A trustee holds a legal responsibility to manage assets or property on behalf of beneficiaries, ensuring their interests are protected according to the terms of a trust. Understanding the duties and powers of a trustee is crucial for effective trust administration and safeguarding your financial legacy. Explore the rest of this article to learn how a trustee can impact your estate planning and what to consider when appointing one.

Table of Comparison

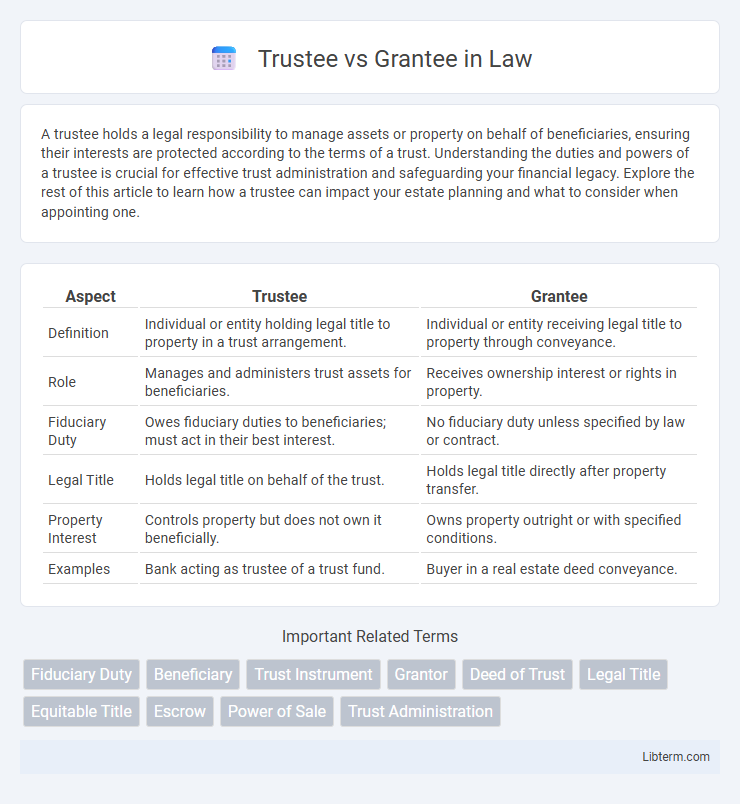

| Aspect | Trustee | Grantee |

|---|---|---|

| Definition | Individual or entity holding legal title to property in a trust arrangement. | Individual or entity receiving legal title to property through conveyance. |

| Role | Manages and administers trust assets for beneficiaries. | Receives ownership interest or rights in property. |

| Fiduciary Duty | Owes fiduciary duties to beneficiaries; must act in their best interest. | No fiduciary duty unless specified by law or contract. |

| Legal Title | Holds legal title on behalf of the trust. | Holds legal title directly after property transfer. |

| Property Interest | Controls property but does not own it beneficially. | Owns property outright or with specified conditions. |

| Examples | Bank acting as trustee of a trust fund. | Buyer in a real estate deed conveyance. |

Understanding the Roles: Trustee vs Grantee

A trustee holds legal title to property on behalf of a beneficiary, managing the trust assets according to the trust agreement's terms. The grantee is the party who receives ownership rights or interest in property through a deed or conveyance. Understanding these roles is crucial in real estate transactions and trust administration, as the trustee controls property management while the grantee gains direct ownership rights.

Key Definitions: Who is a Trustee? Who is a Grantee?

A trustee is an individual or entity holding legal title to property or assets in a trust, responsible for managing and administering the trust according to its terms and for the benefit of the beneficiaries. A grantee is the recipient of property or assets through a deed, such as in a real estate transaction, acquiring legal ownership or interest from the grantor. The trustee's duties involve fiduciary responsibilities and trust management, while the grantee's role centers on ownership acquisition and rights transfer.

Legal Responsibilities of Trustees

Trustees hold fiduciary duties to manage and protect trust assets in accordance with the trust document and applicable laws, ensuring beneficiaries' interests are prioritized. They must maintain accurate records, provide transparent accounting, and avoid conflicts of interest, bearing legal liability for breaches of duty. Grantees, in contrast, receive legal title to property but do not assume the ongoing management responsibilities entrusted to trustees.

Rights and Obligations of Grantees

Grantees hold the legal title to a property and possess the right to use, lease, or sell the asset according to the terms of the deed. They are obligated to comply with any covenants, restrictions, or conditions outlined in the trust or deed, ensuring adherence to local property laws and regulations. Grantees must also pay property taxes and maintain the property as required to preserve their vested interests.

Trust Structure: How Trustees and Grantees Interact

The trustee holds legal title to the trust property, managing assets in accordance with the trust terms for the benefit of the grantee, who is the trust beneficiary or recipient of the equitable interest. Trustees have fiduciary duties to act prudently and loyally, ensuring assets are preserved and properly administered while grantees receive income or principal distributions as outlined in the trust agreement. The trust structure creates a clear separation of ownership and beneficial interest, enabling efficient asset management and protection under trust law.

Key Differences Between Trustee and Grantee

A trustee holds legal title to a property or asset on behalf of a beneficiary, managing the trust according to its terms, while a grantee is the recipient of a property interest through a deed transfer. Trustees have fiduciary duties and control over trust assets, whereas grantees gain ownership or rights without ongoing management responsibilities. Understanding the trustee's role in administering a trust contrasts with the grantee's role as a direct property owner clarifies their distinct legal and functional positions.

Common Scenarios Involving Trustees and Grantees

In real estate transactions, trustees hold legal title to property on behalf of grantees, such as beneficiaries or buyers, ensuring trust terms are fulfilled. Common scenarios include real estate deeds in trust, where trustees manage property until reaching specified conditions or events, and foreclosure processes where trustees sell property to satisfy debts owed by grantees. Understanding roles prevents conflicts of interest and ensures proper execution of conveyances, trust agreements, and property transfers between trustees and grantees.

Choosing the Right Trustee or Grantee

Choosing the right trustee or grantee is crucial for effective property or asset management, as trustees hold fiduciary responsibilities to manage trust assets fairly, while grantees receive ownership rights without management duties. Key factors in selecting a trustee include integrity, financial expertise, and the ability to navigate legal obligations, whereas choosing a grantee depends on their commitment to maintaining the property's intended use and long-term value. Understanding the distinct roles ensures proper stewardship and protects the interests of all parties involved in a trust or transfer transaction.

Legal Implications of Mismanagement by Trustees or Grantees

Mismanagement by trustees often results in significant legal liabilities, including breach of fiduciary duty claims, financial restitution, and court interventions to protect beneficiaries' interests. Grantees, while generally less regulated, may face legal consequences if they fail to uphold grant conditions or misuse transferred property, potentially leading to contract violations or forfeiture of rights. Both parties must adhere to stringent legal standards to avoid disputes, liability, and potential litigation in property and trust law contexts.

Frequently Asked Questions About Trustees and Grantees

Trustees manage and hold legal title to trust assets for the benefit of beneficiaries, while grantees receive ownership rights to property through a deed transfer. Common questions about trustees involve their fiduciary duties, authority to make decisions, and how they distribute trust assets. Grantee-related FAQs typically address how ownership is transferred, what rights grantees have, and the implications of receiving property via deed.

Trustee Infographic

libterm.com

libterm.com