Regressive taxation disproportionately impacts lower-income individuals by imposing a higher relative tax burden on them compared to wealthier taxpayers. This system can exacerbate income inequality and reduce overall economic fairness. Discover how regressive taxes affect Your finances and the broader economy by reading the rest of the article.

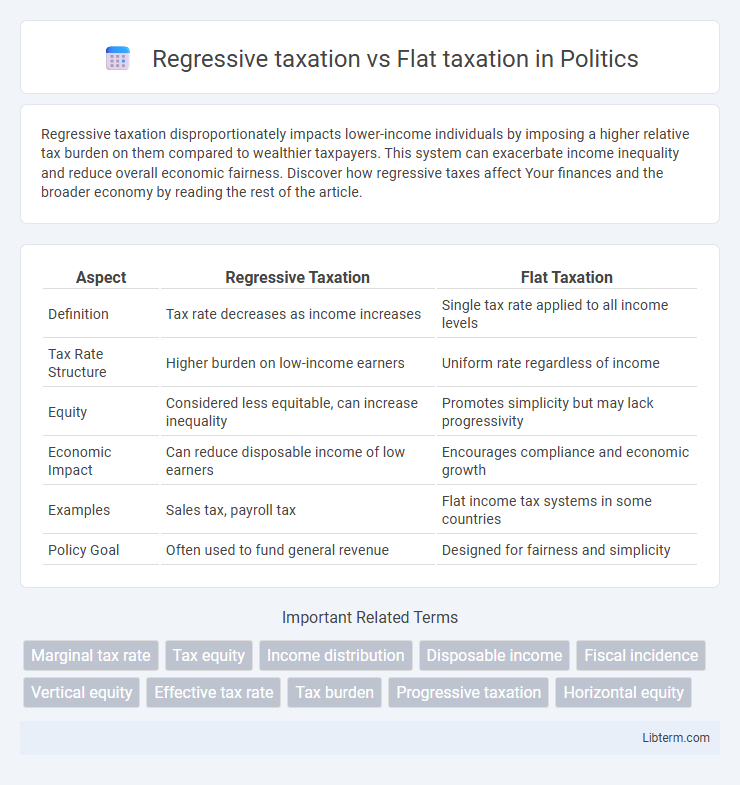

Table of Comparison

| Aspect | Regressive Taxation | Flat Taxation |

|---|---|---|

| Definition | Tax rate decreases as income increases | Single tax rate applied to all income levels |

| Tax Rate Structure | Higher burden on low-income earners | Uniform rate regardless of income |

| Equity | Considered less equitable, can increase inequality | Promotes simplicity but may lack progressivity |

| Economic Impact | Can reduce disposable income of low earners | Encourages compliance and economic growth |

| Examples | Sales tax, payroll tax | Flat income tax systems in some countries |

| Policy Goal | Often used to fund general revenue | Designed for fairness and simplicity |

Understanding Regressive Taxation: Definition and Examples

Regressive taxation imposes a higher relative tax burden on low-income individuals compared to high-income earners, typically through fixed-rate taxes such as sales taxes or excise taxes on goods. This system results in a larger percentage of income being taken from those with lower earnings, exemplified by taxes on essential items like gasoline, tobacco, and groceries. Understanding regressive taxation is crucial for evaluating its impact on economic equity and the financial strain it places on vulnerable populations.

What is Flat Taxation? Core Principles Explained

Flat taxation is a tax system where a single constant rate is applied to all levels of income, eliminating brackets or variations. Its core principles emphasize simplicity, transparency, and efficiency, aiming to reduce administrative costs and encourage economic growth. By taxing income uniformly, flat taxation seeks to create a straightforward and predictable fiscal environment for taxpayers and governments alike.

Key Differences Between Regressive and Flat Taxes

Regressive taxation imposes a higher relative burden on lower-income individuals by taxing a larger percentage of their income compared to high earners, whereas flat taxation applies a uniform tax rate to all taxpayers irrespective of income levels. In regressive tax systems, essential goods and services often carry higher tax rates, disproportionately affecting those with limited financial resources. Flat taxes promote simplicity and predictability in tax collection, but they may lack the equity considerations inherent in regressive tax structures.

Economic Impacts: Flat vs Regressive Taxation

Flat taxation imposes a uniform tax rate on all income levels, promoting simplicity and potentially encouraging economic growth by providing consistent incentives for productivity and investment. Regressive taxation, where lower-income individuals pay a higher percentage of their income compared to wealthier individuals, can exacerbate income inequality and reduce overall consumer spending, hindering economic demand. Economic impacts of flat versus regressive tax systems largely depend on their influence on income distribution, consumption patterns, and incentives for labor and capital investment.

Effects on Income Inequality and Social Equity

Regressive taxation disproportionately impacts lower-income individuals by taking a larger percentage of their earnings, which exacerbates income inequality and undermines social equity. Flat taxation applies a uniform tax rate across all income levels, potentially reducing administrative complexity but often failing to address disparities in wealth distribution. Implementing progressive tax measures alongside or instead of flat taxes can better promote social equity by increasing the tax burden on higher earners and funding public services benefiting lower-income groups.

Administrative Simplicity: Flat vs Regressive Tax Systems

Flat taxation systems offer greater administrative simplicity due to a uniform tax rate applied to all income levels, reducing the complexity of calculations and compliance requirements. Regressive tax systems involve varying rates that increase administrative burdens by necessitating detailed income assessments and adjustments to tax liabilities. This simplicity in flat tax systems often leads to lower enforcement costs and streamlined tax collection processes.

Global Examples: Countries Using Regressive or Flat Tax Models

Countries like Russia and Ukraine implement flat tax systems, applying a uniform tax rate on individual income regardless of earnings to simplify tax administration and encourage compliance. In contrast, regressive tax models are evident in indirect taxes such as sales taxes in the United States and value-added taxes in certain developing countries, where lower-income groups spend a higher proportion of their income, bearing a heavier tax burden. These global examples highlight the diversity in tax structures, reflecting varying fiscal policies aimed at balancing equity and revenue efficiency.

Arguments for and Against Regressive Taxation

Regressive taxation imposes a higher relative burden on lower-income individuals, reducing their disposable income and potentially increasing economic inequality. Proponents argue it can simplify tax administration and encourage investment by taxing consumption rather than income. Critics highlight that regressive taxes, such as sales taxes, disproportionately impact the poor and can exacerbate social disparities.

Arguments for and Against Flat Taxation

Flat taxation offers simplicity and transparency by applying a single tax rate to all income levels, potentially improving compliance and reducing administrative costs. Critics argue it disproportionately benefits higher-income earners by reducing their tax burden relative to lower-income individuals, potentially increasing income inequality. Supporters claim it encourages economic growth and investment by providing predictable tax liabilities, while opponents highlight concerns about fairness and reduced revenue for social programs.

Policy Considerations: Choosing the Right Tax System

Regressive taxation places a higher relative burden on lower-income earners, potentially increasing income inequality, while flat taxation applies a uniform rate that simplifies compliance and administration but may overlook equity concerns. Policymakers must weigh economic efficiency, fairness, administrative costs, and social impact when selecting between regressive and flat tax systems. The ideal tax policy balances revenue generation with minimizing adverse effects on vulnerable populations and promoting sustainable economic growth.

Regressive taxation Infographic

libterm.com

libterm.com