Appraisal action plays a crucial role in determining the value and condition of assets, ensuring accurate financial reporting and decision-making. Proper implementation of appraisal action helps businesses maintain compliance and optimize resource management. Explore the detailed insights ahead to master how appraisal action impacts your operations.

Table of Comparison

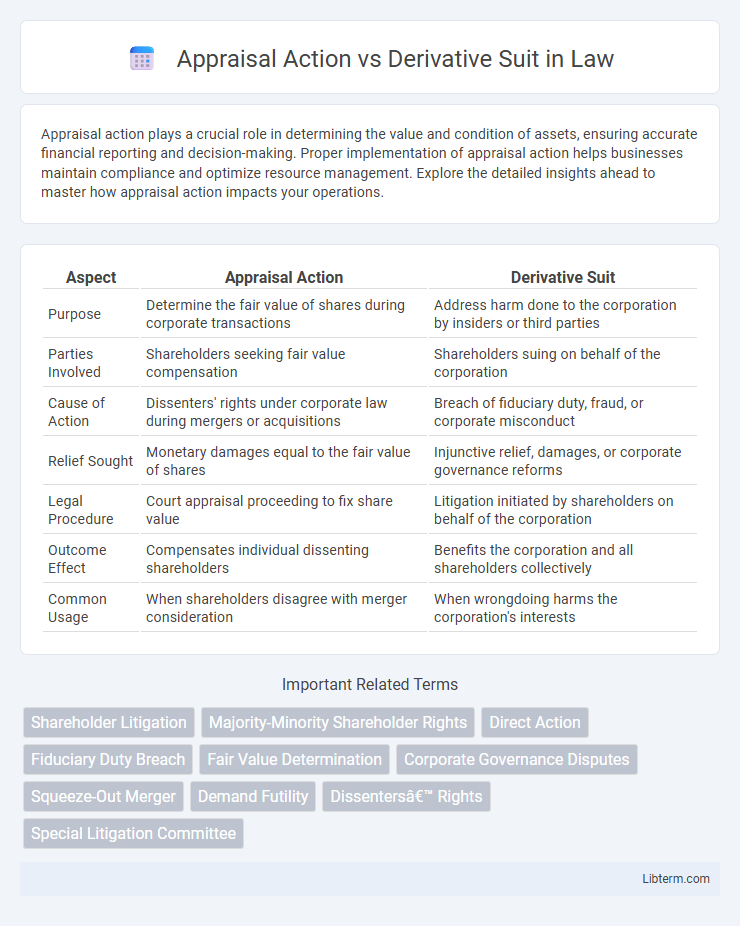

| Aspect | Appraisal Action | Derivative Suit |

|---|---|---|

| Purpose | Determine the fair value of shares during corporate transactions | Address harm done to the corporation by insiders or third parties |

| Parties Involved | Shareholders seeking fair value compensation | Shareholders suing on behalf of the corporation |

| Cause of Action | Dissenters' rights under corporate law during mergers or acquisitions | Breach of fiduciary duty, fraud, or corporate misconduct |

| Relief Sought | Monetary damages equal to the fair value of shares | Injunctive relief, damages, or corporate governance reforms |

| Legal Procedure | Court appraisal proceeding to fix share value | Litigation initiated by shareholders on behalf of the corporation |

| Outcome Effect | Compensates individual dissenting shareholders | Benefits the corporation and all shareholders collectively |

| Common Usage | When shareholders disagree with merger consideration | When wrongdoing harms the corporation's interests |

Introduction to Appraisal Actions and Derivative Suits

Appraisal actions provide shareholders the right to obtain a judicial determination of the fair value of their shares when dissenting from certain corporate actions, ensuring equitable compensation. Derivative suits allow shareholders to initiate legal action on behalf of the corporation against insiders for breaches of fiduciary duty, protecting the corporation's interests. Both legal mechanisms serve as critical tools for shareholder rights enforcement and corporate governance accountability.

Defining Appraisal Action: Key Concepts

Appraisal action is a legal proceeding allowing shareholders to obtain a court-determined fair value of their shares during mergers or acquisitions when they dissent from the transaction price. It involves a judicial review to evaluate company valuation based on financial metrics, market conditions, and future prospects to ensure equitable shareholder compensation. This process differs from derivative suits, which address corporate governance and fiduciary breaches affecting the company rather than direct shareholder valuation disputes.

Understanding Derivative Suits: An Overview

Derivative suits allow shareholders to file lawsuits on behalf of the corporation against directors or officers for breaches of fiduciary duty, whereas appraisal actions focus on determining the fair value of shares during mergers or acquisitions. In derivative suits, shareholders assert claims to protect corporate interests and hold management accountable for mismanagement or fraud. These legal mechanisms differ in purpose, with derivative suits addressing governance issues and appraisal actions ensuring equitable shareholder compensation.

Legal Foundations and Statutory Basis

Appraisal actions are grounded in state statutes, such as Delaware General Corporation Law Section 262, which grant shareholders the right to obtain a judicial determination of the fair value of their shares during certain corporate events like mergers. Derivative suits rely on both state statutory provisions and common law principles that authorize shareholders to initiate litigation on behalf of the corporation to address wrongs committed against the company. The statutory basis for appraisal actions typically centers on shareholder rights during mergers, whereas derivative suits hinge on procedural rules for representative litigation and fiduciary duty enforcement.

Purpose and Objectives of Each Remedy

Appraisal Action provides shareholders a legal remedy to obtain a judicial determination of the fair value of their shares when they dissent from major corporate actions like mergers, ensuring they receive just compensation. Derivative Suit enables shareholders to sue on behalf of the corporation to address wrongs committed against the company, targeting breaches of fiduciary duty or corporate mismanagement that harm corporate interests. Both remedies serve distinct purposes: Appraisal Action protects individual shareholder investments, while Derivative Suit aims to safeguard the corporation's overall health and enforce accountability among directors and officers.

Eligibility and Standing Requirements

Appraisal actions require shareholders to hold shares continuously from the time of the merger proposal through the judicial determination, establishing strict eligibility criteria. Derivative suits necessitate that the plaintiff is a current shareholder during the alleged wrongdoing and first makes a demand on the board unless such demand would be futile. Standing in appraisal actions is limited to dissenting shareholders seeking just compensation, whereas derivative suits allow shareholders to enforce corporate rights on behalf of the corporation.

Procedural Steps: From Filing to Resolution

Appraisal actions require shareholders to file a petition within a statutory period after a merger or acquisition, triggering a judicial determination of the fair value of shares, followed by discovery, valuation evidence presentation, and court resolution. Derivative suits begin with a demand on the corporation's board or a written justification for demand excusal, then proceed through complaint filing, possible dismissal motions, fact and expert discovery, pretrial motions, and trial or settlement. Both actions emphasize distinct procedural timelines and standards, with appraisal focusing on valuation disputes and derivative suits addressing claims for corporate mismanagement or breaches of fiduciary duty.

Remedies and Outcomes: What Shareholders Can Achieve

Appraisal action allows shareholders to obtain a judicial determination of the fair value of their shares when they dissent from a corporate transaction, ensuring they receive just compensation without contesting the transaction's validity. Derivative suits enable shareholders to pursue claims on behalf of the corporation against insiders for breaches of fiduciary duty, potentially leading to damages awarded to the corporation and corporate governance reforms. Remedies in appraisal actions primarily focus on financial compensation, while derivative suits can result in broader outcomes including monetary recovery for the corporation and changes in management practices.

Key Differences Between Appraisal Actions and Derivative Suits

Appraisal actions focus on determining the fair value of shares for dissenting shareholders in mergers or acquisitions, while derivative suits involve shareholders suing on behalf of the corporation for harm caused to the company. Appraisal actions are limited to valuation disputes, and remedies typically involve monetary compensation; derivative suits seek broader remedies, including corporate governance changes or recovery of damages. Statutory requirements and procedural rules differ, with appraisal actions often governed by state corporate statutes and derivative suits requiring demand on the board or establishing futility.

Choosing the Right Legal Path: Factors for Shareholders

Shareholders facing disputes must weigh appraisal action and derivative suit based on objectives and case specifics. Appraisal actions focus on obtaining fair value for shares during mergers or acquisitions, ideal for dissenting shareholders seeking monetary compensation. Derivative suits address corporate wrongs by management or directors, allowing shareholders to enforce company rights and seek remedies for harm done to the corporation.

Appraisal Action Infographic

libterm.com

libterm.com