Tenancy in Common allows two or more individuals to share ownership of a property, with each party holding an undivided interest that can be independently sold or bequeathed. This form of co-ownership offers flexibility, as ownership shares do not need to be equal and there is no right of survivorship, meaning each owner's interest passes according to their will. Discover how Tenancy in Common could impact your property rights and estate planning by reading the rest of the article.

Table of Comparison

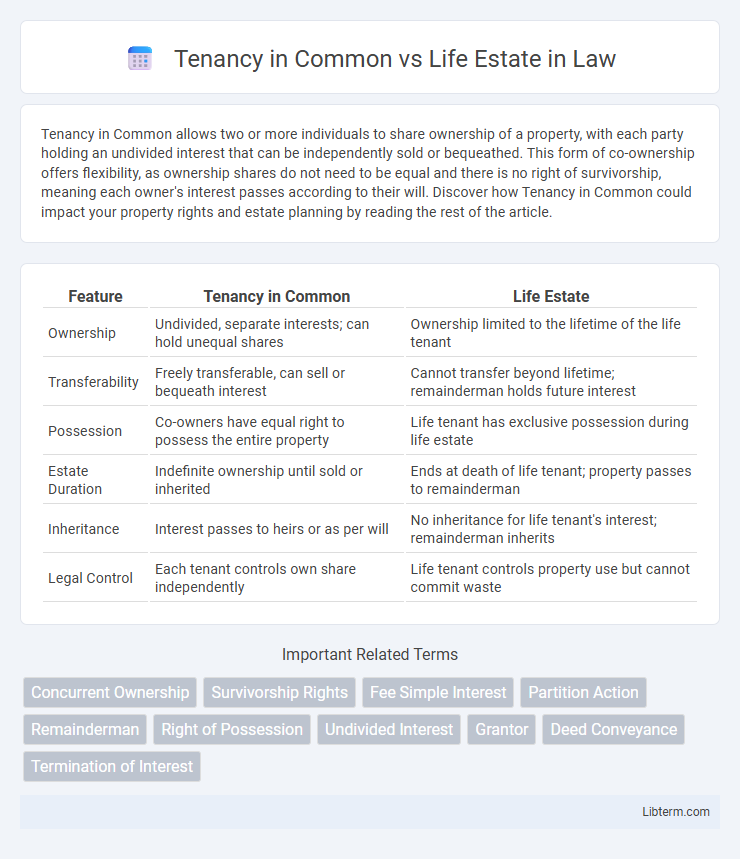

| Feature | Tenancy in Common | Life Estate |

|---|---|---|

| Ownership | Undivided, separate interests; can hold unequal shares | Ownership limited to the lifetime of the life tenant |

| Transferability | Freely transferable, can sell or bequeath interest | Cannot transfer beyond lifetime; remainderman holds future interest |

| Possession | Co-owners have equal right to possess the entire property | Life tenant has exclusive possession during life estate |

| Estate Duration | Indefinite ownership until sold or inherited | Ends at death of life tenant; property passes to remainderman |

| Inheritance | Interest passes to heirs or as per will | No inheritance for life tenant's interest; remainderman inherits |

| Legal Control | Each tenant controls own share independently | Life tenant controls property use but cannot commit waste |

Understanding Tenancy in Common

Tenancy in Common allows multiple individuals to hold undivided ownership interests in a property, with each owner possessing a distinct share that can be sold, transferred, or inherited independently. Unlike a Life Estate, which grants usage rights for the duration of an individual's life, Tenancy in Common provides each co-owner with equal rights to possess and use the entire property simultaneously. This form of ownership is commonly used in estate planning and investment scenarios where flexibility in transferring ownership is essential.

Defining a Life Estate

A Life Estate grants an individual the right to use and occupy property for the duration of their life, after which the ownership transfers to another designated party, known as the remainderman. Unlike Tenancy in Common, where multiple parties have undivided ownership interests that can be sold or inherited independently, a Life Estate involves a temporary interest limited to the life tenant's lifespan. This legal arrangement ensures property control during the life tenant's lifetime while preserving the remainder interest for successors.

Key Differences Between Tenancy in Common and Life Estate

Tenancy in common allows multiple owners to hold undivided interests in a property, each with the right to transfer or sell their share independently, while a life estate grants ownership rights to an individual for the duration of their life, with the property passing to a designated remainderman upon their death. In tenancy in common, owners share possession rights simultaneously and can have unequal ownership percentages, whereas a life estate provides exclusive possession only to the life tenant during their lifetime. Unlike tenancy in common, where ownership does not automatically terminate upon death, a life estate terminates at the life tenant's death, triggering the transfer of full ownership to the remainderman.

Ownership Rights and Responsibilities

Tenancy in Common grants each owner an undivided interest in the property with equal rights to use and transfer their share independently, without survivorship rights. Life Estate provides ownership rights limited to the lifetime of the life tenant, who is responsible for maintaining the property but cannot sell or bequeath it beyond their lifespan. Upon the life tenant's death, ownership passes automatically to the remainderman, who holds the remainder interest free from the life estate.

Inheritance and Survivorship Rules

Tenancy in Common allows each co-owner to inherit their share independently, with no right of survivorship, so ownership passes according to each deceased party's will or state law. Life Estate grants a temporary interest to the life tenant, who has possession during their lifetime, while the property automatically passes to the remainderman upon death, bypassing probate. These distinctions impact estate planning strategies, as Tenancy in Common enables flexible inheritance distribution, whereas Life Estate ensures survivorship rights and smoother title transfer.

Property Transfer Processes

Tenancy in Common allows co-owners to transfer their individual interest in the property independently through sale, will, or gift, making the ownership interests divisible and inheritable. In contrast, a Life Estate grants ownership rights strictly for the duration of the life tenant's lifetime, after which the property automatically transfers to the remainderman without probate. The Life Estate document outlines the remainder interest, ensuring a streamlined transfer process upon the life tenant's death, whereas Tenancy in Common requires explicit agreements or legal instruments for transfer among co-owners.

Advantages of Tenancy in Common

Tenancy in Common offers flexibility by allowing multiple owners to hold undivided interests in a property, each with the right to sell or transfer their share independently. It provides ease of inheritance, as ownership shares pass according to each co-owner's will or state law without requiring probate. This arrangement also enables diverse ownership percentages, accommodating varying investment amounts or contributions among co-owners.

Benefits of a Life Estate

A Life Estate provides the grantor with control over property during their lifetime while allowing a designated remainderman to inherit the estate automatically, avoiding probate. It offers protection against creditors and ensures that the property cannot be sold or encumbered by the remainderman until the life tenant's death. Life Estates enable efficient estate planning by preserving family assets and simplifying the transfer of ownership without the complexities involved in Tenancy in Common arrangements.

Potential Legal and Tax Implications

Tenancy in Common allows multiple owners to hold distinct shares, which can be sold or inherited independently, potentially triggering capital gains tax and probate proceedings. Life Estate grants an individual the right to use property during their lifetime, with ownership transferring to a remainder beneficiary upon death, often avoiding probate but possibly leading to gift tax consequences. Both arrangements require careful estate planning to address property tax reassessments, inheritance issues, and income tax liabilities.

Choosing the Right Option for Your Needs

Tenancy in Common offers flexible ownership where multiple parties hold undivided shares, making it ideal for individuals seeking shared property rights without survivorship benefits. Life Estate grants a person the right to use and control property for their lifetime, transferring ownership to a designated remainder beneficiary upon death, which suits those prioritizing control during life and ensuring inheritance. Selecting between these depends on goals for control, transferability, and estate planning, with Tenancy in Common favoring shared investments and Life Estate supporting seamless property transition after death.

Tenancy in Common Infographic

libterm.com

libterm.com