Pre-acquired property refers to assets owned before entering into a legal agreement, often impacting financial or marital arrangements. Understanding how these properties are treated can protect Your rights and clarify ownership boundaries. Explore the rest of this article to learn how pre-acquired property affects your legal and financial standing.

Table of Comparison

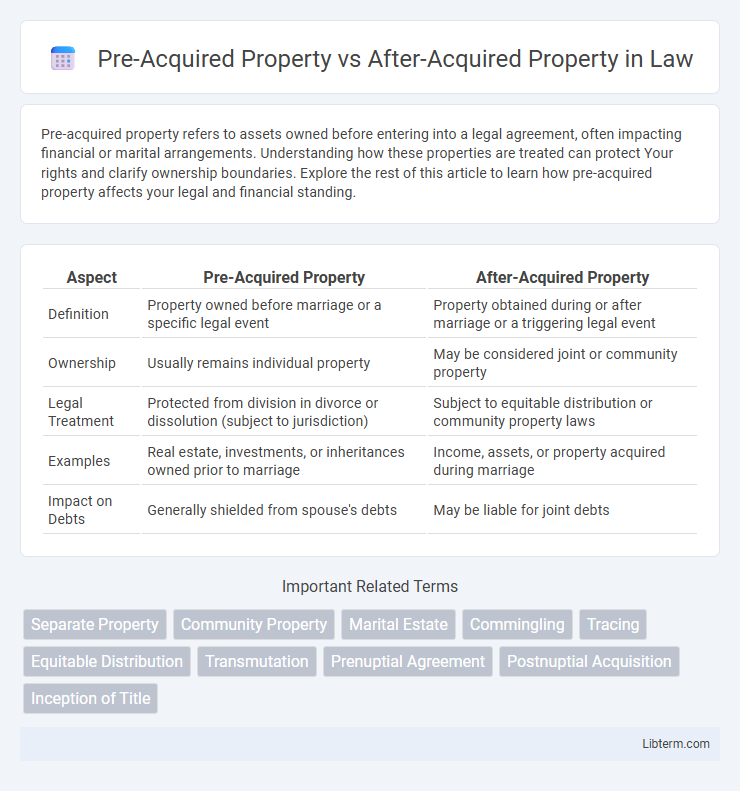

| Aspect | Pre-Acquired Property | After-Acquired Property |

|---|---|---|

| Definition | Property owned before marriage or a specific legal event | Property obtained during or after marriage or a triggering legal event |

| Ownership | Usually remains individual property | May be considered joint or community property |

| Legal Treatment | Protected from division in divorce or dissolution (subject to jurisdiction) | Subject to equitable distribution or community property laws |

| Examples | Real estate, investments, or inheritances owned prior to marriage | Income, assets, or property acquired during marriage |

| Impact on Debts | Generally shielded from spouse's debts | May be liable for joint debts |

Introduction to Pre-Acquired vs After-Acquired Property

Pre-acquired property refers to assets owned by an individual before entering into a legal agreement or marriage, whereas after-acquired property encompasses assets obtained during the course of that agreement or marriage. Distinctions between these categories are crucial for property division, estate planning, and creditor claims. Understanding how jurisdictions treat pre-acquired versus after-acquired property impacts ownership rights, tax implications, and liability protections.

Defining Pre-Acquired Property

Pre-acquired property refers to assets owned by an individual or entity before entering a new legal agreement, such as marriage or partnership. These properties remain separate from any jointly held or acquired assets during the relationship, often protected under property division laws or prenuptial agreements. Understanding the distinction between pre-acquired and after-acquired property is crucial for effective asset management and legal clarity.

Understanding After-Acquired Property

After-acquired property refers to assets obtained by an individual or entity after entering into a legal agreement, such as a contract or deed, where future acquisitions are subject to specific terms or claims. This concept commonly arises in property law, creditor rights, and security agreements, allowing creditors or parties to have interests in assets acquired post-agreement to secure obligations or debts. Understanding after-acquired property is crucial for interpreting rights, priorities, and claims in transactions involving evolving asset holdings.

Legal Distinctions Between the Two Types

Pre-acquired property refers to assets owned by an individual before marriage or legal partnership, while after-acquired property consists of assets obtained during the relationship. Legal distinctions hinge on jurisdiction-specific marital property laws, where pre-acquired property is typically considered separate property, exempt from division upon divorce, whereas after-acquired property may be deemed community or marital property subject to equitable distribution. Understanding these differences is crucial for asset protection, prenuptial agreements, and custody considerations in family law.

Importance in Marital and Inheritance Law

Pre-acquired property, obtained before marriage, often remains a separate asset, crucial for delineating ownership and protecting individual rights in marital property disputes. After-acquired property, gained during the marriage, typically falls under joint ownership rules, impacting division during divorce or death. Clear differentiation between these properties ensures fair inheritance distribution and safeguards spouses' financial interests under family law.

Implications for Property Ownership Rights

Pre-acquired property refers to assets owned before marriage, which typically remain the sole property of the original owner, preserving individual ownership rights under most marital property laws. After-acquired property consists of assets obtained during the marriage, often subject to joint ownership or equitable distribution depending on jurisdiction-specific marital property regimes. Understanding these distinctions is crucial for property ownership rights, especially in divorce or death scenarios, as it directly impacts asset division and claims by spouses or heirs.

Case Studies Highlighting Key Differences

Case studies reveal that pre-acquired property, owned by a spouse before marriage, remains separate and is typically protected from division in divorce settlements, as seen in Landmark v. Smith (2015), where courts upheld the original ownership despite marital duration. After-acquired property, obtained during the marriage, is generally considered marital property subject to equitable distribution, demonstrated in Johnson v. Roberts (2018), where assets acquired post-marriage were divided regardless of whose name held title. These cases underscore the legal importance of acquisition timing, impacting spousal property rights and divorce asset allocation.

Impact on Creditors and Debt Settlement

Pre-acquired property refers to assets owned before marriage or a specific legal agreement, which typically remain separate and protected from creditors' claims related to joint debts. After-acquired property, obtained after marriage or agreement commencement, often becomes part of the marital estate and may be subject to creditor claims for debt settlement. Creditors prioritize after-acquired property for satisfying debts since pre-acquired assets are usually exempt, influencing the availability of funds during insolvency or bankruptcy proceedings.

Common Disputes and Their Resolution

Common disputes between pre-acquired property and after-acquired property often involve ownership rights, division of assets, and valuation of property acquired before and during marriage or partnership. Resolution typically requires detailed examination of property titles, tracing asset origin, and applying relevant family or property laws to determine equitable distribution. Courts may consider timing of acquisition, contributions of each party, and intentions during acquisition to adjudicate conflicts fairly.

Practical Tips for Clear Property Classification

Establish clear documentation at the time of property acquisition to distinguish pre-acquired property, owned before marriage or partnership, from after-acquired property obtained during the union. Maintain separate accounts and records for properties bought individually and jointly to avoid co-mingling and simplify classification disputes. Consult legal frameworks specific to jurisdictional property laws to correctly apply criteria such as purchase date, source of funds, and ownership titles for accurate and enforceable property classification.

Pre-Acquired Property Infographic

libterm.com

libterm.com