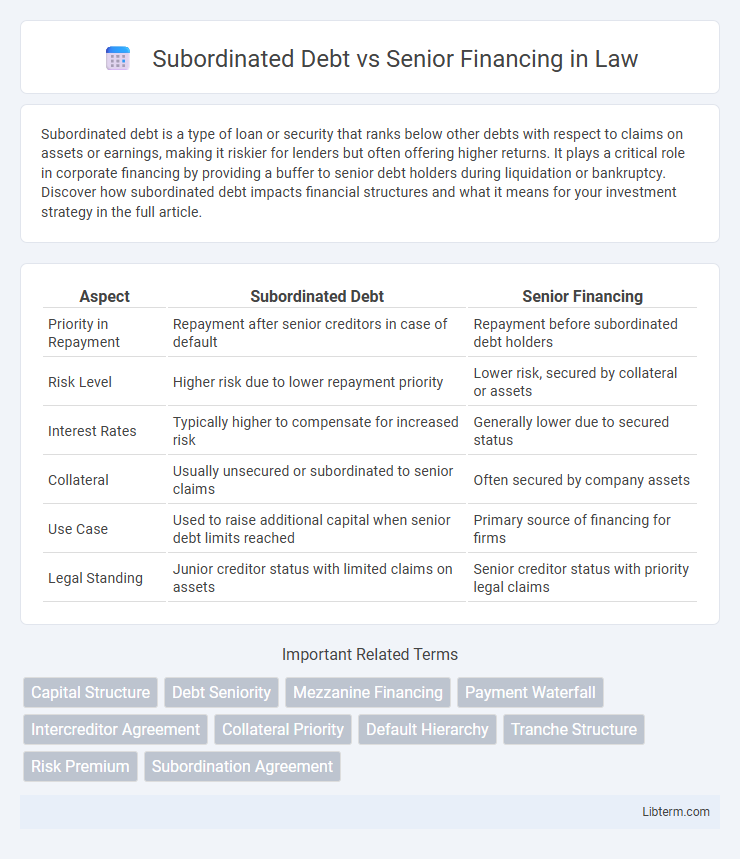

Subordinated debt is a type of loan or security that ranks below other debts with respect to claims on assets or earnings, making it riskier for lenders but often offering higher returns. It plays a critical role in corporate financing by providing a buffer to senior debt holders during liquidation or bankruptcy. Discover how subordinated debt impacts financial structures and what it means for your investment strategy in the full article.

Table of Comparison

| Aspect | Subordinated Debt | Senior Financing |

|---|---|---|

| Priority in Repayment | Repayment after senior creditors in case of default | Repayment before subordinated debt holders |

| Risk Level | Higher risk due to lower repayment priority | Lower risk, secured by collateral or assets |

| Interest Rates | Typically higher to compensate for increased risk | Generally lower due to secured status |

| Collateral | Usually unsecured or subordinated to senior claims | Often secured by company assets |

| Use Case | Used to raise additional capital when senior debt limits reached | Primary source of financing for firms |

| Legal Standing | Junior creditor status with limited claims on assets | Senior creditor status with priority legal claims |

Introduction to Subordinated Debt and Senior Financing

Subordinated debt represents a class of financing that ranks below senior debt in the capital structure, meaning it is repaid after senior obligations in the event of default or liquidation. Senior financing, often secured by company assets, holds the highest priority for repayment and typically offers lower interest rates due to its reduced risk profile. Understanding the hierarchy and risk-reward balance between subordinated debt and senior financing is crucial for optimizing capital structure and managing lender preferences.

Defining Subordinated Debt

Subordinated debt refers to a type of loan or security that ranks below senior financing in terms of claims on assets or repayment priority in the event of default or liquidation. It carries higher risk compared to senior debt, leading to higher interest rates to compensate investors. This debt is often used by companies to raise additional capital without diluting equity, serving as a crucial layer of financing between senior loans and equity investments.

What is Senior Financing?

Senior financing refers to loans or debt obligations that hold the highest priority for repayment in the capital structure of a company, typically secured by collateral or specific assets. It carries lower risk for lenders due to its priority status, resulting in lower interest rates compared to subordinated debt. Senior financing is commonly used for working capital, asset acquisition, and operational funding, ensuring lenders are repaid before any junior creditors in case of bankruptcy or liquidation.

Key Differences Between Subordinated Debt and Senior Financing

Subordinated debt ranks below senior financing in the repayment hierarchy, meaning it carries higher risk but offers higher interest rates to compensate investors. Senior financing has priority claims on assets and cash flows during liquidation, providing lower risk and typically lower returns. Key differences also include collateral requirements, with senior financing often secured by company assets, while subordinated debt is usually unsecured.

Risk Profiles: Subordinated vs Senior Debt

Subordinated debt carries higher risk compared to senior financing because it ranks lower in the capital structure, meaning it is repaid after senior debt holders in the event of liquidation. Senior debt typically features lower interest rates due to its secured nature and priority claim on assets, reducing lenders' exposure to default risk. Investors in subordinated debt demand higher yields to compensate for increased risk, reflecting its subordinate position and greater likelihood of loss in financial distress.

Priority of Claims in Liquidation

Subordinated debt ranks below senior financing in the priority of claims during liquidation, meaning senior creditors are paid in full before any funds are distributed to subordinated debt holders. This lower priority increases risk for subordinated debt investors, often resulting in higher interest rates to compensate. Senior financing is secured by company assets, providing creditors with stronger protection and greater likelihood of recovery in insolvency events.

Typical Uses of Subordinated Debt

Subordinated debt is typically used by companies to bridge the gap between senior financing and equity, providing additional capital without diluting ownership. It is often employed in leveraged buyouts, growth financing, and recapitalizations where senior lenders have priority claims but higher leverage is necessary. This financing form carries higher risk and interest rates, making it suitable for businesses seeking flexible capital with fewer collateral requirements.

Advantages and Disadvantages of Senior Financing

Senior financing offers lower interest rates and higher priority in repayment during liquidation, reducing lender risk and enhancing borrower cash flow stability. However, it may impose stricter covenants and collateral requirements, limiting borrower flexibility and increasing compliance costs. This form of financing typically demands rigorous credit assessments, which can extend approval timelines and restrict access for riskier projects.

Impact on Borrower and Lender Relationships

Subordinated debt carries higher risk for lenders due to its lower claim priority in case of borrower default, often resulting in higher interest rates to compensate for this risk. Borrowers benefit from subordinated debt as it can enhance leverage capacity without affecting existing senior loan covenants, but it may complicate lender relationships due to differing priorities in repayment. Senior financing maintains prioritized claims, fostering more straightforward lender relationships and often offering lower borrowing costs, though it limits the borrower's ability to take on additional secured debt.

Choosing Between Subordinated Debt and Senior Financing

Choosing between subordinated debt and senior financing depends on the company's risk tolerance, capital structure, and cost of capital objectives. Subordinated debt carries higher interest rates due to its lower repayment priority, making it suitable for businesses seeking flexible funding without diluting equity. Senior financing offers lower interest rates and priority repayment, appealing to lenders and companies prioritizing lower risk and stronger collateral requirements.

Subordinated Debt Infographic

libterm.com

libterm.com