Class action lawsuits allow multiple individuals with similar claims to join forces in a single legal case, often resulting in more efficient and cost-effective resolutions. These cases can address widespread issues ranging from consumer rights violations to workplace discrimination. Explore the rest of the article to understand how class actions can impact Your rights and the legal process.

Table of Comparison

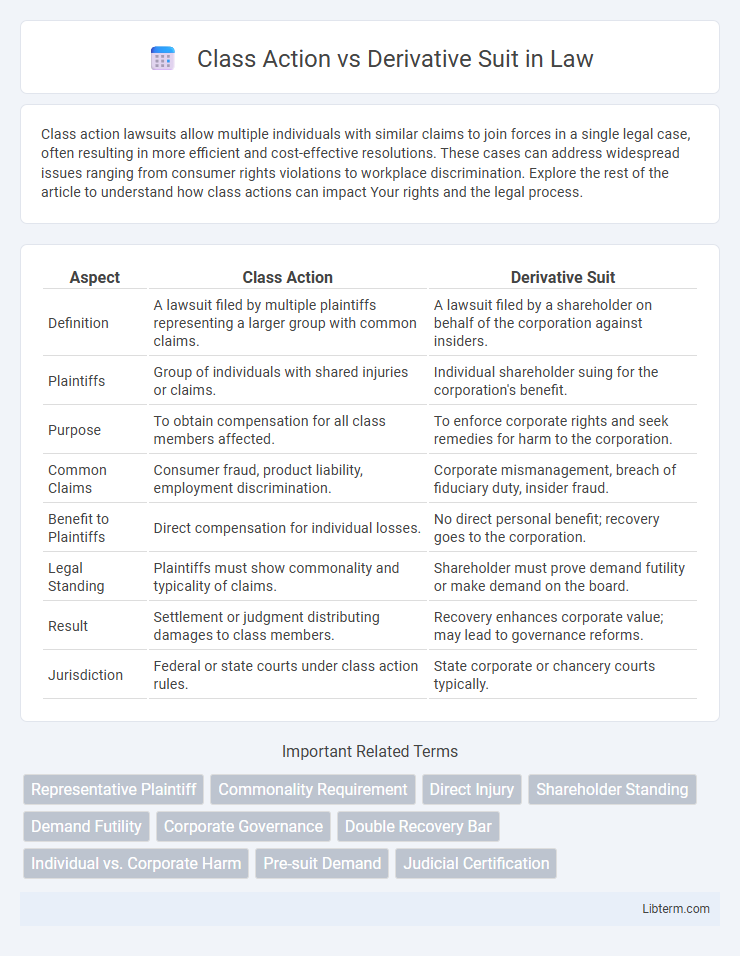

| Aspect | Class Action | Derivative Suit |

|---|---|---|

| Definition | A lawsuit filed by multiple plaintiffs representing a larger group with common claims. | A lawsuit filed by a shareholder on behalf of the corporation against insiders. |

| Plaintiffs | Group of individuals with shared injuries or claims. | Individual shareholder suing for the corporation's benefit. |

| Purpose | To obtain compensation for all class members affected. | To enforce corporate rights and seek remedies for harm to the corporation. |

| Common Claims | Consumer fraud, product liability, employment discrimination. | Corporate mismanagement, breach of fiduciary duty, insider fraud. |

| Benefit to Plaintiffs | Direct compensation for individual losses. | No direct personal benefit; recovery goes to the corporation. |

| Legal Standing | Plaintiffs must show commonality and typicality of claims. | Shareholder must prove demand futility or make demand on the board. |

| Result | Settlement or judgment distributing damages to class members. | Recovery enhances corporate value; may lead to governance reforms. |

| Jurisdiction | Federal or state courts under class action rules. | State corporate or chancery courts typically. |

Introduction to Class Actions and Derivative Suits

Class actions enable a group of plaintiffs with common claims to collectively file a lawsuit against a defendant, streamlining judicial efficiency and consistency in similar cases. Derivative suits are initiated by shareholders on behalf of a corporation to address wrongs committed against the company, such as breach of fiduciary duty by executives or directors. Both legal mechanisms serve to protect collective interests but differ fundamentally in their party representation and underlying purpose.

Defining Class Action Lawsuits

Class action lawsuits allow a group of plaintiffs with similar claims against a defendant to sue collectively, streamlining the legal process and conserving judicial resources. These lawsuits address widespread harm or misconduct affecting many individuals, such as consumer fraud or employment discrimination. Unlike derivative suits, which are filed by shareholders on behalf of a corporation, class actions seek direct relief for the class members affected by alleged violations.

Understanding Derivative Suits

Derivative suits enable shareholders to initiate legal action on behalf of the corporation against insiders such as directors or officers who breach fiduciary duties or commit fraud. Unlike class actions, derivative suits address wrongs done to the company itself rather than to individual shareholders directly. These lawsuits require plaintiffs to demonstrate that the corporation failed to take appropriate action, thus allowing shareholders to seek remedies that restore corporate value.

Key Differences Between Class Actions and Derivative Suits

Class actions allow multiple plaintiffs to collectively sue a defendant for harm allegedly caused to a group, emphasizing individual damages and consumer protection. Derivative suits are filed by shareholders on behalf of a corporation against insiders, targeting breaches of fiduciary duty or corporate misconduct impacting the company. The fundamental difference lies in the injury focus: class actions address direct harm to individuals, whereas derivative suits address harm to the corporation itself.

Who Has the Right to Sue?

Shareholders in a class action lawsuit sue on their own behalf for harms directly affecting them, typically involving consumer fraud or securities violations. In contrast, a derivative suit is filed by a shareholder on behalf of the corporation to address wrongs committed against the company, such as breaches of fiduciary duty by directors or officers. Only shareholders who owned stock at the time of the alleged wrongdoing usually have the right to initiate a derivative suit.

Types of Claims in Each Suit

Class actions primarily address claims involving widespread harm to multiple plaintiffs, such as consumer fraud, securities fraud, or employment discrimination, where plaintiffs seek collective damages or injunctive relief. Derivative suits involve claims brought by shareholders on behalf of a corporation, typically targeting breaches of fiduciary duty, corporate mismanagement, or self-dealing by directors and officers. Both types of suits serve distinct purposes: class actions consolidate individual claims for efficiency, while derivative suits focus on protecting corporate interests from internal wrongdoing.

Legal Procedures: Class Action vs Derivative Suit

Class action lawsuits consolidate numerous plaintiffs with similar claims against a defendant into one legal proceeding, streamlining the litigation process and reducing court burden. Derivative suits are brought by shareholders on behalf of a corporation to address wrongs committed against the company, requiring plaintiffs to meet demand requirements and demonstrate that the board failed in its fiduciary duties. Class actions emphasize collective harm to individuals, while derivative suits focus on corporate injury and the enforcement of internal governance.

Common Examples and Case Studies

Class action lawsuits commonly address widespread consumer fraud, defective products, or employment discrimination, as seen in the landmark Tobacco Master Settlement or Volkswagen emissions scandal cases. Derivative suits typically arise in corporate governance disputes, where shareholders sue company directors for breaches of fiduciary duty, exemplified by the Disney shareholder litigation addressing executive compensation. Both types of legal actions play pivotal roles in holding organizations accountable while protecting collective and individual stakeholder interests.

Advantages and Disadvantages of Each Legal Remedy

Class actions offer advantages such as lower individual litigation costs, efficient resolution of common claims, and increased access to justice for plaintiffs with small damages; however, they can suffer from less individualized attention and potential conflicts among class members. Derivative suits enable shareholders to address wrongs committed against the corporation, promoting corporate governance and accountability, but they often involve complex procedural requirements, higher costs, and risk of dismissal due to demand requirements. While class actions aggregate numerous similar claims improving judicial economy, derivative suits focus on protecting corporate interests, leading to distinct strategic considerations for plaintiffs depending on the nature of the harm and desired outcomes.

Choosing the Appropriate Legal Action

Choosing between a class action and a derivative suit depends on the nature of the harm and the affected parties. Class actions are appropriate when numerous shareholders or consumers experience similar harm from the defendant's conduct, allowing collective claims for damages or relief. Derivative suits are suited for situations where shareholders seek to address wrongs committed against the corporation itself, requiring litigation on the corporation's behalf to enforce its rights.

Class Action Infographic

libterm.com

libterm.com