Taxation plays a crucial role in funding public services and infrastructure, directly impacting economic stability and growth. Understanding tax regulations and compliance can help you optimize your financial planning and avoid penalties. Explore the rest of this article to learn how taxation affects your finances and the strategies you can use to manage it effectively.

Table of Comparison

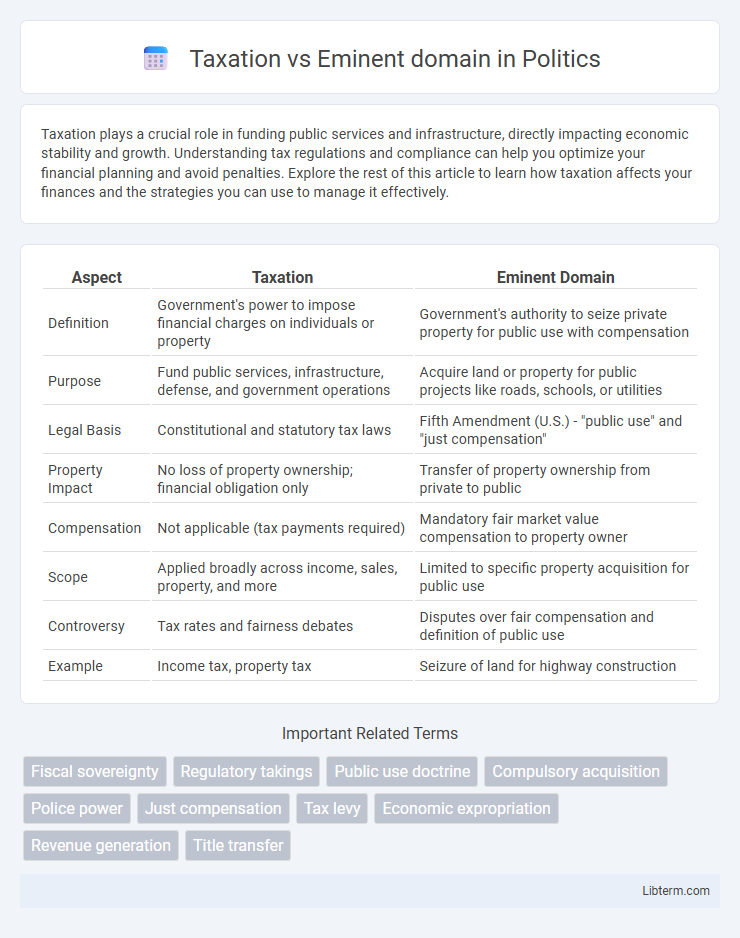

| Aspect | Taxation | Eminent Domain |

|---|---|---|

| Definition | Government's power to impose financial charges on individuals or property | Government's authority to seize private property for public use with compensation |

| Purpose | Fund public services, infrastructure, defense, and government operations | Acquire land or property for public projects like roads, schools, or utilities |

| Legal Basis | Constitutional and statutory tax laws | Fifth Amendment (U.S.) - "public use" and "just compensation" |

| Property Impact | No loss of property ownership; financial obligation only | Transfer of property ownership from private to public |

| Compensation | Not applicable (tax payments required) | Mandatory fair market value compensation to property owner |

| Scope | Applied broadly across income, sales, property, and more | Limited to specific property acquisition for public use |

| Controversy | Tax rates and fairness debates | Disputes over fair compensation and definition of public use |

| Example | Income tax, property tax | Seizure of land for highway construction |

Understanding Taxation: Definition and Purpose

Taxation is the legal process by which governments impose financial charges on individuals or entities to fund public services and infrastructure. It serves the purpose of reallocating resources to maintain government operations, promote economic stability, and ensure social equity. Unlike eminent domain, which involves the government's power to seize private property for public use, taxation does not transfer ownership but requires periodic payments based on income, property value, or transactions.

Exploring Eminent Domain: Key Concepts

Eminent domain refers to the government's power to seize private property for public use, with just compensation provided to the owner as mandated by the Fifth Amendment. This legal process involves valuation of the property to ensure fair market value compensation, distinguishing it from taxation which is a mandatory financial charge without property acquisition. Understanding eminent domain is crucial for property owners and public agencies, emphasizing legal rights, proper valuation methods, and the intended public benefits of infrastructure development or urban renewal projects.

Legal Foundations of Taxation and Eminent Domain

The legal foundations of taxation stem from the government's constitutional authority to impose levies for public revenue, grounded in statutes like the Sixteenth Amendment for income tax. Eminent domain derives its legal basis from the Fifth Amendment, which permits the government to seize private property for public use, provided just compensation is given. Both doctrines balance individual rights and public interests but operate under distinct constitutional provisions and procedural requirements.

Historical Evolution of Property Rights

The historical evolution of property rights reveals a complex balance between taxation and eminent domain as tools of governmental authority. Taxation originated as a means to fund public services through property value assessments, while eminent domain developed to allow governments to acquire private land for public use with just compensation. Over time, legal doctrines have refined these powers, ensuring property owners' rights are protected while enabling state interests in infrastructure and community development.

Taxation: Methods and Mechanisms

Taxation operates through various methods such as income tax, property tax, sales tax, and capital gains tax, each designed to generate revenue for government functionality and public services. Mechanisms include withholding taxes, estimated tax payments, and self-assessment systems that ensure compliance and efficient collection. Taxation impacts individuals and businesses differently based on rate structures, exemptions, and deductions embedded within legal frameworks.

Eminent Domain Process: Procedures and Limitations

The eminent domain process involves the government's legal authority to seize private property for public use, following strict procedural steps including a formal notice, appraisal, and an offer of just compensation to the property owner. Limitations on eminent domain ensure that property acquisition is necessary, serves a legitimate public purpose, and that owners receive fair market value, with judicial review available to challenge excessive compensation or procedural flaws. Taxation differs as a routine levy on property value without government ownership transfer, whereas eminent domain results in ownership change under regulated conditions.

Comparing Public Benefits: Tax Revenue vs Land Use

Taxation generates continuous public revenue that funds essential services such as education, healthcare, and infrastructure development, directly benefiting the community's economic and social welfare. Eminent domain provides land for critical public projects like highways, schools, and utilities, facilitating long-term urban planning and community growth through strategic land use. While taxation sustains government operations financially, eminent domain enables specific land acquisitions that support public infrastructure and development goals.

Controversies and Criticisms: Taxation vs Eminent Domain

Taxation faces criticism for disproportionate burdens on lower-income groups and perceived government overreach, sparking debates about fairness and efficiency in resource allocation. Eminent domain controversies arise from conflicts over property rights, with disputes centered on inadequate compensation and forced displacement fueling public outcry. Both practices generate legal challenges and ethical debates about balancing public interest with individual rights, highlighting ongoing tensions in governance.

Protecting Individual Rights: Legal Safeguards

Taxation and eminent domain both involve government authority but differ significantly in legal safeguards protecting individual rights. Taxation requires adherence to established laws ensuring fair assessment and due process before collection, whereas eminent domain mandates just compensation and due process when private property is taken for public use. Courts rigorously scrutinize eminent domain cases to prevent abuse, reinforcing protections against unlawful seizures and preserving constitutional rights.

Future Trends in Property and Government Authority

Future trends in property highlight increasing tensions between taxation policies and eminent domain use as governments seek innovative revenue streams and urban redevelopment projects. Emerging smart city initiatives and digital property records enhance transparency, potentially reshaping eminent domain applications while prompting calls for fairer taxation systems. Advances in AI-driven property valuation and blockchain technology signal a shift toward more precise tax assessments and socially responsible eminent domain practices.

Taxation Infographic

libterm.com

libterm.com