Appropriation involves adopting elements of one culture by another, often raising important questions about respect and authenticity. Understanding the historical context and power dynamics behind appropriation helps clarify when cultural exchange becomes exploitation. Explore the rest of the article to learn how to navigate appropriation thoughtfully and respectfully.

Table of Comparison

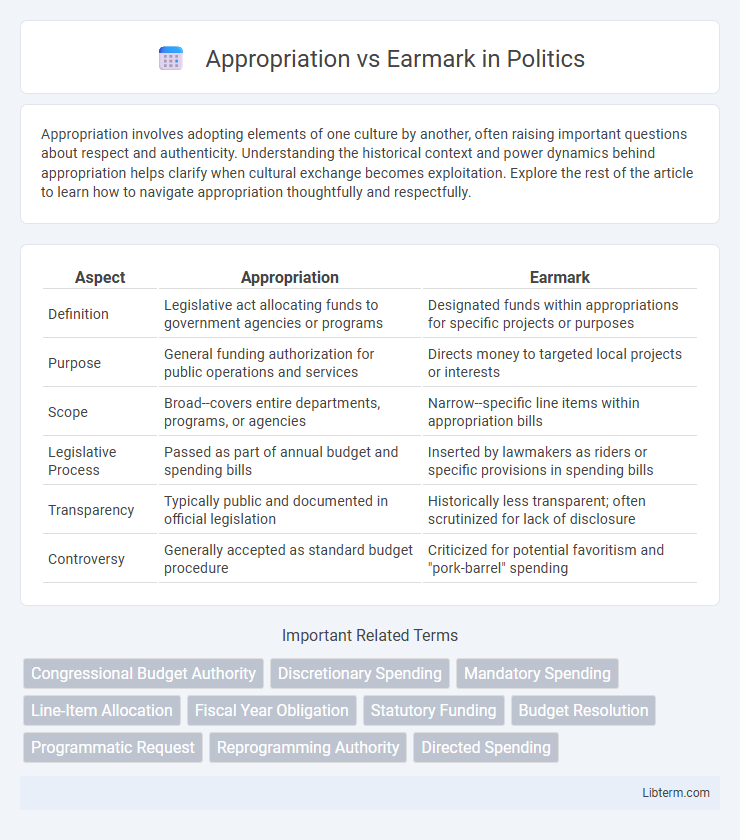

| Aspect | Appropriation | Earmark |

|---|---|---|

| Definition | Legislative act allocating funds to government agencies or programs | Designated funds within appropriations for specific projects or purposes |

| Purpose | General funding authorization for public operations and services | Directs money to targeted local projects or interests |

| Scope | Broad--covers entire departments, programs, or agencies | Narrow--specific line items within appropriation bills |

| Legislative Process | Passed as part of annual budget and spending bills | Inserted by lawmakers as riders or specific provisions in spending bills |

| Transparency | Typically public and documented in official legislation | Historically less transparent; often scrutinized for lack of disclosure |

| Controversy | Generally accepted as standard budget procedure | Criticized for potential favoritism and "pork-barrel" spending |

Introduction to Appropriation and Earmark

Appropriation refers to the legislative act of authorizing government spending for specific purposes, enabling federal agencies to allocate funds within established budget limits. Earmarks are provisions inserted into appropriations bills directing funds to particular projects, often benefiting individual congressional districts or interests. Understanding the distinction between appropriation, which provides general budget authority, and earmarks, which designate precise funding destinations, is critical in analyzing federal budget processes.

Defining Appropriation: Key Concepts

Appropriation refers to the legal authorization by a legislative body allowing government agencies to incur obligations and make payments from the treasury for specified purposes, forming the foundation of federal budget execution. It enables the allocation of funds to various departments, ensuring that expenditures align with legislative intent and fiscal policy. Understanding appropriation is essential for distinguishing it from earmarks, which are specific designations within appropriations directing funds to particular projects or entities.

Understanding Earmarks: An Overview

Earmarks refer to designated funds within a broader appropriations bill allocated for specific projects or purposes, often at the request of lawmakers to address local needs. Unlike general appropriations, earmarks ensure targeted spending without separate legislation, facilitating direct funding for infrastructure, education, or community programs. Understanding earmarks is essential for analyzing budget transparency, federal spending priorities, and the political process behind congressional allocations.

Historical Context of Appropriations and Earmarks

Appropriations have historically served as congressional legislation that allocates federal funds for government operations and programs, originating with the Constitution's requirement that no money be drawn from the Treasury without an appropriation made by law. Earmarks emerged prominently in the late 20th century as specific provisions inserted into appropriations bills, directing funds to particular projects often benefiting individual districts or states. The evolution of earmarks reflects debates over legislative transparency and fiscal control, with Congress periodically imposing moratoria to address concerns about spending accountability.

How Appropriations Work in Government

Government appropriations are legislative grants of money to fund specific federal agencies, programs, or activities, authorized through annual appropriations bills passed by Congress. These allocations determine how much funding each government entity receives to implement its operations, guided by budget resolutions and spending limits. Appropriations provide the legal authority for federal agencies to obligate and expend funds, ensuring accountability and adherence to fiscal policy.

The Role of Earmarks in Budgeting

Earmarks play a crucial role in budgeting by directing funds toward specific projects or purposes within broader appropriations, ensuring targeted allocation of government resources. Unlike general appropriations that provide overall funding authority, earmarks specify precise uses, helping legislators address constituent needs and expedite funding for local initiatives. This targeted approach enhances transparency and accountability by clearly linking fiscal resources to designated programs or expenditures.

Differences Between Appropriation and Earmark

Appropriation refers to the legislative act that allocates funds to government agencies and programs for specific purposes, forming part of the federal budget process. An earmark is a provision inserted into an appropriations bill that directs funds to a specific project, location, or recipient, often bypassing standard merit-based or competitive allocation methods. The primary difference lies in scope and specificity: appropriations authorize broad budget authority, while earmarks designate funds for targeted projects within those appropriations.

Impact on Public Policy and Spending

Appropriation determines the allocation of government funds, directly shaping public policy by enabling or restricting program implementation through budget authority. Earmarks influence spending priorities within appropriations by designating funds for specific projects, often benefiting targeted constituencies and affecting overall budget flexibility. The balance between appropriation and earmarks impacts fiscal discipline and the responsiveness of public policy to diverse stakeholder interests.

Controversies and Debates Surrounding Earmarks

Earmarks have sparked controversies due to concerns over transparency, potential for wasteful spending, and influence-peddling by lawmakers directing funds to favored projects without competitive review. Critics argue earmarks contribute to budget inflation and enable special interests to bypass standard legislative scrutiny, raising ethical questions about fairness and fiscal responsibility. Supporters claim earmarks facilitate targeted investments in local needs and enhance legislative compromise, yet debates continue over their role in government accountability and efficient public resource allocation.

Conclusion: Appropriations vs Earmarks—Key Takeaways

Appropriations involve the allocation of federal funds through legislation, granting agencies the authority to spend money, while earmarks specify funds directed to particular projects or recipients within appropriations bills. Understanding the distinction is essential for transparency and budget control, as appropriations set overall spending limits and earmarks influence the distribution of those funds. Clear differentiation helps policymakers balance broad funding priorities with targeted investments without compromising fiscal accountability.

Appropriation Infographic

libterm.com

libterm.com