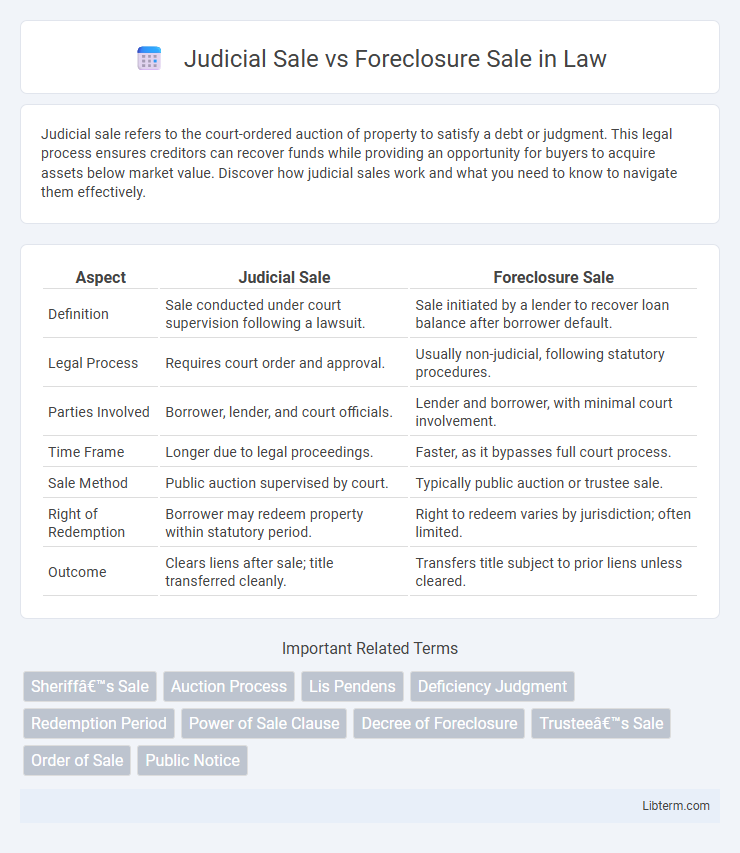

Judicial sale refers to the court-ordered auction of property to satisfy a debt or judgment. This legal process ensures creditors can recover funds while providing an opportunity for buyers to acquire assets below market value. Discover how judicial sales work and what you need to know to navigate them effectively.

Table of Comparison

| Aspect | Judicial Sale | Foreclosure Sale |

|---|---|---|

| Definition | Sale conducted under court supervision following a lawsuit. | Sale initiated by a lender to recover loan balance after borrower default. |

| Legal Process | Requires court order and approval. | Usually non-judicial, following statutory procedures. |

| Parties Involved | Borrower, lender, and court officials. | Lender and borrower, with minimal court involvement. |

| Time Frame | Longer due to legal proceedings. | Faster, as it bypasses full court process. |

| Sale Method | Public auction supervised by court. | Typically public auction or trustee sale. |

| Right of Redemption | Borrower may redeem property within statutory period. | Right to redeem varies by jurisdiction; often limited. |

| Outcome | Clears liens after sale; title transferred cleanly. | Transfers title subject to prior liens unless cleared. |

Introduction to Judicial Sale and Foreclosure Sale

Judicial sale refers to the court-ordered sale of a property to satisfy a debt, typically initiated after a mortgage default and requiring a legal process to authorize the sale. Foreclosure sale occurs when a lender repossesses and sells a property due to the borrower's failure to meet mortgage obligations, often under state-specific foreclosure laws. Both sales aim to recover unpaid debt but differ primarily in the involvement of the judicial system and procedural requirements.

Defining Judicial Sale

A judicial sale is a court-ordered process where a property is sold to satisfy a debt or judgment, typically following a foreclosure suit. This sale occurs under the supervision of a judge to ensure legal compliance and protects the rights of both the debtor and creditor. It differs from a foreclosure sale, which may happen outside court involvement, often through a non-judicial process.

Defining Foreclosure Sale

A foreclosure sale is a legal process in which a lender sells a property to recover the outstanding mortgage debt after the borrower defaults on loan payments. Unlike a judicial sale that occurs through court oversight, a foreclosure sale typically follows specific statutory procedures designed to terminate the borrower's ownership rights. Foreclosure sales often result in properties being sold at public auction to the highest bidder, with proceeds applied to satisfy the mortgage lien.

Key Legal Differences

Judicial sale involves a court-ordered auction following a lawsuit to recover debt, ensuring strict compliance with due process and legal oversight. Foreclosure sale typically occurs without court intervention, often under statutory or power-of-sale clauses in mortgage agreements, allowing quicker property disposition. The key legal difference lies in judicial sale requiring court supervision, whereas foreclosure sale relies on contractual terms and state laws for enforcement.

Process Overview: Judicial Sale

Judicial sale involves a court-supervised process where the property is sold to satisfy a judgment lien, typically initiated after a borrower defaults on a mortgage. The process begins with the lender filing a lawsuit, followed by a court order to auction the property, ensuring legal oversight and protection for both parties. Bidders participate in a public auction, and the sale proceeds are used to pay off the outstanding debt, with any surplus returned to the borrower.

Process Overview: Foreclosure Sale

A foreclosure sale is a legal process where a lender seizes and sells a property due to the borrower's default on mortgage payments. The process begins with a notice of default, followed by a public auction where the property is sold to the highest bidder. This sale aims to recover the outstanding loan balance, often quicker than a judicial sale, but with limited borrower rights during the proceedings.

Pros and Cons of Judicial Sale

Judicial sale involves selling a property through a court-ordered process, providing a transparent and legally supervised transaction that protects buyers and lenders by ensuring proper notification and adherence to law. However, the judicial sale process tends to be slower and more costly due to court fees and procedural requirements, potentially reducing the net proceeds for sellers. It offers greater legal security and reduces the risk of future disputes compared to foreclosure sales, which may be faster but less regulated and more prone to challenges.

Pros and Cons of Foreclosure Sale

Foreclosure sales offer a faster process for lenders to recover unpaid loan amounts, often resulting in properties being sold below market value, which attracts bargain hunters and investors. However, the lack of clear title guarantees and the potential for hidden liens or property damages pose significant risks to buyers. The foreclosure process also limits buyer negotiation, often requiring cash purchases with minimal opportunity for inspections or financing contingencies.

Impacts on Borrowers and Lenders

Judicial sales require court approval, often leading to longer timelines and higher legal costs that can strain borrowers financially while providing lenders with a structured, legally secure recovery process. Foreclosure sales, typically faster and non-judicial, reduce costs and expedite asset liquidation but may limit borrower protections and increase the risk of lower sale prices, impacting lender recovery amounts. Both processes significantly affect borrower credit and financial stability while influencing lender risk exposure and asset recovery strategies.

Choosing the Right Option

Choosing between judicial sale and foreclosure sale depends on the legal requirements and time sensitivity of the property recovery process. Judicial sales involve court supervision, ensuring legal protections and clear title transfer, while foreclosure sales are typically faster, conducted outside court, but may risk title disputes. Evaluating state laws, potential costs, and the need for speed helps determine the most advantageous method for recovering collateral in real estate transactions.

Judicial Sale Infographic

libterm.com

libterm.com