Mastering the concept of stopping time is crucial in probability theory and stochastic processes, where it defines a random time determined by events up to that moment without future knowledge. It plays a vital role in optimal stopping problems, filtration, and martingale theory, influencing decisions in finance, gambling, and various statistical models. Explore the following article to deepen your understanding of stopping time and its practical applications.

Table of Comparison

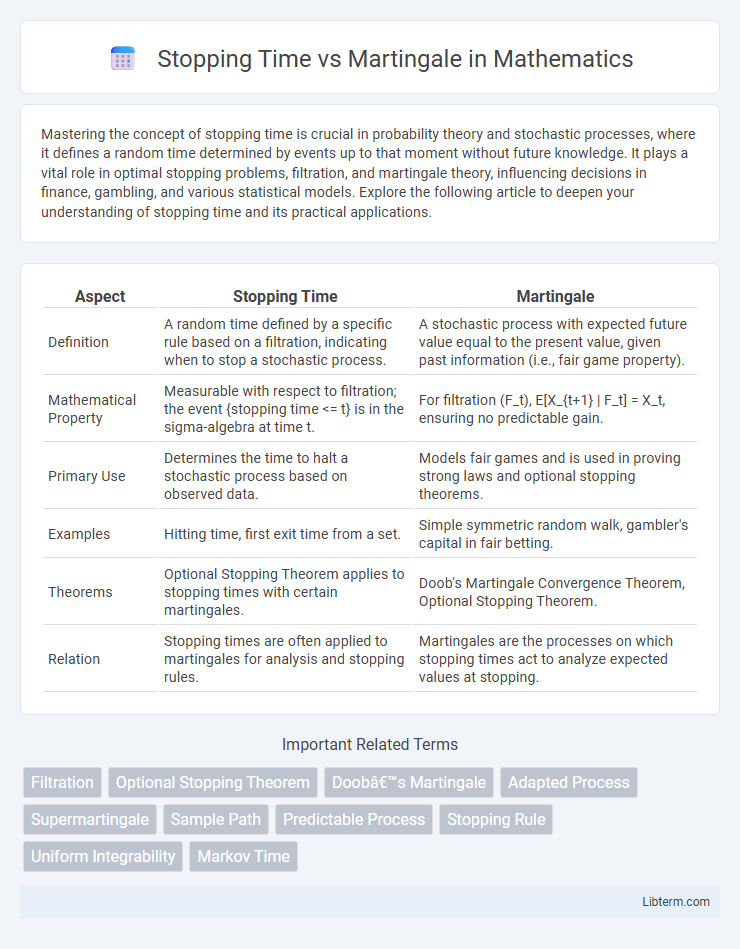

| Aspect | Stopping Time | Martingale |

|---|---|---|

| Definition | A random time defined by a specific rule based on a filtration, indicating when to stop a stochastic process. | A stochastic process with expected future value equal to the present value, given past information (i.e., fair game property). |

| Mathematical Property | Measurable with respect to filtration; the event {stopping time <= t} is in the sigma-algebra at time t. | For filtration (F_t), E[X_{t+1} | F_t] = X_t, ensuring no predictable gain. |

| Primary Use | Determines the time to halt a stochastic process based on observed data. | Models fair games and is used in proving strong laws and optional stopping theorems. |

| Examples | Hitting time, first exit time from a set. | Simple symmetric random walk, gambler's capital in fair betting. |

| Theorems | Optional Stopping Theorem applies to stopping times with certain martingales. | Doob's Martingale Convergence Theorem, Optional Stopping Theorem. |

| Relation | Stopping times are often applied to martingales for analysis and stopping rules. | Martingales are the processes on which stopping times act to analyze expected values at stopping. |

Understanding Stopping Time in Probability Theory

Stopping time in probability theory is a random variable representing the time at which a given stochastic process satisfies a specific condition for the first time, based on information available up to that point. It plays a critical role in the theory of martingales, as it allows for the formulation of optimal stopping problems and the analysis of fair games. Understanding stopping times involves grasping concepts such as filtration, adapted processes, and the strong Markov property, which together enable precise modeling of decision-making in uncertain environments.

Defining the Martingale Property

The martingale property defines a stochastic process where the conditional expectation of the next value, given all prior information, equals the current value, ensuring no predictable trends in future increments. In stopping time theory, this property is crucial for establishing fair game conditions at random times, allowing optional stopping theorems to determine expected values at stopping times. Martingales facilitate modeling fair bets and price-neutral financial instruments under filtration and adapted processes.

Key Differences Between Stopping Time and Martingale

Stopping time is a random variable representing the time at which a given stochastic process satisfies a specific condition, typically defined by the available information up to that time. Martingale is a type of stochastic process with the property that its conditional expected future value, given the past and present, equals its current value, reflecting a "fair game" scenario. The key difference lies in that stopping time refers to a random time at which an event occurs, whereas a martingale describes the behavior of a stochastic process over time without a trend or drift.

Real-World Applications of Stopping Time

Stopping time plays a crucial role in financial modeling by determining optimal moments to execute trades or exercise options, enhancing portfolio management strategies amid market uncertainties. In risk management, stopping times help identify times to halt processes to minimize potential losses, such as in credit risk assessment and insurance claim processing. Algorithms for high-frequency trading leverage stopping times to optimize order execution and reduce adverse price movements, improving real-world trading efficiency.

Examples of Martingales in Financial Modeling

Martingales in financial modeling are exemplified by the discounted asset price processes under a risk-neutral measure, where expected future prices equal current prices, reflecting a "fair game" condition. Stopping time concepts are applied to model optimal exercise strategies in American option pricing, where the payoff depends on the chosen stopping rule, linking the martingale property to optimal stopping problems. The interplay between stopping times and martingales underpins fundamental theorems in arbitrage pricing theory and dynamic hedging strategies.

The Role of Filtration in Stopping Times

Filtration plays a crucial role in defining stopping times, as it formalizes the flow of information available up to each time instant in a stochastic process. A stopping time is a random time \(\tau\) such that the event \(\{\tau \leq t\}\) belongs to the filtration \(\mathcal{F}_t\), ensuring decisions depend only on information up to time \(t\). This adaptedness property distinguishes stopping times within the theory of martingales, where filtration underpins the conditional expectation and fair game properties crucial for martingale stopping theorems.

Optional Stopping Theorem: Connecting Stopping Time and Martingale

The Optional Stopping Theorem establishes a fundamental link between stopping times and martingales by asserting that, under certain conditions, the expected value of a martingale at a stopping time equals its initial value. This theorem requires that the stopping time be almost surely finite and that the martingale satisfies integrability and boundedness conditions to prevent arbitrage opportunities. By connecting stopping times and martingales, the theorem plays a crucial role in stochastic processes, financial mathematics, and optimal stopping problems.

Common Pitfalls in Interpreting Stopping Time and Martingale

Misinterpreting stopping times as fixed or deterministic moments rather than random variables can lead to incorrect conclusions in martingale analysis. Confusing optional stopping theorem conditions, such as boundedness or integrability, often results in false assumptions about martingale expectations at stopping times. Failure to recognize that martingale properties may not hold after stopping times without proper conditions causes significant errors in probability modeling and prediction.

Significance of Adapted Processes

Stopping time and martingale theory are fundamentally linked through the concept of adapted processes, which ensures that the value of a stochastic process at any given time is based solely on past and present information. Adapted processes enable the precise definition of stopping times, making them measurable with respect to the filtration generated by the process, and this measurability is crucial for establishing key martingale properties like optional stopping theorems. The significance of adaptedness lies in its role in preserving the integrity of conditional expectations and maintaining the martingale property under random time indexing, which is essential for both theoretical developments and practical applications in financial modeling and stochastic analysis.

Advanced Topics: Local Martingales and Stopping Times

Local martingales refine classical martingales by allowing the martingale property to hold only up to a sequence of stopping times, facilitating analysis where global integrability may fail. Stopping times act as random time horizons that adaptively truncate processes, ensuring local martingales retain key properties such as optional stopping and martingale decomposition within bounded intervals. This framework underpins advanced stochastic calculus applications including the Doob-Meyer decomposition, where predictable compensators emerge by examining local martingales stopped at suitable stopping times.

Stopping Time Infographic

libterm.com

libterm.com