Deregulation involves the reduction or elimination of government rules and restrictions in various industries to promote competition and efficiency. This process can lead to lower prices, innovation, and increased consumer choice but may also pose risks such as reduced oversight and potential market instability. Discover how deregulation impacts your industry and what it means for the future by reading the rest of the article.

Table of Comparison

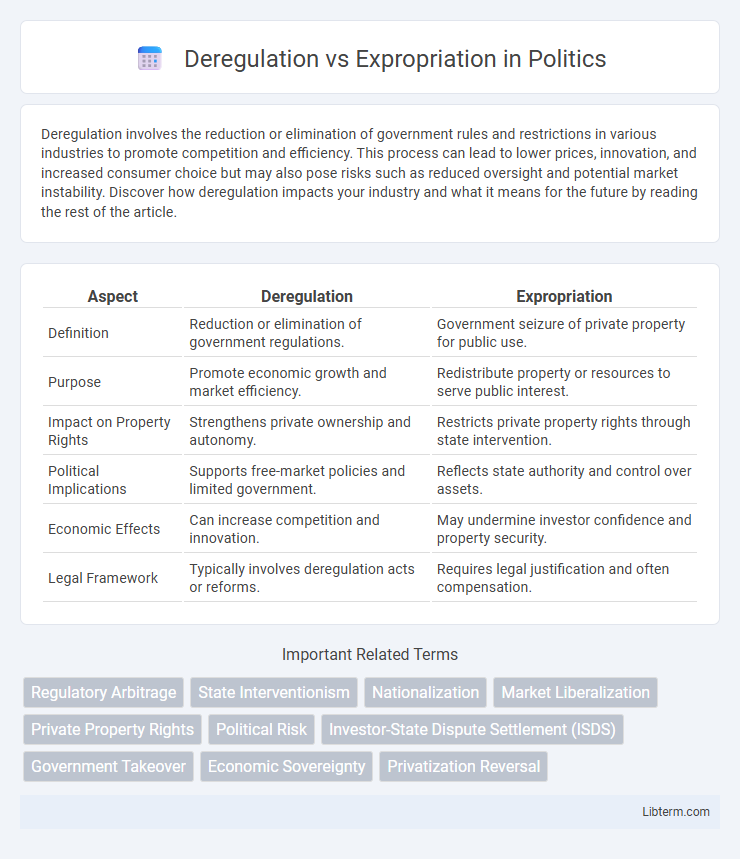

| Aspect | Deregulation | Expropriation |

|---|---|---|

| Definition | Reduction or elimination of government regulations. | Government seizure of private property for public use. |

| Purpose | Promote economic growth and market efficiency. | Redistribute property or resources to serve public interest. |

| Impact on Property Rights | Strengthens private ownership and autonomy. | Restricts private property rights through state intervention. |

| Political Implications | Supports free-market policies and limited government. | Reflects state authority and control over assets. |

| Economic Effects | Can increase competition and innovation. | May undermine investor confidence and property security. |

| Legal Framework | Typically involves deregulation acts or reforms. | Requires legal justification and often compensation. |

Understanding Deregulation: Definition and Scope

Deregulation refers to the process of reducing or eliminating government rules and restrictions in a specific industry to foster competition and enhance efficiency. It serves to remove barriers that inhibit market entry and innovation, impacting sectors such as telecommunications, energy, and transportation. Understanding deregulation involves recognizing its role in shifting control from public to private entities, thereby promoting economic growth and consumer choice.

What Is Expropriation? Key Concepts

Expropriation refers to the act by which a government takes private property for public use, often with compensation to the owner, although the fairness and adequacy of compensation can vary widely. Key concepts include eminent domain, where legal authority permits state ownership transfer, and indirect expropriation, involving measures that effectively deprive owners of property value without outright seizure. Understanding expropriation involves recognizing its impact on property rights, investor protections, and international investment law frameworks governing state actions.

Historical Background: Deregulation and Expropriation

Deregulation emerged prominently in the late 20th century as governments reduced state control over industries to enhance market efficiency and competition, particularly visible in the 1980s during the Reagan and Thatcher administrations. Expropriation, historically rooted in sovereign rights dating back to colonial and early post-colonial eras, involves the state seizing private property, often without fair compensation, driven by political or economic motives. These contrasting approaches reflect differing governmental philosophies toward property rights, economic intervention, and state versus market dominance throughout modern economic history.

Economic Impacts: Growth vs. Risk

Deregulation often stimulates economic growth by reducing barriers to entry and encouraging competition, which can lead to increased innovation and efficiency in markets. In contrast, expropriation introduces significant risks by undermining property rights and investor confidence, often resulting in capital flight and slowed economic development. The balance between deregulation fostering growth and expropriation imposing risk is critical for sustainable economic policy and investment climate stability.

Legal Frameworks Governing Both Approaches

Legal frameworks governing deregulation and expropriation vary significantly, with deregulation typically involving statutes that reduce government intervention to promote market freedom, while expropriation is strictly regulated under international and domestic laws to protect property rights and ensure just compensation. Deregulation policies are guided by regulatory agencies and legal provisions that streamline or eliminate rules hindering business operations, whereas expropriation laws are embedded in constitutional protections and bilateral investment treaties, balancing state sovereignty with investor rights. Courts and arbitration panels often play a critical role in interpreting these frameworks, ensuring compliance with legal standards and resolving disputes related to both deregulatory measures and expropriation claims.

Case Studies: Global Examples of Deregulation

Global examples of deregulation highlight significant economic impacts, as seen in the U.S. airline industry post-1978 Airline Deregulation Act, which increased competition and lowered fares. Similarly, the United Kingdom's financial sector deregulation in the 1980s, known as the "Big Bang," transformed London into a leading global financial hub by removing restrictive practices and promoting market liberalization. These case studies illustrate how deregulation can stimulate market efficiency and innovation compared to expropriation, which often results in economic instability and loss of investor confidence.

Case Studies: High-Profile Expropriations

High-profile expropriations such as Venezuela's 2007 nationalization of oil assets and Argentina's 2012 takeover of YPF highlight the drastic economic and legal consequences for foreign investors. These cases reveal how expropriation often leads to prolonged international arbitration, as seen in the disputes involving Chevron and Repsol. Deregulation contrasts sharply by promoting market entry and competition through reducing government controls, avoiding the contentious outcomes associated with expropriation.

Investor Confidence: Comparing Effects

Deregulation enhances investor confidence by reducing governmental intervention, creating a more predictable and competitive market environment conducive to investment. Expropriation, on the other hand, significantly undermines investor trust due to the risk of asset seizure without fair compensation, deterring foreign and domestic capital inflows. Empirical studies reveal that countries with frequent expropriation events experience higher capital flight and lower levels of foreign direct investment compared to those with stable deregulated economies.

Social Consequences: Public Welfare and Policy

Deregulation often aims to increase market efficiency and competition but can lead to reduced public oversight, potentially compromising social safety nets and public welfare programs. Expropriation involves the compulsory acquisition of private property by the government, which may disrupt individual livelihoods but can fund public goods and infrastructure development critical for social welfare. Both policies significantly shape public welfare outcomes by balancing government intervention and market freedom in policy frameworks affecting health, education, and social equity.

Key Takeaways: Choosing Between Deregulation and Expropriation

Choosing between deregulation and expropriation hinges on balancing economic growth and property rights protection. Deregulation promotes market efficiency by reducing government intervention, encouraging investment and innovation, while expropriation involves government seizure of private assets, often leading to legal disputes and investor uncertainty. Key takeaways emphasize that deregulation fosters a stable business environment, whereas expropriation can deter foreign direct investment due to heightened political risk.

Deregulation Infographic

libterm.com

libterm.com