Unallocated Loss Adjustment Expense (ULAE) refers to the indirect costs insurers incur while processing claims, such as salaries and overhead, which are not directly tied to any specific claim. Understanding how ULAE impacts your insurance company's overall expense management can help in evaluating claim reserve adequacy. Dive into the rest of the article to explore strategies for optimizing these essential yet often overlooked expenses.

Table of Comparison

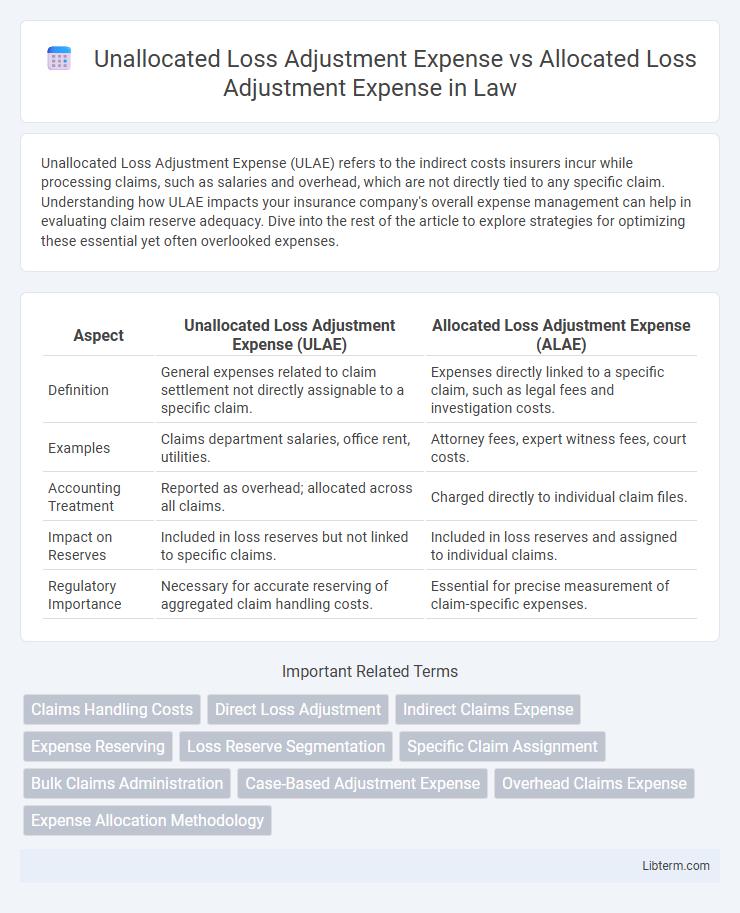

| Aspect | Unallocated Loss Adjustment Expense (ULAE) | Allocated Loss Adjustment Expense (ALAE) |

|---|---|---|

| Definition | General expenses related to claim settlement not directly assignable to a specific claim. | Expenses directly linked to a specific claim, such as legal fees and investigation costs. |

| Examples | Claims department salaries, office rent, utilities. | Attorney fees, expert witness fees, court costs. |

| Accounting Treatment | Reported as overhead; allocated across all claims. | Charged directly to individual claim files. |

| Impact on Reserves | Included in loss reserves but not linked to specific claims. | Included in loss reserves and assigned to individual claims. |

| Regulatory Importance | Necessary for accurate reserving of aggregated claim handling costs. | Essential for precise measurement of claim-specific expenses. |

Understanding Loss Adjustment Expenses (LAE)

Unallocated Loss Adjustment Expense (ULAE) consists of indirect costs such as salaries and overhead not tied to specific claims, while Allocated Loss Adjustment Expense (ALAE) includes direct costs related to individual claim settlements like legal fees and investigation expenses. Understanding Loss Adjustment Expenses (LAE) is crucial for accurate insurance claim accounting and pricing, as it impacts the overall loss reserves and profitability. Proper differentiation between ULAE and ALAE allows insurers to manage expenses effectively and ensure regulatory compliance.

Definition of Allocated Loss Adjustment Expense (ALAE)

Allocated Loss Adjustment Expense (ALAE) refers to the specific costs directly associated with investigating, defending, and settling individual insurance claims, including legal fees, expert witness charges, and investigation costs. It contrasts with Unallocated Loss Adjustment Expense (ULAE), which encompasses general administrative expenses not tied to a particular claim. Insurers track ALAE separately to accurately assess the financial impact of each claim on their overall loss adjustment process.

Definition of Unallocated Loss Adjustment Expense (ULAE)

Unallocated Loss Adjustment Expense (ULAE) refers to overhead costs related to claims handling that cannot be directly attributed to a specific claim, such as salaries of claims department staff and general office expenses. These expenses differ from Allocated Loss Adjustment Expense (ALAE), which includes costs directly associated with individual claims, like legal fees and investigation costs. Properly distinguishing ULAE helps insurers accurately estimate total claims expenses and maintain precise financial reporting.

Key Differences Between ALAE and ULAE

Allocated Loss Adjustment Expense (ALAE) refers to costs directly attributable to specific claims, such as legal fees and expert witness expenses, while Unallocated Loss Adjustment Expense (ULAE) encompasses general expenses not linked to individual claims, including salaries of claims staff and overhead. ALAE is variable and claim-specific, often fluctuating with the number and complexity of claims, making it easier to assign to individual loss events. ULAE is more fixed in nature, representing overall operational costs in claims handling, and is typically spread across all claims regardless of individual claim characteristics.

Examples of Allocated Loss Adjustment Expenses

Allocated Loss Adjustment Expenses (ALAE) include specific costs directly tied to individual claims, such as attorney fees, court costs, expert witness fees, and investigation expenses. These expenses differ from Unallocated Loss Adjustment Expenses (ULAE), which cover general claims administration costs like salaries of claims adjusters and office overhead. Examples of ALAE are payments made to defense attorneys in a liability claim or fees for a private investigator hired to verify a disputed accident claim.

Examples of Unallocated Loss Adjustment Expenses

Unallocated Loss Adjustment Expenses (ULAE) include costs such as salaries of claims department personnel, office rent, and general administrative expenses that cannot be directly linked to specific claims. Examples of ULAE involve expenses like overhead for claim processing, employee training, and technology systems supporting multiple claims simultaneously. These contrast with Allocated Loss Adjustment Expenses (ALAE), which are directly attributable to individual claims, such as legal fees and expert witness costs.

Accounting Treatment of ALAE vs. ULAE

Allocated Loss Adjustment Expense (ALAE) refers to costs directly attributable to specific claims, such as legal fees and expert witness expenses, and is recorded as a separate liability on the balance sheet to match claim reserves. Unallocated Loss Adjustment Expense (ULAE) includes indirect claims handling costs, like salaries of claims adjusters, which are typically expensed in the period incurred and not directly linked to individual claims. Accounting treatment of ALAE requires precise allocation to claim-specific reserves, enhancing reserve accuracy, whereas ULAE is pooled and treated as an operational cost impacting underwriting results.

Impact on Insurance Premiums and Reserving

Unallocated Loss Adjustment Expense (ULAE) represents overhead costs not directly tied to specific claims, while Allocated Loss Adjustment Expense (ALAE) relates to costs directly associated with individual claims. Insurers incorporate both ULAE and ALAE into reserving to ensure accurate liability estimation, which in turn influences the calculation of insurance premiums. Higher ALAE generally leads to increased premiums due to its direct claim impact, whereas elevated ULAE reflects administrative expense projections affecting overall premium adequacy.

Importance in Claims Management and Reporting

Unallocated Loss Adjustment Expenses (ULAE) represent overhead costs not directly tied to specific claims, such as salaries of claims department staff, while Allocated Loss Adjustment Expenses (ALAE) are directly associated with individual claim handling activities like legal fees or expert consultations. Accurate differentiation between ULAE and ALAE is crucial for precise claims management, cost control, and regulatory reporting, ensuring insurers allocate resources efficiently and maintain proper financial reserves. Effective tracking of these expenses supports better loss forecasting and enhances the overall transparency of an insurer's financial health.

Best Practices for Managing LAE in Insurance

Effective management of Loss Adjustment Expense (LAE) requires clear differentiation between Unallocated Loss Adjustment Expense (ULAE) and Allocated Loss Adjustment Expense (ALAE) to ensure accurate financial reporting and reserving. Best practices include deploying advanced claims analytics to track ALAE by individual claims and using actuarial models to estimate ULAE based on historical data trends. Insurers optimize resource allocation and improve loss cost forecasting by regularly reviewing expense categories and implementing automated workflows for claims processing.

Unallocated Loss Adjustment Expense Infographic

libterm.com

libterm.com