Accurate forecasting plays a vital role in business planning and decision-making, helping companies anticipate market trends and allocate resources efficiently. Leveraging advanced analytics and historical data, forecasts provide actionable insights to reduce risks and maximize opportunities. Explore the rest of this article to discover how precise forecasting can transform Your strategy and enhance outcomes.

Table of Comparison

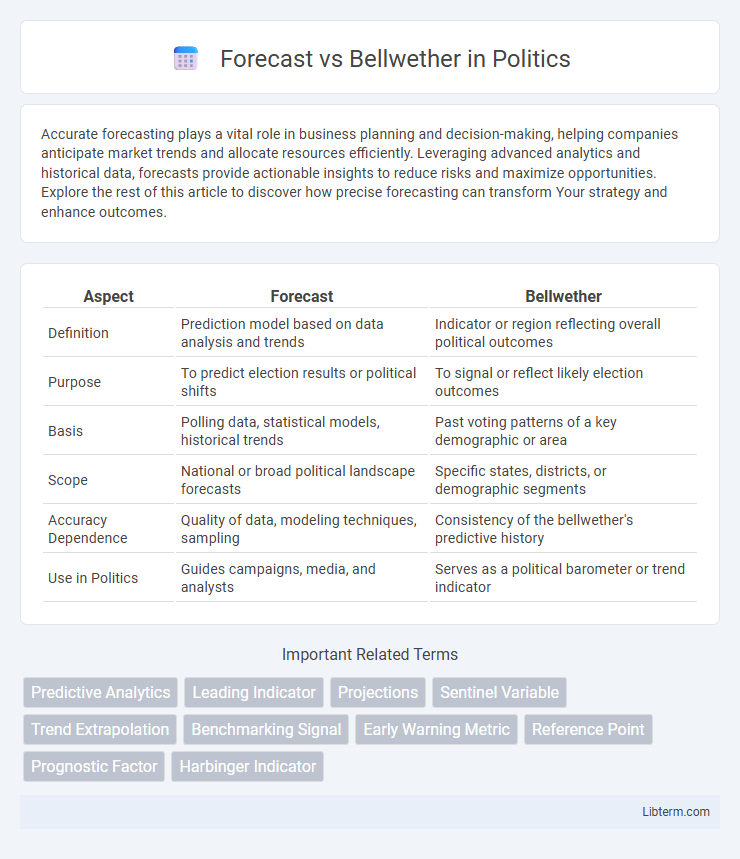

| Aspect | Forecast | Bellwether |

|---|---|---|

| Definition | Prediction model based on data analysis and trends | Indicator or region reflecting overall political outcomes |

| Purpose | To predict election results or political shifts | To signal or reflect likely election outcomes |

| Basis | Polling data, statistical models, historical trends | Past voting patterns of a key demographic or area |

| Scope | National or broad political landscape forecasts | Specific states, districts, or demographic segments |

| Accuracy Dependence | Quality of data, modeling techniques, sampling | Consistency of the bellwether's predictive history |

| Use in Politics | Guides campaigns, media, and analysts | Serves as a political barometer or trend indicator |

Understanding Forecasts and Bellwethers

Forecasts provide data-driven predictions based on historical trends, statistical models, and current market conditions, offering a quantitative analysis of future events or outcomes. Bellwethers act as leading indicators, representing entities or metrics that historically signal broader economic or industry trends before they fully materialize. Understanding forecasts involves analyzing probability and scenario planning, while interpreting bellwethers requires recognizing key patterns and shifts within influential benchmarks or companies.

Definition of Forecast in Business and Finance

Forecast in business and finance refers to the process of estimating future financial outcomes, market trends, or economic conditions based on historical data, statistical models, and current market indicators. It involves predicting revenues, expenses, sales, and other key performance metrics to guide strategic planning and decision-making. Accurate forecasting enables businesses to allocate resources efficiently, manage risks, and improve financial performance.

What is a Bellwether?

A bellwether is an entity, such as a stock, company, or indicator, that reliably signals trends or changes in a broader market or sector. It serves as a leading indicator, providing early insight into economic shifts or investor sentiment, making it crucial for market analysis and forecasting. Investors and analysts monitor bellwethers to anticipate future movements and adjust strategies accordingly.

Key Differences Between Forecast and Bellwether

Forecast relies on data-driven models to predict future outcomes based on historical patterns and statistical analysis. Bellwether refers to an indicator or entity that signals or predicts trends by leading changes in the market or social behavior before they become widespread. The key difference lies in forecast using systematic methods for projections, whereas bellwether serves as an early qualitative signal reflecting emerging trends.

Importance of Forecasting in Strategic Planning

Forecasting plays a critical role in strategic planning by providing data-driven insights that guide decision-making and resource allocation. Accurate forecasts enable businesses to anticipate market trends, manage risks, and capitalize on emerging opportunities to maintain competitive advantage. Utilizing bellwether indicators within forecasting models enhances predictive accuracy by reflecting leading economic or industry signals essential for proactive strategy development.

Bellwether Indicators and Their Role in Market Analysis

Bellwether indicators serve as crucial markers in market analysis, reflecting economic trends ahead of broader market movements. These indicators, such as key stock indexes or leading economic data, help investors predict shifts in market sentiment and potential turning points. By closely monitoring bellwether indicators, analysts gain insights into future market conditions, enabling strategic investment decisions.

Advantages and Limitations of Forecasting

Forecasting provides valuable insights by analyzing historical data and trends to predict future events, enhancing decision-making accuracy in business and economics. Its advantages include improved planning, resource allocation, and risk management, yet it faces limitations such as data quality dependency, uncertainty in volatile markets, and potential bias in model assumptions. Bellwether indicators, while useful as leading signals to gauge market or economic direction, cannot replace comprehensive forecasting due to their narrower scope and susceptibility to sudden changes.

How Bellwether Stocks Influence Market Trends

Bellwether stocks, representing leading companies in key industries, serve as critical indicators of overall market health and investor sentiment. Their performance often signals broader economic trends and can influence market forecasts by shaping expectations for sector growth and risk. Analysts closely monitor bellwether stocks to adjust portfolio strategies and predict shifts in market direction based on these influential companies' earnings and market movements.

Real-World Examples: Forecast vs. Bellwether

Forecast models use quantitative data and algorithms to predict future trends, such as weather forecasts relying on atmospheric data to anticipate storms. Bellwether indicators represent leading signals in markets or politics, like the stock performance of tech giants signaling broader economic trends. Real-world examples include election bellwethers such as Ohio predicting US presidential outcomes and forecast models in supply chain management optimizing inventory based on demand projections.

Choosing the Right Approach: Forecast or Bellwether?

Choosing between a forecast and a bellwether approach depends on the specific goals and available data of a project. Forecast methods use historical data and statistical models to predict future outcomes, ideal for long-term strategic planning and trend analysis. Bellwether approaches rely on leading indicators or key influencers to signal imminent changes, making them better suited for real-time decision-making and market sentiment monitoring.

Forecast Infographic

libterm.com

libterm.com