Actual value represents the true worth or real price of an asset, product, or service as determined by objective criteria rather than market speculation or perceived value. Understanding actual value helps you make informed decisions in finance, investments, or everyday purchases by distinguishing between intrinsic and market values. Explore the rest of the article to learn how actual value impacts financial strategies and purchasing choices.

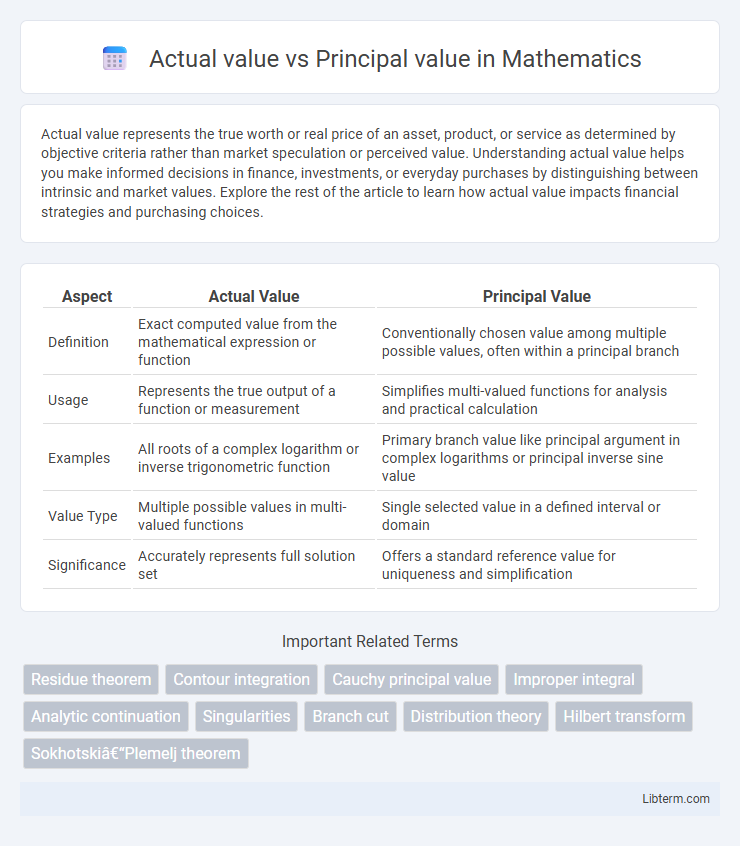

Table of Comparison

| Aspect | Actual Value | Principal Value |

|---|---|---|

| Definition | Exact computed value from the mathematical expression or function | Conventionally chosen value among multiple possible values, often within a principal branch |

| Usage | Represents the true output of a function or measurement | Simplifies multi-valued functions for analysis and practical calculation |

| Examples | All roots of a complex logarithm or inverse trigonometric function | Primary branch value like principal argument in complex logarithms or principal inverse sine value |

| Value Type | Multiple possible values in multi-valued functions | Single selected value in a defined interval or domain |

| Significance | Accurately represents full solution set | Offers a standard reference value for uniqueness and simplification |

Understanding Actual Value and Principal Value

Actual value refers to the current market price of an asset or security, reflecting its true worth based on supply and demand dynamics. Principal value denotes the original amount of money invested or loaned, excluding any interest or market fluctuations. Understanding the distinction is crucial for accurate financial analysis and investment decision-making.

Definitions: Actual Value vs Principal Value

Actual value refers to the current market price or worth of an asset, reflecting real-time conditions and demand. Principal value denotes the original amount of money invested or loaned, excluding any interest or market fluctuations. Understanding the distinction between actual value and principal value is essential for accurate financial analysis and investment decisions.

Importance in Financial Analysis

Actual value reflects the current market worth of an asset, while principal value represents the original amount invested or the face value of a financial instrument. Understanding the disparity between actual and principal values is crucial for accurate financial analysis, as it impacts investment appraisal, risk assessment, and portfolio valuation. Precise measurement of these values ensures effective decision-making and maximizes returns by identifying undervalued or overvalued assets.

Calculation Methods Explained

The actual value of a financial instrument reflects its current market price, calculated using methods such as discounted cash flow (DCF) analysis that accounts for present value of expected future cash flows adjusted for risk. Principal value, also known as face or par value, represents the nominal amount stated on the instrument and is used as the basis for interest payments and redemption but does not fluctuate with market conditions. Understanding the distinction requires calculating actual value through market-based models, whereas principal value remains a fixed amount specified in the contract.

Key Differences Between Actual and Principal Value

Actual value reflects the current worth of an asset based on market conditions, whereas principal value denotes the original amount invested or loaned. The key differences include that actual value fluctuates over time due to market dynamics, while principal value remains fixed unless adjusted by repayments or additional investments. Investors use actual value to assess real-time portfolio performance, whereas principal value serves as a baseline for calculating gains or losses.

Real-World Applications

Actual value reflects the true worth or market price of an asset at a specific time, crucial for investment decisions and financial reporting accuracy. Principal value denotes the original sum of money invested or loaned, serving as the baseline for calculating interest or returns in banking, mortgages, and bonds. Distinguishing these values aids in risk assessment, ensuring precise valuation in real estate, stock trading, and loan repayments.

Impact on Investment Decisions

The difference between actual value and principal value significantly impacts investment decisions by influencing risk assessment and return expectations. Actual value reflects the current market worth, capturing real-time fluctuations and market sentiment, while principal value represents the original amount invested, providing a baseline for measuring gains or losses. Investors rely on actual value to make informed decisions about portfolio adjustments, risk management, and timing of asset sales to maximize returns.

Common Misconceptions Clarified

The actual value of a financial asset reflects its current market price, while the principal value denotes the original amount invested or loaned. A common misconception is that the principal value always equals the asset's worth, but market fluctuations often cause the actual value to diverge. Understanding this distinction clarifies investment performance and risk assessment in portfolio management.

Practical Examples and Case Studies

Actual value refers to the real market price of an asset, while principal value is the original amount invested or face value of a financial instrument. For example, in bond investments, a bond purchased at $950 with a face value (principal) of $1,000 has an actual value lower than its principal value due to market conditions or credit risk. Case studies in real estate show that properties often sell below or above their principal loan value, reflecting actual market values influenced by location, demand, and property condition.

Conclusion: Making Informed Choices

Choosing between actual value and principal value requires careful analysis of financial goals, risk tolerance, and market conditions. Actual value reflects the current worth of an asset, incorporating market fluctuations and potential returns, whereas principal value represents the original amount invested. Understanding these distinctions enables investors to make informed decisions aligned with their long-term financial strategies and risk management preferences.

Actual value Infographic

libterm.com

libterm.com