interest coverage ratios, and minimum net worth requirements to ensure a borrower's financial stability. Affirmative covenants, by contrast, mandate specific actions such as maintaining insurance, submitting financial statements, or paying taxes. Common financial covenants safeguard lenders by imposing quantitative thresholds, while affirmative covenants focus on operational compliance and transparency.

Examples of Affirmative Covenants in Agreements

Affirmative covenants in financial agreements often require borrowers to maintain specific financial ratios, such as a minimum debt service coverage ratio or a certain net worth level. Examples include obligations to provide regular financial statements, maintain insurance policies, and comply with all applicable laws and regulations. These covenants ensure ongoing transparency and operational standards, helping lenders mitigate risk during the loan period.

Importance of Covenants in Loan Contracts

Financial covenants set quantitative financial targets such as debt-to-equity ratios or minimum net worth that borrowers must maintain, ensuring lenders monitor the borrower's fiscal health and reduce credit risk. Affirmative covenants require borrowers to take specific actions like timely financial reporting and asset maintenance, promoting transparency and operational stability throughout the loan term. Both covenants are crucial in loan contracts as they safeguard lender interests, enforce compliance, and help mitigate potential defaults by creating clear, enforceable obligations.

Impact of Covenant Breach on Borrowers

A breach of a financial covenant, such as failing to maintain required debt-to-equity ratios, can trigger loan default and accelerate repayment demands, severely impacting the borrower's liquidity and credit standing. Affirmative covenant breaches, like neglecting to provide regular financial reports, typically lead to warnings or penalties but may not immediately result in default, allowing borrowers some operational flexibility. Lenders often enforce stricter consequences on financial covenant breaches due to their direct indicator of financial health, which can restrict borrower activities and increase borrowing costs.

Negotiating Financial and Affirmative Covenants

Negotiating financial covenants involves setting specific quantitative metrics such as debt-to-equity ratio, interest coverage ratio, and minimum liquidity levels to ensure borrower creditworthiness and lender protection. Affirmative covenants require borrowers to commit to actions like providing regular financial statements, maintaining insurance coverage, and complying with laws, emphasizing operational transparency and compliance. Striking a balance between stringent financial metrics and reasonable affirmative obligations is critical for aligning borrower flexibility with lender risk management.

Monitoring and Compliance Requirements

Financial covenants require companies to maintain specific financial ratios or thresholds, monitored through regular financial reporting and audits to ensure compliance. Affirmative covenants mandate certain actions or operational practices, with compliance verified via documented procedures, periodic certifications, and site inspections. Both covenants involve ongoing monitoring frameworks, but financial covenants primarily focus on quantitative financial metrics, while affirmative covenants emphasize qualitative operational adherence.

Best Practices for Managing Covenants

Monitoring financial covenants involves regularly reviewing key financial ratios such as debt-to-equity and interest coverage to ensure compliance and avoid default triggers. Affirmative covenants require proactive measures like maintaining insurance policies, submitting timely financial reports, and meeting operational benchmarks as stipulated in loan agreements. Employing covenant management software and establishing clear communication channels with lenders enhances transparency and enables early identification of potential breaches.

Financial Covenant Infographic

libterm.com

libterm.com