A lien is a legal claim or right against property, typically used as security for a debt or obligation. It ensures that the creditor can seek repayment through the collateral if the debtor defaults. Explore the rest of the article to understand how liens affect your property and financial decisions.

Table of Comparison

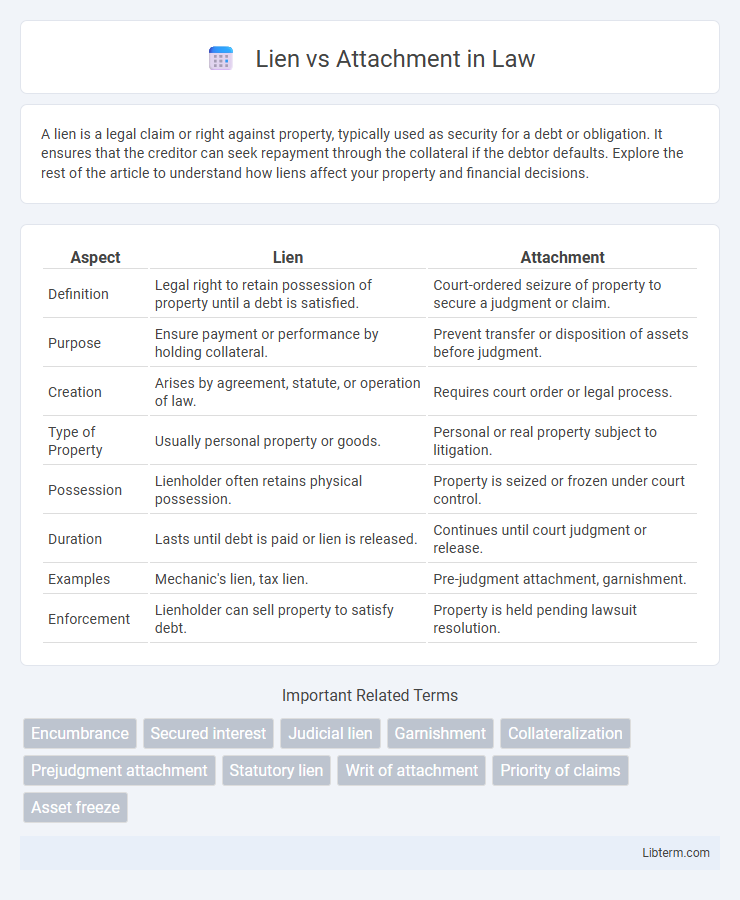

| Aspect | Lien | Attachment |

|---|---|---|

| Definition | Legal right to retain possession of property until a debt is satisfied. | Court-ordered seizure of property to secure a judgment or claim. |

| Purpose | Ensure payment or performance by holding collateral. | Prevent transfer or disposition of assets before judgment. |

| Creation | Arises by agreement, statute, or operation of law. | Requires court order or legal process. |

| Type of Property | Usually personal property or goods. | Personal or real property subject to litigation. |

| Possession | Lienholder often retains physical possession. | Property is seized or frozen under court control. |

| Duration | Lasts until debt is paid or lien is released. | Continues until court judgment or release. |

| Examples | Mechanic's lien, tax lien. | Pre-judgment attachment, garnishment. |

| Enforcement | Lienholder can sell property to satisfy debt. | Property is held pending lawsuit resolution. |

Understanding the Basics: What is a Lien?

A lien is a legal claim or right against property granted to a creditor to secure the payment of a debt or obligation, typically arising from a contractual agreement or by law. It allows the lienholder to retain possession of the asset or seek its sale to recover the owed amount until the debt is satisfied. Unlike attachment, which is a pre-judgment seizure of property to secure a potential future judgment, a lien directly establishes the creditor's right in the property as security for an existing debt.

What is an Attachment in Legal Terms?

An attachment in legal terms refers to a court-ordered seizure or control of a defendant's property to secure a potential judgment in a lawsuit. It ensures that the property remains available to satisfy a creditor's claim if the plaintiff wins the case. Unlike a lien, which creates a security interest in the property, an attachment physically restrains the property from being sold or transferred during litigation.

Key Differences Between Lien and Attachment

A lien provides a legal right or interest a creditor has in the debtor's property as security for a debt or obligation, while an attachment is a legal process that seizes or freezes property before a judgment to secure potential claims. Liens generally arise from agreements or statutes and remain until the debt is satisfied or the lien is released, whereas attachment is a provisional remedy imposed by the court to prevent asset transfer during litigation. Unlike liens, attachments require court involvement and are often temporary, ensuring the property is available to satisfy a potential future judgment.

Types of Liens: Voluntary vs. Involuntary

Voluntary liens are created with the property owner's consent, typically through agreements like mortgages or home equity loans, allowing creditors to claim interest in the property until debts are paid. Involuntary liens arise without the owner's permission, often imposed by law for unpaid taxes, judgments, or contractor work, creating a legal claim against the property. Both types of liens affect the owner's ability to sell or refinance the property until resolved, but voluntary liens stem from contractual obligations, whereas involuntary liens result from external legal actions.

Types of Attachments: Pre-judgment and Post-judgment

Pre-judgment attachment allows a creditor to secure a debtor's property before a court judgment to prevent asset dissipation, commonly used in cases involving potential financial loss. Post-judgment attachment occurs after a court ruling, ensuring enforcement of the judgment by seizing or freezing a debtor's assets to satisfy the debt. Both types aim to protect creditor rights but differ in timing and legal prerequisites.

Legal Procedures for Obtaining a Lien

Legal procedures for obtaining a lien typically involve filing a claim or notice with the appropriate government office, such as the county recorder or the court, establishing a secured interest in the property. The claimant must demonstrate the existence of a valid debt or obligation, often supported by contracts, invoices, or court judgments, to legally enforce the lien. Failure to follow precise statutory requirements, including deadlines and notification to the property owner, can result in the lien being invalidated or unenforceable.

Legal Process for Obtaining an Attachment Order

Obtaining an attachment order involves filing a petition with the court demonstrating a probable cause that the debtor possesses property subject to attachment and that there is a risk of asset dissipation before judgment. The court typically requires a sworn affidavit and may demand a bond to secure potential damages to the defendant if the attachment is wrongful. This legal process differs from liens, as liens arise automatically by operation of law or agreement, whereas attachment orders are judicial remedies issued through specific court procedures.

Implications for Debtors and Creditors

Liens grant creditors a secured interest in a debtor's property, enabling them to claim or sell the collateral to satisfy unpaid debts, which often restricts the debtor's ability to transfer or encumber the property. Attachments serve as court-ordered restraints on specific assets before judgment, preserving property value for potential recovery but limiting the debtor's control and use of those assets. Both liens and attachments impact creditworthiness and borrowing capacity, as they signal existing claims and potential financial encumbrances to other creditors and lenders.

Lien vs. Attachment: Advantages and Disadvantages

Liens provide a secured interest in property without transferring possession, allowing creditors to claim payment without seizing the asset immediately, which preserves the debtor's use of the property but may complicate enforcement. Attachments involve court-ordered seizure of assets to secure a judgment, offering stronger creditor control and preventing asset dissipation but potentially leading to higher legal costs and delayed access to funds for the debtor. While liens are generally easier and less expensive to create, attachments offer more immediate legal protection and asset control, making the choice dependent on the creditor's urgency and resource availability.

Choosing the Right Legal Remedy: Lien or Attachment

Selecting the appropriate legal remedy between a lien and attachment depends on the nature of the claim and the debtor's assets. A lien provides a secured interest in specific property until a debt is satisfied, often preferred for established contractual relationships. Attachment is a pre-judgment remedy enabling creditors to seize or freeze assets to prevent dissipation during litigation, suitable when there is a risk of asset concealment or transfer.

Lien Infographic

libterm.com

libterm.com