An assignee is an individual or entity that receives rights, property, or obligations from another party, known as the assignor, through a legal agreement. Understanding the roles and responsibilities of an assignee is crucial for ensuring proper transfer of duties and benefits in contracts or intellectual property assignments. Discover how assignees impact your agreements by reading the full article.

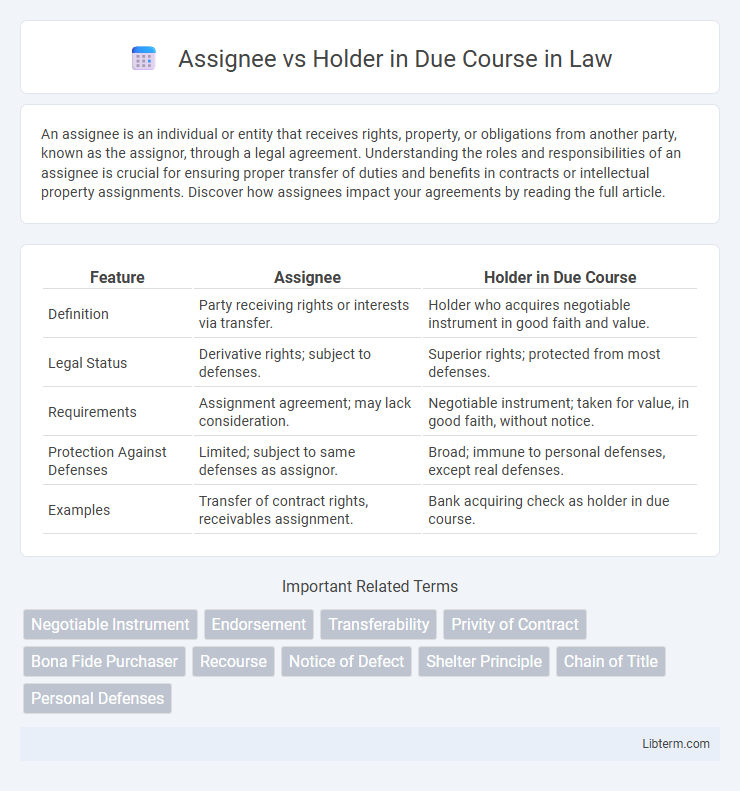

Table of Comparison

| Feature | Assignee | Holder in Due Course |

|---|---|---|

| Definition | Party receiving rights or interests via transfer. | Holder who acquires negotiable instrument in good faith and value. |

| Legal Status | Derivative rights; subject to defenses. | Superior rights; protected from most defenses. |

| Requirements | Assignment agreement; may lack consideration. | Negotiable instrument; taken for value, in good faith, without notice. |

| Protection Against Defenses | Limited; subject to same defenses as assignor. | Broad; immune to personal defenses, except real defenses. |

| Examples | Transfer of contract rights, receivables assignment. | Bank acquiring check as holder in due course. |

Introduction to Assignee and Holder in Due Course

An assignee is a party to whom rights or property are transferred through an assignment, often acquiring the assignor's interest but subject to existing defenses and claims. A holder in due course, under the Uniform Commercial Code (UCC), is a special type of assignee who obtains a negotiable instrument for value, in good faith, and without notice of defects, gaining enhanced protection against most defenses. Understanding the distinction between a general assignee and a holder in due course is crucial for assessing legal rights and remedies in commercial transactions involving negotiable instruments.

Definitions: Assignee vs Holder in Due Course

An assignee is a party who receives rights or property through an assignment from the assignor but takes the rights subject to all existing defenses and claims. A holder in due course is a special type of assignee who obtains a negotiable instrument in good faith, for value, and without notice of defects or claims, thus acquiring greater protection against defenses. The key distinction lies in the holder in due course's ability to enforce the instrument free from many defenses that could be asserted against the original payee or assignor.

Legal Framework and Background

The legal framework distinguishes an assignee as a party who receives rights or interests through assignment, subject to existing defenses and equities, whereas a holder in due course acquires negotiable instruments free from many defenses, protected under the Uniform Commercial Code (UCC) Article 3. An assignee's rights depend on the original contract terms and any defenses against assignor, while a holder in due course must meet specific requirements such as taking the instrument for value, in good faith, and without notice of defects. This distinction underlies the broader protection mechanisms in commercial law to facilitate negotiability and credit transactions.

Rights and Responsibilities of an Assignee

An assignee acquires the assignor's rights under a contract but typically does not obtain greater rights than the original party and may be subject to defenses against the assignor. The rights of an assignee include the ability to enforce the assigned obligations, while responsibilities may involve notifying the obligor of the assignment and ensuring the assignment does not violate any contractual restrictions. Unlike a holder in due course, an assignee does not receive protection from certain defenses or claims, limiting their ability to collect if the obligor raises valid objections.

Rights and Responsibilities of a Holder in Due Course

A Holder in Due Course (HDC) possesses superior rights compared to an assignee, including the ability to enforce the instrument free from many defenses available against prior parties. The Holder in Due Course acquires the instrument in good faith, for value, and without notice of any defects, granting them the right to collect payment even if there are underlying disputes between prior parties. Their responsibilities involve ensuring the instrument is genuine and transferable, maintaining good faith, and honoring the terms without exploiting any defects unknown to previous holders.

Key Differences Between Assignee and Holder in Due Course

An assignee acquires rights by transfer but may be subject to defenses available against the assignor, whereas a holder in due course obtains negotiable instruments free from many defenses and claims. The holder in due course must meet specific requirements, such as taking the instrument for value, in good faith, and without notice of prior claims, distinguishing their protection level from that of an assignee. Unlike assignees, holders in due course enjoy enhanced legal protections, making their rights more secure against disputes arising from the instrument.

Protection Against Defenses and Claims

An assignee is generally subject to the same defenses and claims that the obligor could assert against the assignor, limiting their protection in contractual disputes. A holder in due course, however, obtains enhanced protection by taking a negotiable instrument for value, in good faith, and without notice of defects, barring most defenses and claims from the obligor. This status provides superior legal rights, often allowing the holder in due course to enforce payment free from personal defenses such as fraud or breach of contract.

Real-World Examples and Case Studies

In the context of negotiable instruments law, an assignee acquires rights through assignment but is subject to any defenses against the assignor, whereas a holder in due course obtains the instrument free from many defenses and claims, ensuring stronger protection. Real-world cases such as *UCC Article 3* disputes illustrate how banks acting as holders in due course can enforce payment even when underlying contractual issues exist, unlike assignees whose rights are limited to the assignor's claims. For example, the case *Sec. Bank v. Credit Corp* demonstrated that the holder in due course status protected a bank from fraud defenses raised by the debtor, highlighting key practical differences in enforcement power.

Implications in Negotiable Instruments Law

In Negotiable Instruments Law, an assignee acquires rights from the assignor but may be subject to defenses against the original parties, limiting enforceability. A holder in due course (HDC) obtains the instrument in good faith, for value, and without notice of defects, thereby gaining enhanced protection against most defenses, ensuring stronger enforceability. The distinction impacts legal rights and liabilities since an HDC's status provides immunity from many claims that could defeat an assignee's claim.

Conclusion: Choosing the Correct Path

Selecting between an assignee and a holder in due course hinges on the specific rights and protections required in a transaction under the Uniform Commercial Code (UCC). An assignee inherits contractual rights without the favorable defenses and protections that a holder in due course obtains, such as immunity from many claims and defenses. Opting for holder in due course status ensures greater security and enforceability of negotiable instruments, making it the preferred path for maximizing legal advantages in financial dealings.

Assignee Infographic

libterm.com

libterm.com