Flat taxation applies a single, uniform tax rate to all income levels, simplifying the tax code and eliminating complex brackets. This system promotes transparency and efficiency by making it easier for individuals and businesses to understand their tax obligations. Explore the rest of the article to learn how flat taxation could impact your financial planning and the broader economy.

Table of Comparison

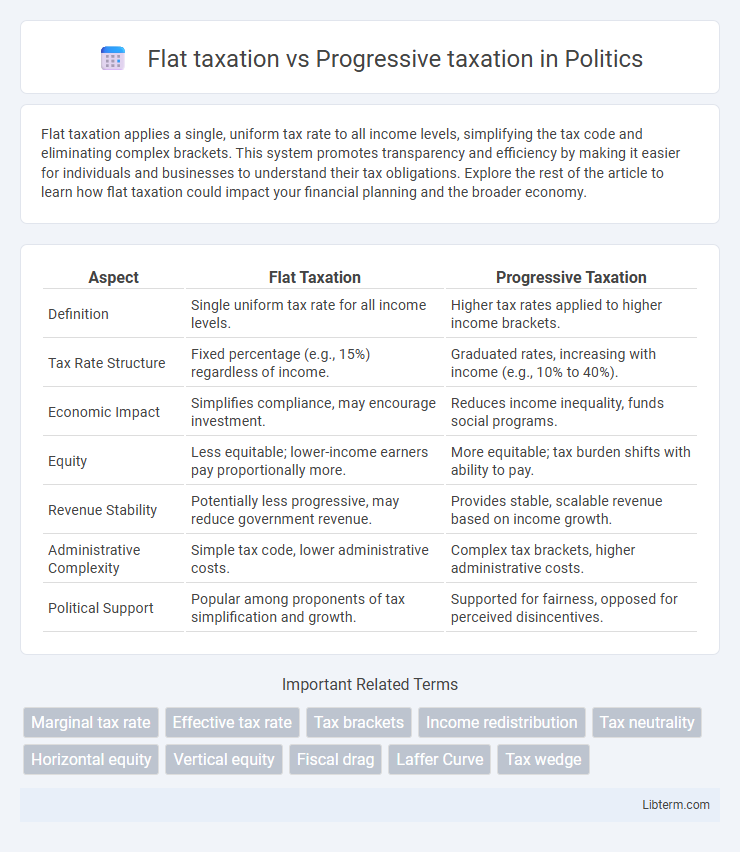

| Aspect | Flat Taxation | Progressive Taxation |

|---|---|---|

| Definition | Single uniform tax rate for all income levels. | Higher tax rates applied to higher income brackets. |

| Tax Rate Structure | Fixed percentage (e.g., 15%) regardless of income. | Graduated rates, increasing with income (e.g., 10% to 40%). |

| Economic Impact | Simplifies compliance, may encourage investment. | Reduces income inequality, funds social programs. |

| Equity | Less equitable; lower-income earners pay proportionally more. | More equitable; tax burden shifts with ability to pay. |

| Revenue Stability | Potentially less progressive, may reduce government revenue. | Provides stable, scalable revenue based on income growth. |

| Administrative Complexity | Simple tax code, lower administrative costs. | Complex tax brackets, higher administrative costs. |

| Political Support | Popular among proponents of tax simplification and growth. | Supported for fairness, opposed for perceived disincentives. |

Introduction to Taxation Systems

Flat taxation imposes a uniform tax rate on all income levels, simplifying tax calculations and ensuring transparency. Progressive taxation applies increasing tax rates as income rises, aiming to reduce income inequality by taxing higher earners more heavily. Understanding these basic structures is essential for evaluating their economic impacts and social fairness in fiscal policy.

Defining Flat Taxation

Flat taxation imposes a single constant tax rate on all levels of income, eliminating the complexity of multiple tax brackets. This system simplifies tax calculations and reduces administrative costs by applying the same percentage to every taxpayer. Countries like Estonia and Hong Kong utilize flat tax models to promote economic efficiency and transparency.

Understanding Progressive Taxation

Progressive taxation imposes higher tax rates on individuals with greater income, ensuring those who earn more contribute a larger share to government revenues. This system aims to reduce income inequality by taxing wealthy taxpayers at increasing rates while providing relief to lower-income earners through lower brackets. Economic studies suggest progressive tax structures can support social welfare programs and redistribute wealth more effectively than flat taxation models.

Historical Context of Tax Policies

Flat taxation first emerged in the early 20th century with countries like Russia implementing a uniform tax rate to simplify tax codes and encourage compliance. Progressive taxation, rooted in the 19th-century industrial era, aimed to address income inequality by levying higher rates on wealthier individuals, inspired by principles of social justice and government revenue needs. Historical shifts in economic theories and political ideologies have continuously influenced the adoption and adjustment of these tax policies worldwide.

Economic Impact of Flat vs Progressive Taxation

Flat taxation promotes simplicity and can stimulate investment by offering a uniform tax rate, potentially enhancing economic growth and efficiency. Progressive taxation redistributes wealth more effectively, reducing income inequality and funding social services, which can support broader economic stability and consumer spending. Studies indicate that while flat taxes may boost short-term economic activity, progressive systems tend to foster long-term socioeconomic balance and resilience.

Tax Fairness and Social Equity

Flat taxation applies a uniform tax rate to all income levels, which can simplify the tax system but may disproportionately burden low-income earners, raising concerns about tax fairness. Progressive taxation levies higher rates on higher income brackets, aiming to reduce income inequality and promote social equity by redistributing wealth more effectively. Empirical studies often show that progressive tax systems better support social equity by funding public services and social programs that benefit lower-income populations.

Administrative Simplicity and Compliance

Flat taxation offers administrative simplicity through a single uniform tax rate, reducing complexities in tax calculation and easing compliance for both taxpayers and authorities. Progressive taxation, while promoting equity, requires multiple tax brackets and variable rates, increasing administrative burdens and the potential for errors in filing. Simplified flat tax systems often result in higher compliance rates due to clarity, whereas progressive systems demand more extensive record-keeping and auditing efforts.

Effects on Income Inequality

Flat taxation applies a uniform tax rate to all income levels, often resulting in lower tax burdens for high earners and potentially exacerbating income inequality. Progressive taxation imposes higher rates on higher income brackets, which can reduce income disparities by redistributing wealth more effectively. Studies show progressive tax systems tend to decrease the Gini coefficient, indicating a more equitable income distribution compared to flat tax regimes.

Case Studies: Countries Implementing Both Systems

Estonia exemplifies flat taxation with its 20% income tax rate, promoting simplicity and boosting economic growth through increased investment incentives. In contrast, Sweden applies a progressive tax system with rates reaching up to 57%, funding extensive social welfare programs that contribute to high living standards. Both models demonstrate distinct impacts on income distribution and economic behavior, highlighting the trade-offs between tax equity and efficiency.

Future Trends in Taxation Policy

Future trends in taxation policy indicate a growing interest in hybrid tax systems that combine flat and progressive elements to balance simplicity with equity. Increasingly, governments employ data analytics and AI-driven models to tailor tax rates reflecting economic inequality and revenue needs while minimizing compliance costs. Digital economy taxation, environmental levies, and automated enforcement mechanisms are shaping the evolution of both flat and progressive tax frameworks globally.

Flat taxation Infographic

libterm.com

libterm.com