Effective administration streamlines organizational processes, ensuring resources are allocated efficiently and goals are achieved on time. Strong leadership and clear communication within administration foster productivity and employee satisfaction. Discover how optimizing your administrative strategies can transform your operations by reading the full article.

Table of Comparison

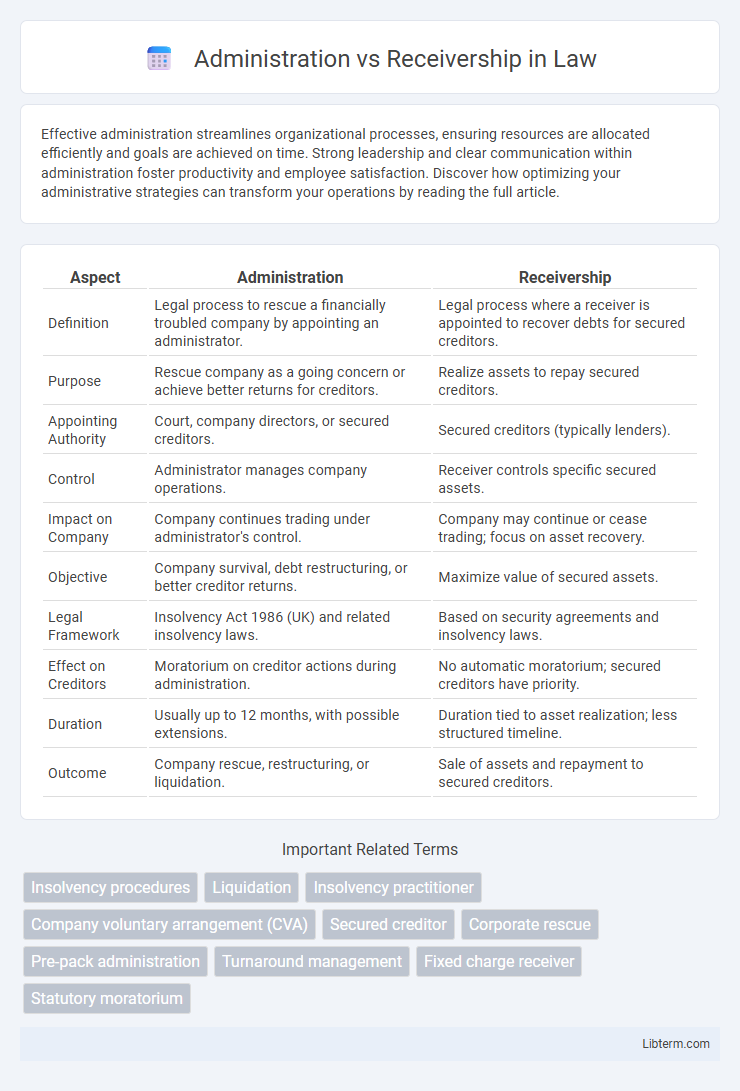

| Aspect | Administration | Receivership |

|---|---|---|

| Definition | Legal process to rescue a financially troubled company by appointing an administrator. | Legal process where a receiver is appointed to recover debts for secured creditors. |

| Purpose | Rescue company as a going concern or achieve better returns for creditors. | Realize assets to repay secured creditors. |

| Appointing Authority | Court, company directors, or secured creditors. | Secured creditors (typically lenders). |

| Control | Administrator manages company operations. | Receiver controls specific secured assets. |

| Impact on Company | Company continues trading under administrator's control. | Company may continue or cease trading; focus on asset recovery. |

| Objective | Company survival, debt restructuring, or better creditor returns. | Maximize value of secured assets. |

| Legal Framework | Insolvency Act 1986 (UK) and related insolvency laws. | Based on security agreements and insolvency laws. |

| Effect on Creditors | Moratorium on creditor actions during administration. | No automatic moratorium; secured creditors have priority. |

| Duration | Usually up to 12 months, with possible extensions. | Duration tied to asset realization; less structured timeline. |

| Outcome | Company rescue, restructuring, or liquidation. | Sale of assets and repayment to secured creditors. |

Introduction to Administration and Receivership

Administration is a legal process in the UK designed to protect insolvent companies by appointing an administrator to manage the company's affairs, business, and property to achieve rescue or better outcome for creditors. Receivership involves appointing a receiver, typically by a secured creditor, to take control of specific assets charged under a security agreement to recover owed debts. Both processes aim to maximize asset value but differ in terms of control scope, objectives, and statutory oversight under insolvency law.

Key Definitions and Legal Framework

Administration is a legal process in insolvency law designed to rescue a financially troubled company, preserving its business and maximizing creditor returns under court supervision. Receivership involves the appointment of a receiver, typically by secured creditors, to take control of specific assets or operations to recover outstanding debts, governed by security agreements and insolvency statutes. Both frameworks operate within insolvency regulations but differ in purpose, control allocation, and potential outcomes for the distressed entity and its stakeholders.

Primary Objectives of Administration

The primary objective of administration is to rescue the company as a going concern or achieve a better result for creditors than immediate liquidation would provide. Administrators aim to stabilize the business, manage its assets efficiently, and maximize returns to creditors while preserving as much employment as possible. This contrasts with receivership, where the focus is primarily on recovering secured creditors' debts by selling the company's assets.

Primary Objectives of Receivership

Receivership primarily aims to safeguard and maximize the value of a distressed company's assets for secured creditors, ensuring orderly management and realization of these assets. It emphasizes creditor interests by stabilizing operations and preventing asset dissipation during insolvency proceedings. This contrasts with administration, which seeks broader objectives including company rescue and maximizing overall stakeholder returns.

Roles and Powers of Administrators

Administrators are appointed to manage the affairs, business, and property of a distressed company with the primary goal of rescuing the company as a going concern or achieving a better result for creditors than immediate liquidation. They possess extensive powers, including controlling company assets, continuing or terminating contracts, and making operational decisions to stabilize the business. Unlike receivers who act mainly to recover secured creditors' debts, administrators have a broader responsibility to balance the interests of all creditors and stakeholders.

Roles and Powers of Receivers

Receivers are appointed to take control of specific assets or a company to protect creditors' interests during financial distress, with powers to manage, sell, or realize secured assets. Unlike administration, which aims to rescue the company as a going concern, receivers primarily focus on recovering debts for secured creditors. The receiver's authority is limited to the security deed or charge and does not encompass the broader management or restructuring powers available under administration.

Impact on Creditors and Stakeholders

Administration provides a structured process where appointed administrators manage the company to maximize returns for creditors and may allow the business to continue operating, often preserving stakeholder value. Receivership involves a receiver taking control of specific assets primarily for secured creditors, often resulting in asset liquidation with limited consideration for unsecured creditors and other stakeholders. The impact on creditors varies, as administration aims for an equitable distribution, while receivership prioritizes recovery for secured lenders, potentially disadvantaging other stakeholders.

Process and Procedures Involved

Administration involves appointing an insolvency practitioner as an administrator to manage the company's affairs, business, and assets to rescue the company or achieve better returns for creditors. The process begins with filing a notice of intention to appoint an administrator or directly appointing one through a court order or creditor resolution. Receivership, typically initiated by secured creditors, appoints a receiver to recover owed sums by taking control of specific charged assets, prioritizing debt recovery rather than company rescue, with the receiver having powers limited to the secured assets under the charge.

Advantages and Disadvantages Comparison

Administration offers companies legal protection from creditors, allowing time to restructure debts and improve financial stability, which enhances the chance of business survival. However, administration procedures can be costly and may dilute existing shareholders' control, sometimes leading to prolonged uncertainty for stakeholders. Receivership focuses on asset recovery for secured creditors, providing a quicker resolution but often results in the sale of company assets, potentially destroying the business's value and leaving unsecured creditors with little return.

Choosing Between Administration and Receivership

Choosing between administration and receivership depends on the company's financial situation and the stakeholders' objectives. Administration offers broader protection by allowing the company to restructure and continue trading under the supervision of an insolvency practitioner, prioritizing the interests of all creditors. Receivership, typically initiated by secured creditors, focuses on recovering owed debts by selling specific assets, often leading to liquidation without protecting the entire business.

Administration Infographic

libterm.com

libterm.com