A Limited Liability Company (LLC) provides business owners with personal liability protection while allowing flexible management and tax benefits. This structure combines the advantages of both corporations and partnerships, making it a popular choice for small to medium-sized businesses. Explore the rest of this article to understand how forming an LLC can benefit your business.

Table of Comparison

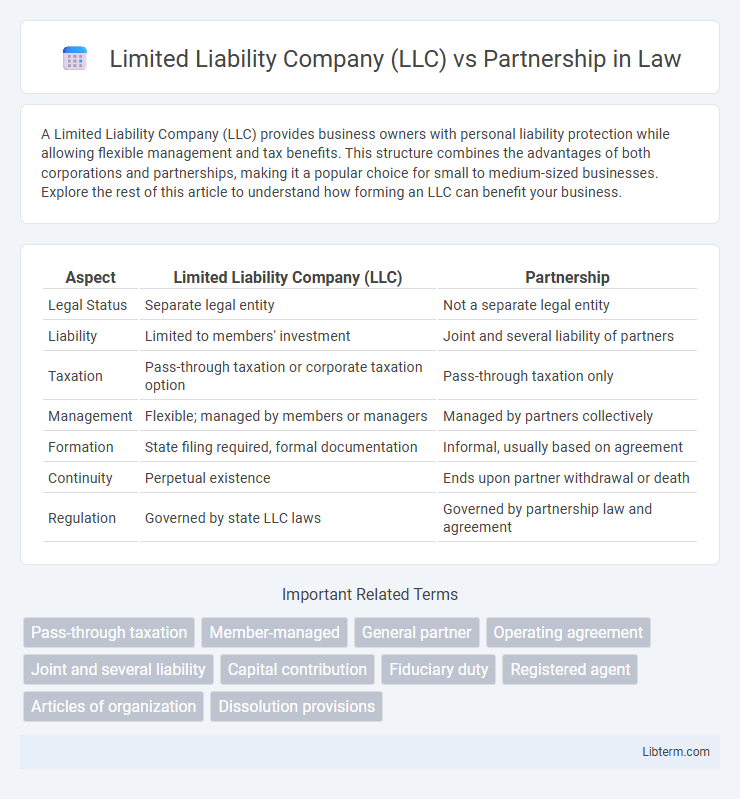

| Aspect | Limited Liability Company (LLC) | Partnership |

|---|---|---|

| Legal Status | Separate legal entity | Not a separate legal entity |

| Liability | Limited to members' investment | Joint and several liability of partners |

| Taxation | Pass-through taxation or corporate taxation option | Pass-through taxation only |

| Management | Flexible; managed by members or managers | Managed by partners collectively |

| Formation | State filing required, formal documentation | Informal, usually based on agreement |

| Continuity | Perpetual existence | Ends upon partner withdrawal or death |

| Regulation | Governed by state LLC laws | Governed by partnership law and agreement |

Understanding Limited Liability Companies (LLCs)

Limited Liability Companies (LLCs) provide owners with protection from personal liability, meaning members are typically not responsible for business debts beyond their investment. Unlike partnerships, where partners have joint and several liability, LLCs offer a separate legal entity that shields personal assets. LLCs also allow flexible management structures and pass-through taxation, combining the benefits of corporations and partnerships.

What Is a Partnership?

A partnership is a business structure where two or more individuals share ownership, responsibilities, and profits based on an agreement. Unlike a Limited Liability Company (LLC), partners in a general partnership have unlimited personal liability for business debts and obligations. This structure emphasizes collaboration but carries increased financial risk compared to the liability protection offered by an LLC.

Key Differences Between LLCs and Partnerships

Limited Liability Companies (LLCs) provide owners with personal liability protection, separating personal assets from business debts, whereas partnerships expose partners to unlimited personal liability for business obligations. LLCs offer flexibility in management and taxation options, allowing members to choose between being taxed as a sole proprietorship, partnership, or corporation, while partnerships are typically taxed as pass-through entities with profits and losses reported on partners' individual tax returns. Ownership structure in LLCs allows for an unlimited number of members with transferable interests, contrasting with partnership models that may have restrictions on ownership changes and fewer formal requirements for management.

Liability Protection: LLC vs Partnership

A Limited Liability Company (LLC) offers owners personal liability protection, meaning members are generally not responsible for business debts or legal actions. In contrast, partnerships typically expose partners to unlimited liability, where personal assets can be used to satisfy business obligations. This key difference makes an LLC a preferable choice for entrepreneurs seeking to shield personal assets from business risks.

Taxation: LLC and Partnership Compared

Limited Liability Companies (LLCs) offer flexible tax options, allowing members to choose between being taxed as a sole proprietorship, partnership, S corporation, or C corporation, leading to potential tax savings and pass-through taxation benefits. Partnerships generally feature pass-through taxation, where profits and losses are reported on individual partners' tax returns, but partners are subject to self-employment taxes on their shares of income. LLCs provide more versatility in tax planning and can mitigate self-employment tax exposure compared to partnerships, making them preferable for businesses seeking tailored tax treatment.

Management Structure and Decision-Making

Limited Liability Companies (LLCs) feature a flexible management structure allowing members to choose between member-managed or manager-managed models, enabling streamlined decision-making tailored to business needs. Partnerships rely on partners sharing management responsibilities and decision-making authority equally or as outlined in a partnership agreement, which can lead to slower consensus processes. LLCs provide clearer separation between ownership and management roles, while partnerships typically involve direct involvement of all partners in daily operations and strategic decisions.

Formation and Legal Requirements

A Limited Liability Company (LLC) requires filing Articles of Organization with the state and adhering to specific operating agreements, providing a formalized structure with liability protection. Partnerships form through an agreement between parties without mandatory state registration, though some states require a partnership registration for formal recognition. LLCs mandate compliance with ongoing state regulations and fees, while partnerships typically have fewer legal formalities and less regulatory oversight.

Flexibility and Operational Control

A Limited Liability Company (LLC) offers greater flexibility in management structures, allowing members to choose between member-managed or manager-managed operations, tailoring control to their preferences. In contrast, partnerships typically require all partners to share operational control equally, unless a specific agreement dictates otherwise, which can limit adaptability. LLCs also provide more straightforward mechanisms for transferring ownership interests without dissolving the business, enhancing operational continuity.

Pros and Cons of Choosing an LLC

Choosing a Limited Liability Company (LLC) provides owners with limited personal liability protection, separating personal assets from business debts and legal liabilities, which is a significant advantage over partnerships where personal liability is often unlimited. LLCs offer flexible management structures and pass-through taxation, avoiding double taxation that corporations face, but they may involve higher formation and compliance costs compared to partnerships. However, partnerships benefit from simpler setup and direct profit sharing, while LLCs require more formalities and ongoing state regulations, potentially increasing administrative burdens.

Pros and Cons of Choosing a Partnership

Choosing a partnership offers the advantage of shared management responsibilities and straightforward tax treatment, with profits directly passing through to partners' personal income, avoiding corporate taxation. However, partners face unlimited personal liability for business debts and obligations, exposing personal assets to risk and potentially straining relationships due to financial entanglements. Unlike LLCs, partnerships lack formal liability protection, making them less suitable for high-risk ventures or those seeking to limit personal financial exposure.

Limited Liability Company (LLC) Infographic

libterm.com

libterm.com