A Charitable Trust is a legal arrangement where assets are managed by trustees to benefit charitable causes, ensuring long-term support for nonprofit organizations. Establishing one can provide significant tax benefits while promoting philanthropy in your community. Explore the full article to understand how a Charitable Trust can align with your giving goals.

Table of Comparison

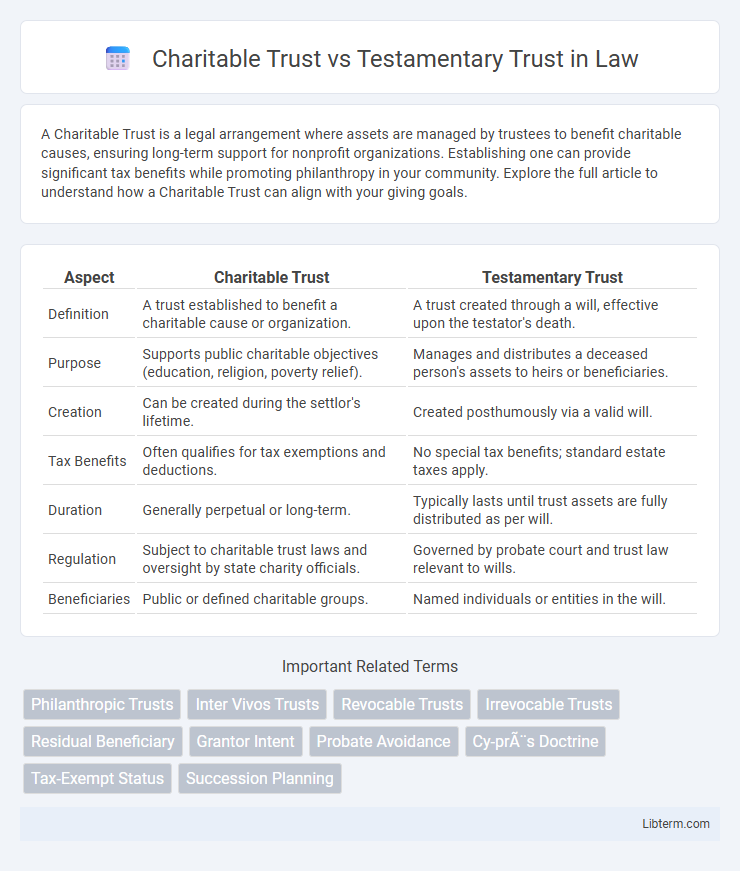

| Aspect | Charitable Trust | Testamentary Trust |

|---|---|---|

| Definition | A trust established to benefit a charitable cause or organization. | A trust created through a will, effective upon the testator's death. |

| Purpose | Supports public charitable objectives (education, religion, poverty relief). | Manages and distributes a deceased person's assets to heirs or beneficiaries. |

| Creation | Can be created during the settlor's lifetime. | Created posthumously via a valid will. |

| Tax Benefits | Often qualifies for tax exemptions and deductions. | No special tax benefits; standard estate taxes apply. |

| Duration | Generally perpetual or long-term. | Typically lasts until trust assets are fully distributed as per will. |

| Regulation | Subject to charitable trust laws and oversight by state charity officials. | Governed by probate court and trust law relevant to wills. |

| Beneficiaries | Public or defined charitable groups. | Named individuals or entities in the will. |

Understanding Charitable Trusts

Charitable trusts are established to benefit a specific charitable purpose or organization, offering donors tax advantages and perpetual support for philanthropic causes. Unlike testamentary trusts, which are created through a will and become effective after the grantor's death, charitable trusts can be set up during the grantor's lifetime or upon their death. These trusts are governed by specific legal requirements to ensure funds are used solely for charitable objectives, enhancing transparency and accountability.

Overview of Testamentary Trusts

Testamentary trusts are established through a will and come into effect upon the death of the testator, providing controlled and conditional asset distribution to beneficiaries. These trusts offer estate tax benefits and protection for minors or incapacitated heirs by managing the inheritance according to the testator's instructions. Unlike charitable trusts, which benefit nonprofit causes, testamentary trusts focus on family members or specific individuals, ensuring long-term financial security and legacy planning.

Key Legal Differences

Charitable trusts are established to benefit a charitable purpose and must comply with specific regulations under the Charities Act, including requirements for public benefit and tax-exempt status. Testamentary trusts arise from a will and take effect upon the testator's death, primarily used to manage and distribute assets to beneficiaries according to the deceased's instructions. Key legal differences include the subject purpose--charitable trusts serve public or community benefits, while testamentary trusts focus on private family interests--and the regulatory frameworks governing each trust type.

Purpose and Objectives

Charitable trusts are established to provide long-term funding for humanitarian, educational, religious, or other philanthropic causes, aiming to benefit the public or a specific community. Testamentary trusts are created through a will to manage and distribute a deceased person's assets according to their wishes, primarily focusing on providing financial support to designated beneficiaries. While charitable trusts prioritize public welfare and social impact, testamentary trusts emphasize family protection, asset management, and inheritance distribution.

Formation and Establishment Process

Charitable trusts are established to benefit the public or specific charitable purposes and require compliance with state charitable trust laws and registration with the appropriate regulatory authority, often the Attorney General's office. Testamentary trusts are created through a will and only come into effect upon the grantor's death, necessitating probate court approval to validate the will and establish the trust. The formation of a charitable trust involves drafting a trust instrument detailing charitable objectives, while a testamentary trust's formation depends on the execution of a valid will and subsequent probate proceedings.

Tax Benefits and Implications

Charitable trusts offer significant tax benefits, including income tax deductions for contributions and exemption from estate and gift taxes, making them a strategic option for donors aiming to reduce overall tax liability. Testamentary trusts, created through wills and activated upon death, provide income tax advantages primarily by allowing income to be taxed at potentially lower trust tax rates and facilitating estate tax planning. Both types of trusts require adherence to specific IRS rules to maintain favorable tax treatment, with charitable trusts benefiting from stricter regulations to qualify as tax-exempt entities.

Administration and Management

Charitable trusts are administered by trustees who manage the trust's assets in alignment with the specific charitable purposes, ensuring compliance with state and federal regulations governing tax-exempt entities. Testamentary trusts are created through a will and only come into effect upon the grantor's death, requiring probate court oversight for administration and asset distribution according to the terms set in the will. Both types demand fiduciary responsibility, but charitable trusts often require ongoing reporting to maintain tax-exempt status, whereas testamentary trusts focus on fulfilling the decedent's wishes and may be dissolved once the trust terms are completed.

Flexibility and Control

Charitable trusts offer limited flexibility as their assets must serve specific charitable purposes, whereas testamentary trusts provide greater control by allowing individuals to dictate terms upon their death. Testamentary trusts can be tailored to beneficiaries' needs with adjustable distributions, while charitable trusts are bound by nonprofit regulations and donor intent. Control in testamentary trusts remains with the trustee and beneficiaries, unlike charitable trusts where oversight is often subject to external charitable objectives and legal constraints.

Common Use Cases

Charitable trusts are commonly established to support nonprofit organizations, fund public causes, or provide ongoing financial support to community projects. Testamentary trusts are often used to manage and distribute assets to heirs or beneficiaries after the grantor's death, ensuring financial protection for minors or individuals with special needs. Both trust types facilitate estate planning but serve distinct purposes based on philanthropic goals versus inheritance management.

Choosing the Right Trust for Estate Planning

When choosing the right trust for estate planning, understanding the distinct purposes of a Charitable Trust and a Testamentary Trust is essential. Charitable Trusts provide ongoing support to designated charities while offering potential tax benefits, making them ideal for those prioritizing philanthropy. Testamentary Trusts are created through a will to manage and distribute assets to beneficiaries after death, providing control and protection for heirs, especially minors or individuals with special needs.

Charitable Trust Infographic

libterm.com

libterm.com