Consumption taxation is a fiscal policy tool used by governments to generate revenue by taxing the purchase of goods and services. It influences consumer behavior and economic activity by altering the cost of consumption, affecting spending patterns and saving rates. Explore the rest of this article to understand how consumption taxes impact your financial decisions and the broader economy.

Table of Comparison

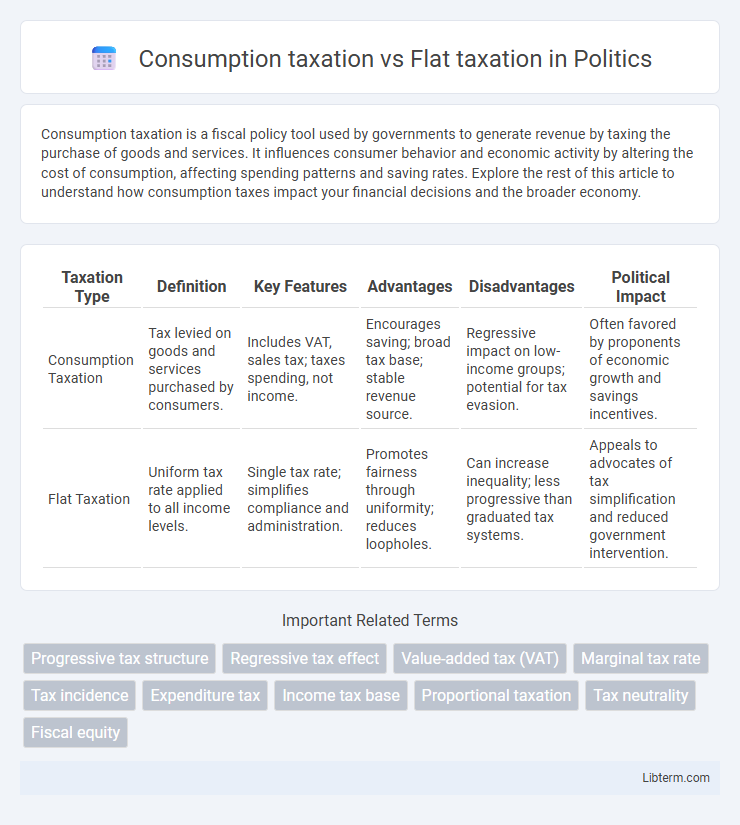

| Taxation Type | Definition | Key Features | Advantages | Disadvantages | Political Impact |

|---|---|---|---|---|---|

| Consumption Taxation | Tax levied on goods and services purchased by consumers. | Includes VAT, sales tax; taxes spending, not income. | Encourages saving; broad tax base; stable revenue source. | Regressive impact on low-income groups; potential for tax evasion. | Often favored by proponents of economic growth and savings incentives. |

| Flat Taxation | Uniform tax rate applied to all income levels. | Single tax rate; simplifies compliance and administration. | Promotes fairness through uniformity; reduces loopholes. | Can increase inequality; less progressive than graduated tax systems. | Appeals to advocates of tax simplification and reduced government intervention. |

Introduction to Taxation Systems

Consumption taxation, exemplified by value-added tax (VAT) and sales tax, targets spending behavior and encourages saving by taxing goods and services at the point of purchase. Flat taxation imposes a uniform income tax rate regardless of earnings, simplifying the tax code and promoting transparency but potentially affecting income inequality. Both systems represent fundamental approaches in taxation policies, influencing economic behavior, revenue generation, and distributional equity.

Defining Consumption Taxation

Consumption taxation is a system where taxes are levied on goods and services at the point of purchase, emphasizing spending rather than income. This model includes value-added tax (VAT) and sales tax, which target consumer expenditures and promote savings by excluding income saved or invested from taxation. Compared to flat taxation, which applies a uniform income tax rate regardless of spending, consumption taxation incentivizes economic growth by encouraging investment and deferred consumption.

Understanding Flat Taxation

Flat taxation imposes a uniform tax rate on all income levels, simplifying compliance and administration while aiming to promote economic growth by eliminating progressive tax brackets. This system contrasts with consumption taxation, which taxes goods and services rather than income, potentially encouraging saving over spending. Understanding flat taxation involves recognizing its emphasis on equity through equal rates, though it may face criticism for its impact on lower-income earners who pay the same percentage as higher earners.

Key Differences Between Consumption and Flat Taxation

Consumption taxation applies taxes on spending, such as sales tax or value-added tax, targeting final goods and services purchased by consumers. Flat taxation impos a single constant tax rate on individual or corporate income, regardless of earnings level, promoting simplicity but potentially affecting income distribution. The key difference lies in the tax base: consumption taxes focus on expenditure while flat taxes focus on income, influencing economic behavior and revenue predictability.

Economic Impact of Consumption Taxes

Consumption taxes, such as sales tax and value-added tax (VAT), influence consumer behavior by incentivizing savings and investment through taxing spending rather than income. These taxes tend to be more stable revenue sources during economic fluctuations, as consumption patterns are less volatile than income levels, providing governments with predictable funding. However, consumption taxes can disproportionately affect lower-income households, potentially reducing overall economic equity if not paired with targeted rebates or exemptions.

Economic Impact of Flat Taxes

Flat taxation systems apply a single tax rate to all income levels, simplifying tax compliance and potentially boosting economic growth by eliminating progressive rate structures that can discourage investment. Empirical studies show flat taxes can increase labor supply and savings rates, fostering higher economic output and productivity. However, the reduced progressivity may lead to concerns about income inequality and reduced government revenue for social programs.

Social Equity and Fairness Considerations

Consumption taxation, such as sales tax or value-added tax (VAT), tends to be regressive, disproportionately impacting lower-income households who spend a larger share of their income on taxed goods and services, thereby raising concerns about social equity and fairness. Flat taxation, with a uniform tax rate on income regardless of level, simplifies tax administration but may inadequately address income inequality, as it does not provide progressive relief for lower-income earners. Policymakers often debate balancing efficiency and fairness, considering that consumption taxes may require targeted rebates or exemptions to mitigate burdens on vulnerable populations while flat taxes prioritize simplicity over redistributive goals.

Administrative Efficiency and Compliance

Consumption taxation generally offers higher administrative efficiency due to its straightforward point-of-sale collection, reducing filing complexities compared to flat taxation systems that require individual income reporting and reconciliation. Compliance rates tend to be higher under consumption taxes as taxpayers have less opportunity for evasion, whereas flat taxes, despite their simplicity, can face challenges with accurate income declaration and enforcement. Studies indicate that consumption taxes lower administrative costs and improve revenue predictability compared to flat taxes.

Global Examples and Case Studies

Consumption taxation systems like VAT in European countries such as France and Germany efficiently generate government revenue by taxing spending rather than income, encouraging savings and investment. Flat taxation models, exemplified by Estonia and Russia, apply a single income tax rate across all brackets, simplifying compliance and attracting foreign investment while raising concerns over income inequality. Case studies reveal that consumption taxes tend to be more stable during economic fluctuations, whereas flat taxes contribute to economic growth in transition economies but often require robust social safety nets to address equity issues.

Future Trends in Taxation Systems

Future trends in taxation systems indicate a shift towards consumption taxation due to its potential for promoting savings and investment, as well as reducing tax evasion compared to flat taxation models. Economies like those in OECD countries are increasingly experimenting with value-added tax (VAT) reforms and digital transaction taxes to capture revenue from expanding e-commerce markets. Advances in data analytics and blockchain technology are enabling more efficient and transparent consumption tax collection, signaling a gradual move away from the simplicity but limited equity of flat income taxes.

Consumption taxation Infographic

libterm.com

libterm.com