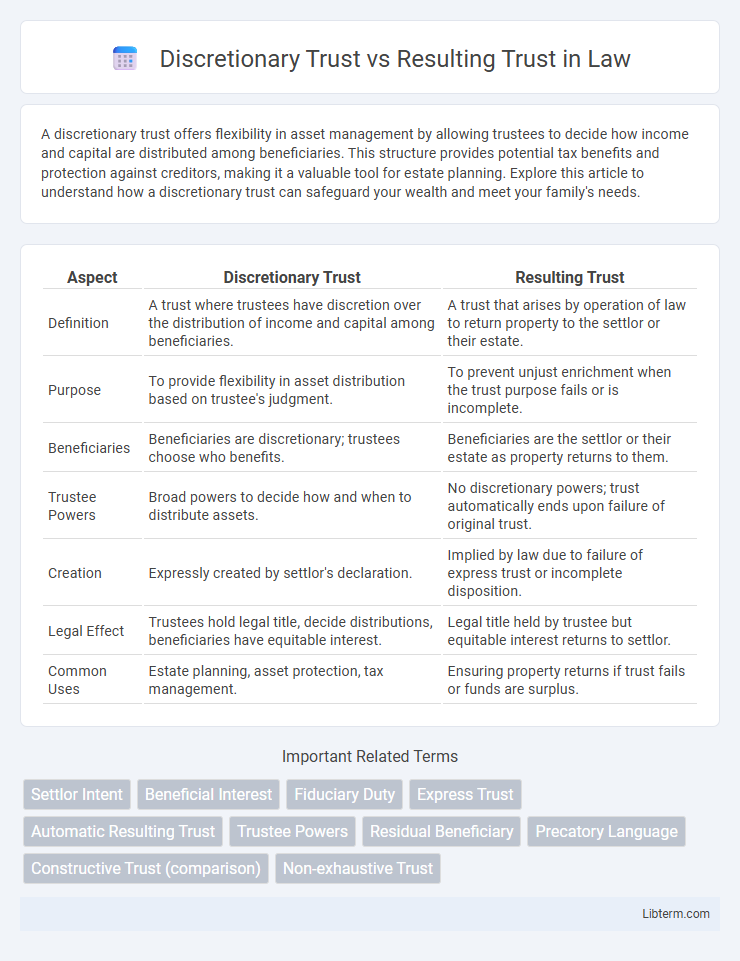

A discretionary trust offers flexibility in asset management by allowing trustees to decide how income and capital are distributed among beneficiaries. This structure provides potential tax benefits and protection against creditors, making it a valuable tool for estate planning. Explore this article to understand how a discretionary trust can safeguard your wealth and meet your family's needs.

Table of Comparison

| Aspect | Discretionary Trust | Resulting Trust |

|---|---|---|

| Definition | A trust where trustees have discretion over the distribution of income and capital among beneficiaries. | A trust that arises by operation of law to return property to the settlor or their estate. |

| Purpose | To provide flexibility in asset distribution based on trustee's judgment. | To prevent unjust enrichment when the trust purpose fails or is incomplete. |

| Beneficiaries | Beneficiaries are discretionary; trustees choose who benefits. | Beneficiaries are the settlor or their estate as property returns to them. |

| Trustee Powers | Broad powers to decide how and when to distribute assets. | No discretionary powers; trust automatically ends upon failure of original trust. |

| Creation | Expressly created by settlor's declaration. | Implied by law due to failure of express trust or incomplete disposition. |

| Legal Effect | Trustees hold legal title, decide distributions, beneficiaries have equitable interest. | Legal title held by trustee but equitable interest returns to settlor. |

| Common Uses | Estate planning, asset protection, tax management. | Ensuring property returns if trust fails or funds are surplus. |

Introduction to Trusts: An Overview

Discretionary trusts grant trustees the authority to decide which beneficiaries receive income or capital, offering flexibility in asset distribution. Resulting trusts arise when the intention behind property transfer is unclear or incomplete, causing the property to revert to the original owner or their estate. Understanding these fundamental trust types is essential for effective estate planning and asset protection strategies.

Defining Discretionary Trusts

Discretionary trusts grant trustees full authority to decide how and when to distribute trust assets among beneficiaries, allowing flexible wealth management tailored to beneficiaries' needs. Beneficiaries have no fixed entitlement, giving trustees discretion over payments and timing, which is ideal for asset protection and tax planning. This contrasts with resulting trusts that arise when trust intentions fail, returning assets to the settlor or their estate by default.

Explaining Resulting Trusts

Resulting trusts arise when property is transferred under circumstances indicating the transferor did not intend to benefit the transferee, often occurring after failed express trusts or voluntary transfers. These trusts operate by returning the property to the original owner or their estate, preserving equity by preventing unjust enrichment. Courts impose resulting trusts to reflect the presumed intentions, emphasizing the absence of a gift or completed trust arrangement.

Key Legal Differences Between Discretionary and Resulting Trusts

Discretionary trusts grant trustees the authority to decide how and when to distribute trust assets among beneficiaries, providing flexibility and protection against creditors. Resulting trusts arise by operation of law when an express trust fails or does not exhaust the trust property, leading to the return of assets to the settlor or their estate. The key legal difference centers on the intention and control: discretionary trusts emphasize trustee discretion and active management, whereas resulting trusts focus on the implied return of property due to lack of an express beneficial interest.

Beneficiary Rights and Interests

Discretionary trusts grant trustees the power to decide how and when beneficiaries receive distributions, providing beneficiaries with no fixed entitlement but a mere hope or interest in the trust assets. Resulting trusts arise when property is transferred under circumstances suggesting the transferor did not intend to benefit the recipient, thereby giving beneficiaries a proprietary interest and the right to reclaim trust property. Beneficiaries under resulting trusts have enforceable rights to specific trust assets, while those under discretionary trusts must rely on trustee discretion and have limited legal claims to trust property.

Trustee Powers and Responsibilities

Discretionary trusts grant trustees broad powers to decide how and when to distribute income or capital among beneficiaries, allowing flexibility based on the trustee's judgment. Trustees in discretionary trusts must act in good faith, considering the best interests of the beneficiaries while exercising their discretion responsibly. Resulting trusts typically arise when an express trust fails or ends, imposing a duty on trustees to return trust property to the settlor or their estate, with limited discretionary powers and a primary focus on restoring equitable ownership.

Creation and Formation of Trusts

Discretionary trusts are created through a formal trust deed specifying the settlor's intent to give trustees discretionary powers over asset distribution among beneficiaries, usually established during the settlor's lifetime or via a will. Resulting trusts arise by operation of law, typically when the trust fails, or there is an absence of clear intention to benefit the recipient, causing the property to "result" back to the settlor or their estate. The formation of discretionary trusts requires explicit documentation and expressed purpose, whereas resulting trusts form automatically based on equitable principles and the parties' actions.

Common Uses and Purposes

Discretionary trusts are commonly used for estate planning to provide flexibility in distributing assets to beneficiaries based on changing circumstances, protecting family wealth, and minimizing tax liabilities. Resulting trusts typically arise to address situations where property is transferred without the intention of gifting, ensuring equitable ownership when the transferor retains beneficial interest or consideration is unpaid. The primary purpose of discretionary trusts is asset management and beneficiary protection, while resulting trusts serve to prevent unjust enrichment and clarify property rights.

Tax Implications and Considerations

Discretionary trusts offer flexible income distribution, allowing trustees to allocate income and capital among beneficiaries, which can optimize tax outcomes through income splitting and tax rate management. Resulting trusts typically arise unintentionally when property is transferred without a clear beneficial owner, leading to less control over tax planning and potential exposure to capital gains or income tax liabilities. Careful consideration of each trust type's tax treatment is essential to minimize tax burdens and align with estate planning objectives.

Choosing the Right Trust Structure

Choosing the right trust structure between a discretionary trust and a resulting trust depends on the intended control and distribution of assets. Discretionary trusts offer flexibility by allowing trustees to decide how and when beneficiaries receive benefits, ideal for asset protection and tax planning. Resulting trusts arise by operation of law where assets revert to the settlor or their estate, often reflecting a lack of intention to gift, making them less suitable for flexible estate planning.

Discretionary Trust Infographic

libterm.com

libterm.com