A foreclosure sale occurs when a lender repossesses a property due to the owner's failure to meet mortgage payments, often resulting in the property being sold at a public auction. These sales offer opportunities to purchase homes below market value, but they come with risks such as unclear titles or necessary repairs. Discover how understanding the foreclosure process can help you make informed decisions by reading the rest of the article.

Table of Comparison

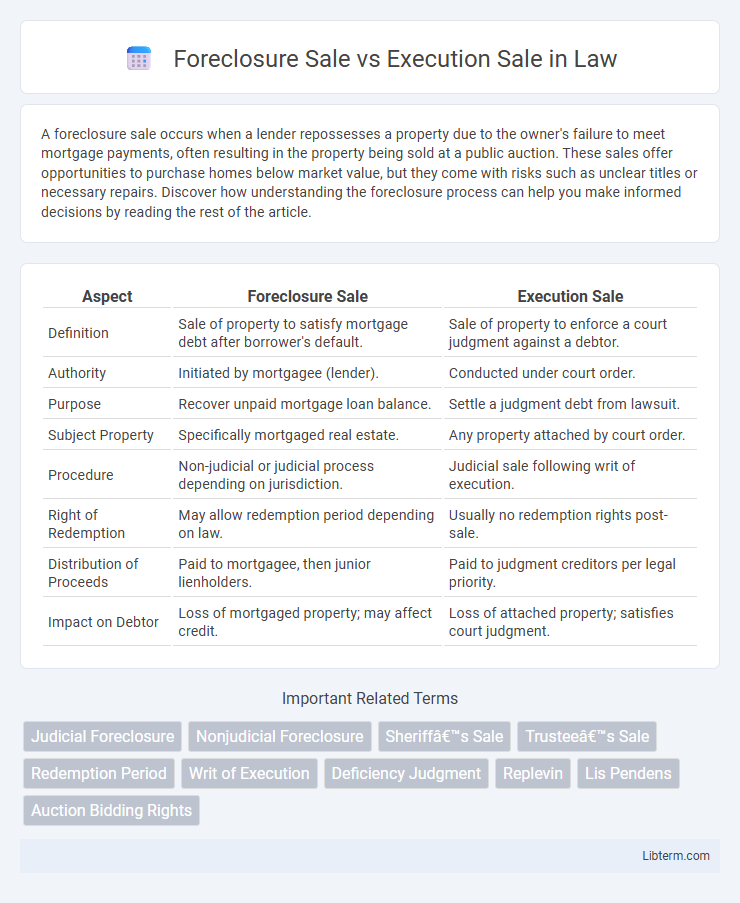

| Aspect | Foreclosure Sale | Execution Sale |

|---|---|---|

| Definition | Sale of property to satisfy mortgage debt after borrower's default. | Sale of property to enforce a court judgment against a debtor. |

| Authority | Initiated by mortgagee (lender). | Conducted under court order. |

| Purpose | Recover unpaid mortgage loan balance. | Settle a judgment debt from lawsuit. |

| Subject Property | Specifically mortgaged real estate. | Any property attached by court order. |

| Procedure | Non-judicial or judicial process depending on jurisdiction. | Judicial sale following writ of execution. |

| Right of Redemption | May allow redemption period depending on law. | Usually no redemption rights post-sale. |

| Distribution of Proceeds | Paid to mortgagee, then junior lienholders. | Paid to judgment creditors per legal priority. |

| Impact on Debtor | Loss of mortgaged property; may affect credit. | Loss of attached property; satisfies court judgment. |

Understanding Foreclosure Sale: Definition and Process

A foreclosure sale occurs when a lender sells a property to recover outstanding loan amounts after the borrower defaults, typically through a public auction. The process begins with the lender issuing a notice of default, followed by a public auction where the highest bidder acquires the property, often below market value. Understanding foreclosure sales is crucial as they involve legal procedures, borrower rights, and potential financial risks for investors.

What is an Execution Sale? Key Principles Explained

An execution sale is a court-ordered public auction of a debtor's property to satisfy a judgment debt, typically following a writ of execution issued by the court. Key principles include the sale being conducted under strict legal procedures to ensure transparency and fairness, with proceeds distributed to creditors according to priority established by law. Unlike foreclosure sales which specifically involve mortgaged properties, execution sales encompass a broader range of assets seized to enforce various types of court judgments.

Legal Grounds: Foreclosure vs. Execution Sales

Foreclosure sales occur based on legal grounds where a lender enforces a mortgage or lien due to the borrower's default, allowing the sale of the secured property to recover the debt. Execution sales arise from court judgments where a debtor's assets, including real estate or personal property, are seized and sold to satisfy a creditor's claim under a writ of execution. Foreclosure strictly involves contractual and statutory rights tied to secured loans, while execution sales stem from judicial enforcement of monetary judgments.

Parties Involved in Each Type of Sale

Foreclosure sales primarily involve the borrower, lender, and trustee or auctioneer, where the lender initiates the process to recover debt by selling the mortgaged property. Execution sales occur following a court judgment where the judgment creditor, debtor, and sheriff or marshal participate, enabling the creditor to satisfy the debt through the forced sale of the debtor's assets. Both types of sales require the involvement of legal authorities to ensure proper execution and transfer of ownership.

Notice and Procedure Differences

Foreclosure Sale requires a public notice period usually ranging from 21 to 30 days before the auction, ensuring that all interested parties are informed, whereas Execution Sale mandates immediate enforcement often with shorter or no advance notice. The procedure for Foreclosure Sale involves a judicial or extra-judicial process initiated by the lender to recover loan dues, while Execution Sale follows the court's direct order to liquidate debtor's assets to satisfy a judgment. Notice for Execution Sale is typically issued through a court decree and published officially, contrasting the more debtor-focused notification process in Foreclosure Sales.

Asset Types Subjected to Foreclosure and Execution Sales

Foreclosure sales typically involve real estate properties such as residential homes, commercial buildings, and land, where the lender enforces the sale to recover unpaid mortgage debt. Execution sales usually encompass a broader range of assets, including movable properties like vehicles, machinery, inventory, and bank accounts, seized to satisfy judgments in civil lawsuits. Both processes aim to liquidate assets but differ significantly in the types of collateral subjected to each sale based on the underlying debt and legal claim.

Impact on Property Ownership Rights

Foreclosure sale transfers property ownership from the borrower to a new buyer or the lender due to default on mortgage payments, extinguishing the original owner's rights. Execution sale occurs when a court mandates selling the property to satisfy a judgment debt, often involving non-mortgage-related liens, impacting ownership based on judicial rulings. Both sales result in loss of ownership rights, but foreclosure centers on mortgage defaults while execution sales address broader creditor claims.

Buyer’s Perspective: Risks and Opportunities

From a buyer's perspective, foreclosure sales often present opportunities to purchase properties below market value, but they come with risks such as unclear title status and potential liens. Execution sales, typically conducted under court orders to satisfy judgments, may provide competitive pricing but can involve more complex legal processes and limited inspection rights. Understanding local regulations and performing thorough due diligence is essential to mitigate risks and leverage the acquisition benefits in both foreclosure and execution sale scenarios.

Redemption Rights: Foreclosure vs. Execution Sales

Redemption rights in foreclosure sales allow the borrower a statutory period to reclaim their property by paying the debt, which varies by jurisdiction but typically ranges from a few months to a year. In execution sales, redemption rights are generally more limited or nonexistent, as these sales are court-ordered to satisfy a judgment rather than a mortgage default. Understanding the specific redemption period and conditions in foreclosure vs. execution sales is critical for debtors aiming to retain their property.

Choosing the Right Sale Type: Legal and Financial Considerations

Choosing between a foreclosure sale and an execution sale requires evaluating the legal framework governing property repossession and the financial implications for creditors and debtors. Foreclosure sales typically arise from mortgage default, enabling lenders to recover loan amounts through public auction, while execution sales result from court orders to satisfy judgment debts, involving sheriff-conducted auctions of seized assets. Understanding jurisdiction-specific statutes, sale procedures, timelines, and potential recovery amounts informs strategic decision-making to optimize asset recovery and minimize losses.

Foreclosure Sale Infographic

libterm.com

libterm.com