A living trust is a legal document that allows you to manage and protect your assets during your lifetime and ensure a smooth transfer to your beneficiaries after your death. It helps avoid probate, maintain privacy, and can offer tax benefits, making it a valuable estate planning tool. Discover how a living trust can secure your legacy by reading the rest of this article.

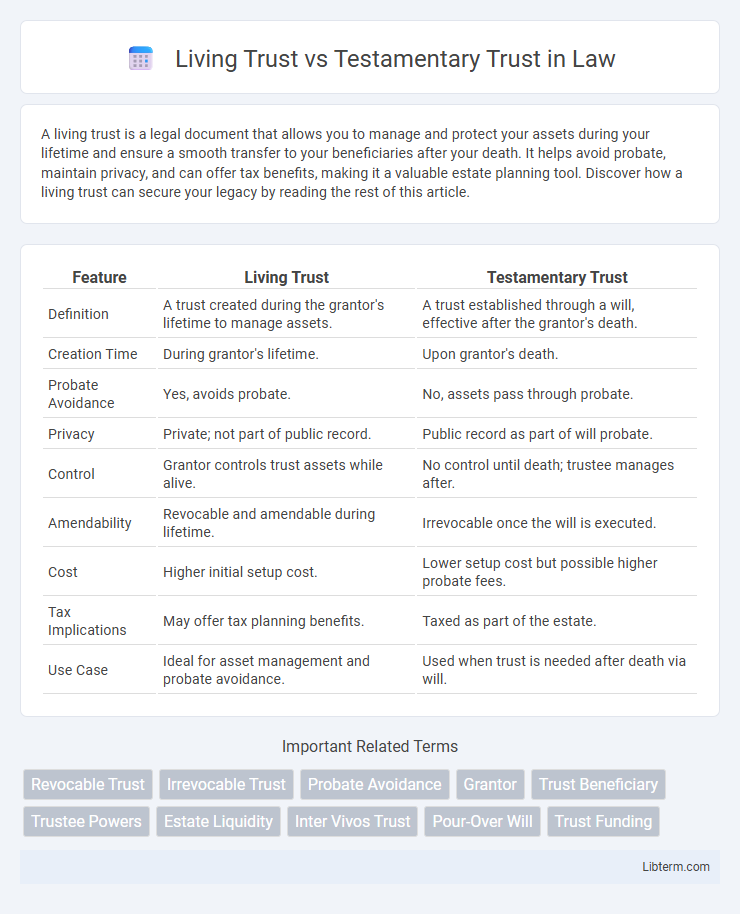

Table of Comparison

| Feature | Living Trust | Testamentary Trust |

|---|---|---|

| Definition | A trust created during the grantor's lifetime to manage assets. | A trust established through a will, effective after the grantor's death. |

| Creation Time | During grantor's lifetime. | Upon grantor's death. |

| Probate Avoidance | Yes, avoids probate. | No, assets pass through probate. |

| Privacy | Private; not part of public record. | Public record as part of will probate. |

| Control | Grantor controls trust assets while alive. | No control until death; trustee manages after. |

| Amendability | Revocable and amendable during lifetime. | Irrevocable once the will is executed. |

| Cost | Higher initial setup cost. | Lower setup cost but possible higher probate fees. |

| Tax Implications | May offer tax planning benefits. | Taxed as part of the estate. |

| Use Case | Ideal for asset management and probate avoidance. | Used when trust is needed after death via will. |

Introduction to Trusts: Living vs Testamentary

Living trusts, established during a grantor's lifetime, allow for immediate management and distribution of assets, avoiding probate and offering privacy benefits. Testamentary trusts are created through a will and only take effect upon the grantor's death, providing controlled asset distribution but subject to probate. Both trust types serve estate planning purposes, with distinctions in timing, control, and administrative processes essential for effective wealth management.

Definition and Purpose of a Living Trust

A Living Trust is a legal arrangement created during an individual's lifetime to manage assets and avoid probate, ensuring seamless distribution to beneficiaries upon death or incapacitation. It offers flexibility and privacy by allowing the grantor to retain control and make changes as needed. Unlike a Testamentary Trust, which only takes effect after death via a will, a Living Trust serves both as a management tool and an estate planning instrument.

Definition and Purpose of a Testamentary Trust

A testamentary trust is a fiduciary arrangement established through a will that takes effect only after the testator's death, designed primarily to manage and distribute assets according to specific instructions. It serves to protect beneficiaries, provide for minors or incapacitated persons, and can offer tax benefits by controlling asset allocation over time. Unlike a living trust, which is created and operational during the grantor's lifetime, a testamentary trust is dependent on the probate process for activation.

Key Differences Between Living and Testamentary Trusts

Living trusts are established during the grantor's lifetime and become effective immediately, allowing for the management of assets without court intervention, while testamentary trusts are created through a will and only take effect after the grantor's death. Living trusts offer privacy and can help avoid probate, whereas testamentary trusts are public documents subject to probate proceedings. The primary distinction lies in timing and control, with living trusts providing ongoing management and testamentary trusts focusing on posthumous asset distribution.

Probate Implications for Each Trust Type

Living trusts avoid probate by transferring assets directly to beneficiaries upon the grantor's death, ensuring faster access and privacy. Testamentary trusts are created through a will and must undergo probate, which can delay asset distribution and increase public exposure. Probate avoidance in living trusts reduces court fees and administrative costs compared to the probate-dependent testamentary trusts.

Control and Flexibility in Trust Management

Living trusts offer greater control and flexibility in trust management by allowing grantors to manage and amend the trust assets during their lifetime, providing immediate access and adjustments as circumstances change. Testamentary trusts, established through a will, only come into effect after the grantor's death, limiting control until that point and requiring court supervision during estate probate. The living trust's ability to bypass probate and enable ongoing management makes it a preferred option for individuals seeking dynamic control over asset distribution and trust administration.

Costs and Complexity of Establishing Trusts

Establishing a living trust typically involves higher initial costs due to the comprehensive legal work required for asset retitling and trust document preparation, averaging between $1,000 and $3,000. Testamentary trusts, created through a will and activated upon death, generally incur lower upfront expenses but result in probate costs and longer administration timelines. Complex asset management and potential tax advantages increase the complexity and price of living trusts compared to the simpler, probate-dependent testamentary trusts.

Privacy Concerns: Public vs Private Administration

Living trusts provide enhanced privacy by avoiding probate and keeping asset distribution details confidential, while testamentary trusts become public record through the probate process. Probate court filings expose testamentary trust arrangements to public scrutiny, potentially revealing sensitive financial information. Choosing a living trust safeguards personal and financial privacy by ensuring private administration outside of court supervision.

Tax Considerations for Living and Testamentary Trusts

Living trusts allow assets to pass outside of probate, often reducing estate taxes by removing assets from the taxable estate, whereas testamentary trusts are funded after death and do not avoid probate, potentially resulting in higher estate tax exposure. Income generated by assets in a living trust is typically taxed to the grantor during their lifetime, while income in a testamentary trust is taxed at trust tax rates after the grantor's death, which are generally higher and can reduce overall tax efficiency. Strategic planning with living trusts can help minimize estate tax liability and provide greater control over income tax treatment compared to testamentary trusts.

Choosing the Right Trust for Your Estate Planning Needs

Living trusts offer immediate control over assets during your lifetime, facilitating probate avoidance and privacy, while testamentary trusts activate only after death through a will, providing structured future asset management. Evaluating factors like asset complexity, tax implications, and desired control upon incapacity helps determine the optimal trust type for your estate plan. Consulting an estate planning attorney ensures alignment with your financial goals and legal requirements, maximizing the trust's effectiveness.

Living Trust Infographic

libterm.com

libterm.com