A defeasible fee is a type of property ownership that can be undone if a specific condition is violated or a particular event occurs. This legal concept allows your rights to the property to continue only as long as certain conditions are met, offering flexibility but also potential risk. Explore the rest of the article to understand the types of defeasible fees and their implications on property ownership.

Table of Comparison

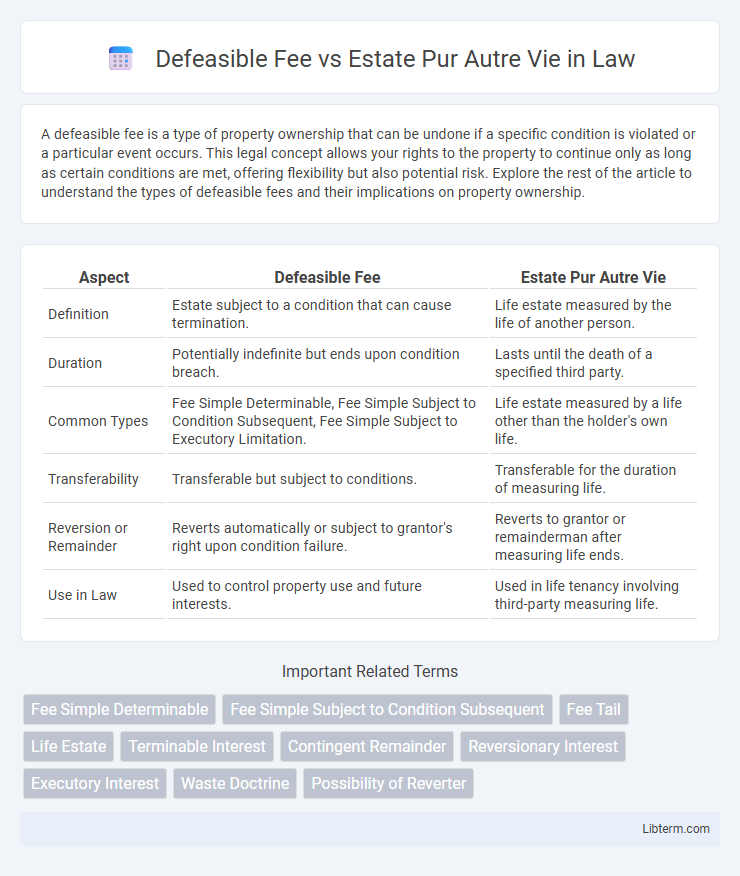

| Aspect | Defeasible Fee | Estate Pur Autre Vie |

|---|---|---|

| Definition | Estate subject to a condition that can cause termination. | Life estate measured by the life of another person. |

| Duration | Potentially indefinite but ends upon condition breach. | Lasts until the death of a specified third party. |

| Common Types | Fee Simple Determinable, Fee Simple Subject to Condition Subsequent, Fee Simple Subject to Executory Limitation. | Life estate measured by a life other than the holder's own life. |

| Transferability | Transferable but subject to conditions. | Transferable for the duration of measuring life. |

| Reversion or Remainder | Reverts automatically or subject to grantor's right upon condition failure. | Reverts to grantor or remainderman after measuring life ends. |

| Use in Law | Used to control property use and future interests. | Used in life tenancy involving third-party measuring life. |

Introduction to Defeasible Fee and Estate Pur Autre Vie

Defeasible fee refers to a type of freehold estate subject to a condition or event that can cause the estate to terminate and revert to the grantor or a third party, often categorized as fee simple determinable or fee simple subject to condition subsequent. Estate pur autre vie is a life estate measured by the life of a third party rather than the life tenant, allowing possession and use of property for the duration of that third person's life. Both estates involve limitations on ownership duration, but defeasible fees are conditional on specific events, while estates pur autre vie depend solely on the lifespan of another individual.

Defining Defeasible Fee: Key Concepts

A Defeasible Fee is a type of freehold estate in property law that can be terminated upon the occurrence of a specified event, meaning the ownership is conditional rather than absolute. Key concepts include determinable fees, where the estate automatically ends when a condition is met, and subject-to-a-condition subsequent, where the grantor retains the right to reclaim the property. This distinguishes Defeasible Fees from Estate Pur Autre Vie, which is a life estate measured by another person's lifespan rather than conditional events.

Types of Defeasible Fees Explained

Defeasible fees include fee simple determinable, fee simple subject to condition subsequent, and fee simple subject to executory limitation, each involving conditions that can terminate ownership upon certain events. Fee simple determinable automatically ends and reverts to the grantor when a specified condition is violated, whereas fee simple subject to condition subsequent requires the grantor to take action to reclaim the property. Estate pur autre vie grants ownership based on the life of another person, differing from defeasible fees by its reliance on a life tenancy rather than conditional events.

Defining Estate Pur Autre Vie: Core Principles

Estate Pur Autre Vie is a life estate created for the duration of a person's life other than the life tenant, transferring ownership that lasts until that third party's death. This interest differs from a defeasible fee, which is a fee simple estate subject to conditions that may cause termination or reversion. Core principles of Estate Pur Autre Vie include its dependence on the measuring life and the automatic reversion of property once that life ends.

Creation and Termination of Defeasible Fees

Defeasible fees arise when property ownership is granted subject to specific conditions, creating estates that can be voided or ended upon the occurrence of a specified event, such as a condition subsequent or a possibility of reverter. These estates are created through language indicating conditional terms, like "so long as" or "until," which define the limits of the holder's interest, and termination occurs automatically or through legal action once the condition is breached. Estate pur autre vie, by contrast, is measured by the lifetime of a third party rather than being conditional, and upon the death of that measuring life, the estate ends without reference to any defeasible condition.

How Estate Pur Autre Vie is Established and Ends

An Estate Pur Autre Vie is established when property is granted to a person for the duration of another individual's life, differing from a Defeasible Fee that hinges on conditions affecting the estate owner's rights. This type of estate ends automatically upon the death of the measuring life, rather than through the occurrence of a specific event or breach of conditions. Upon termination, ownership typically reverts to the original grantor or passes to a remainderman as specified in the conveyance.

Legal Differences: Defeasible Fee vs Estate Pur Autre Vie

A Defeasible Fee grants ownership that can be terminated upon the occurrence of a specified event, creating a conditional estate that may revert to the original grantor or a third party. An Estate Pur Autre Vie is a life estate measured by the life of a third party, conferring possession and interests that last for the duration of that person's life rather than the grantee's life. While Defeasible Fee interests depend on triggering conditions, Estates Pur Autre Vie are strictly limited by the lifespan of another individual, resulting in distinct termination and transferability rules under property law.

Practical Examples: Comparing Real-World Scenarios

A defeasible fee grants property ownership until a specified condition occurs, such as "to A so long as the land is used for farming," meaning ownership can be terminated if the condition is violated. An estate pur autre vie lasts for the duration of another person's life, as in "to A for the life of B," where A's interest ends upon B's death. For example, a defeasible fee applies when a land grant prohibits commercial use with reversion on breach, whereas an estate pur autre vie suits arrangements like providing a caregiver a home only for as long as a patient lives.

Advantages and Disadvantages of Each Estate

A Defeasible Fee provides property owners with conditional ownership that can be terminated upon the occurrence of a specific event, offering flexibility but also creating uncertainty for future interests. Estate Pur Autre Vie grants ownership for the duration of another person's life, ensuring a fixed term but limiting the owner's control after that person's death. Defeasible Fees allow for dynamic property management, whereas Estates Pur Autre Vie provide clarity and predictability, though they can restrict long-term planning.

Conclusion: Choosing Between Defeasible Fee and Estate Pur Autre Vie

Choosing between a defeasible fee and an estate pur autre vie depends on the duration and conditions of property interest desired; defeasible fees grant ownership that may be terminated upon certain events, suitable for conditional or limited estate planning. Estates pur autre vie provide a life estate measured by the life of a third party, offering flexibility when the measuring life differs from the holder, often used in intricate life interest arrangements. Evaluating the purpose of the transfer, the potential for reversion or forfeiture, and the specific lifespan criteria is crucial for optimal estate planning and asset control.

Defeasible Fee Infographic

libterm.com

libterm.com