Misappropriation involves the unauthorized use or theft of resources, funds, or property for personal gain, often leading to legal consequences and financial losses. Identifying signs of misappropriation can help protect Your assets and maintain organizational integrity. Explore the rest of the article to understand how to recognize and prevent misappropriation effectively.

Table of Comparison

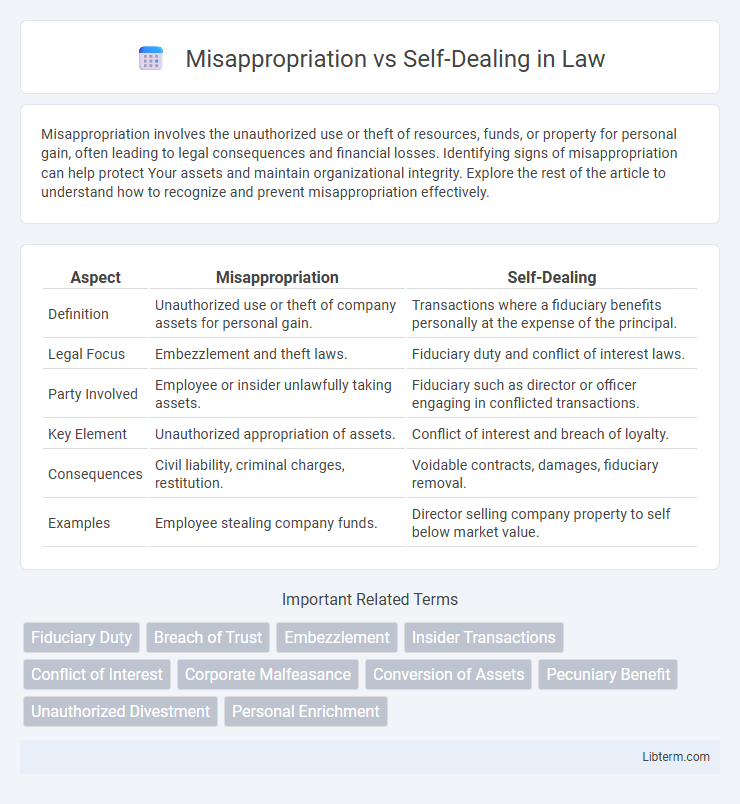

| Aspect | Misappropriation | Self-Dealing |

|---|---|---|

| Definition | Unauthorized use or theft of company assets for personal gain. | Transactions where a fiduciary benefits personally at the expense of the principal. |

| Legal Focus | Embezzlement and theft laws. | Fiduciary duty and conflict of interest laws. |

| Party Involved | Employee or insider unlawfully taking assets. | Fiduciary such as director or officer engaging in conflicted transactions. |

| Key Element | Unauthorized appropriation of assets. | Conflict of interest and breach of loyalty. |

| Consequences | Civil liability, criminal charges, restitution. | Voidable contracts, damages, fiduciary removal. |

| Examples | Employee stealing company funds. | Director selling company property to self below market value. |

Understanding Misappropriation: Definition and Context

Misappropriation involves the unauthorized use or theft of assets or funds entrusted to an individual, often violating fiduciary duties in corporate or legal contexts. It extends beyond simple theft by encompassing breaches of trust where an individual exploits assets for personal gain without consent. Understanding misappropriation clarifies its distinction from self-dealing, where actions typically involve conflicts of interest rather than outright theft.

What is Self-Dealing? Key Concepts Explained

Self-dealing occurs when a fiduciary, such as a corporate officer or trustee, uses their position to benefit personally at the expense of the entity they serve, violating their duty of loyalty. Key concepts include conflicts of interest, unauthorized transactions, and personal gain derived from the fiduciary role. This contrasts with misappropriation, which involves unauthorized use or theft of the entity's assets without necessarily involving a fiduciary duty breach.

Legal Differences Between Misappropriation and Self-Dealing

Misappropriation involves the unauthorized use or theft of assets or funds, typically violating fiduciary duties through covert actions. Self-dealing occurs when a fiduciary exploits their position to engage in transactions that benefit themselves at the expense of the principal or entity they represent. Legally, misappropriation centers on the wrongful conversion of property, while self-dealing concentrates on conflicts of interest and the breach of loyalty in contractual or transactional dealings.

Common Examples of Misappropriation in Business

Common examples of misappropriation in business include the unauthorized use of company funds for personal expenses, theft of intellectual property such as proprietary software or trade secrets, and diverting business opportunities for personal gain. Employees or executives may also manipulate expense reports or falsify financial records to conceal embezzlement. Such acts undermine corporate governance and expose businesses to significant legal and financial risks.

Typical Instances of Self-Dealing in Corporate Settings

Typical instances of self-dealing in corporate settings involve corporate officers or directors engaging in transactions that benefit themselves at the expense of shareholders, such as approving contracts with businesses they own or have a financial interest in. These actions often include the sale or purchase of company assets to insiders under favorable terms, diverting corporate opportunities for personal gain. Such conduct breaches fiduciary duties, undermining trust and exposing the corporation to potential legal and financial liabilities.

Impact of Misappropriation on Organizations

Misappropriation severely undermines organizational integrity by diverting assets or funds for unauthorized personal use, leading to significant financial losses and operational disruption. This fraudulent activity damages stakeholder trust, harms company reputation, and may result in legal penalties or regulatory sanctions. Organizations often face decreased employee morale and increased scrutiny, necessitating robust internal controls and audits to prevent recurrence.

Consequences of Self-Dealing for Individuals and Companies

Self-dealing results in severe legal and financial consequences for both individuals and companies, including fines, restitution, and potential criminal charges for violating fiduciary duties. Companies risk reputational damage, loss of investor trust, and internal disruption, which can lead to decreased market value and operational inefficiencies. Individuals involved often face dismissal, civil liability, and exclusion from future corporate positions or directorships.

Preventive Measures Against Misappropriation

Implementing robust internal controls, such as segregation of duties and regular audits, effectively prevents misappropriation by limiting opportunities for unauthorized asset use. Employee training programs emphasizing ethical standards and clear reporting mechanisms encourage vigilance and early detection of fraudulent activities. Utilizing advanced financial monitoring software enhances transparency and accountability, deterring potential misappropriation within organizations.

How to Detect and Address Self-Dealing

Detecting self-dealing involves scrutinizing financial records for unusual transactions that benefit insiders disproportionately and monitoring conflicts of interest disclosures for inconsistencies. Effective approaches to address self-dealing include implementing robust internal controls, requiring board or independent committee approval for related-party transactions, and conducting regular audits to ensure transparency and compliance. Enforcement measures may involve corrective actions such as restitution, disciplinary procedures, or legal interventions to uphold organizational integrity.

Regulatory Frameworks: Laws Governing Misappropriation and Self-Dealing

Regulatory frameworks governing misappropriation and self-dealing are primarily established under corporate governance laws, such as the Sarbanes-Oxley Act, which imposes strict fiduciary responsibilities on corporate officers to prevent unauthorized use of company assets. The Securities Exchange Act of 1934 enforces disclosure requirements and penalties for insider trading and self-dealing transactions that breach duty of loyalty. State laws, including the Model Business Corporation Act, provide additional statutory guidelines and protections against both misappropriation of funds and conflicts of interest in self-dealing scenarios.

Misappropriation Infographic

libterm.com

libterm.com