Ushr is an Islamic agricultural tax levied at a fixed rate on the produce of land, traditionally one-tenth or one-twentieth depending on the method of irrigation. This form of zakat supports community welfare and helps sustain local economies by redistributing wealth among those in need. Explore the rest of the article to understand how ushr impacts your financial responsibilities and the welfare system.

Table of Comparison

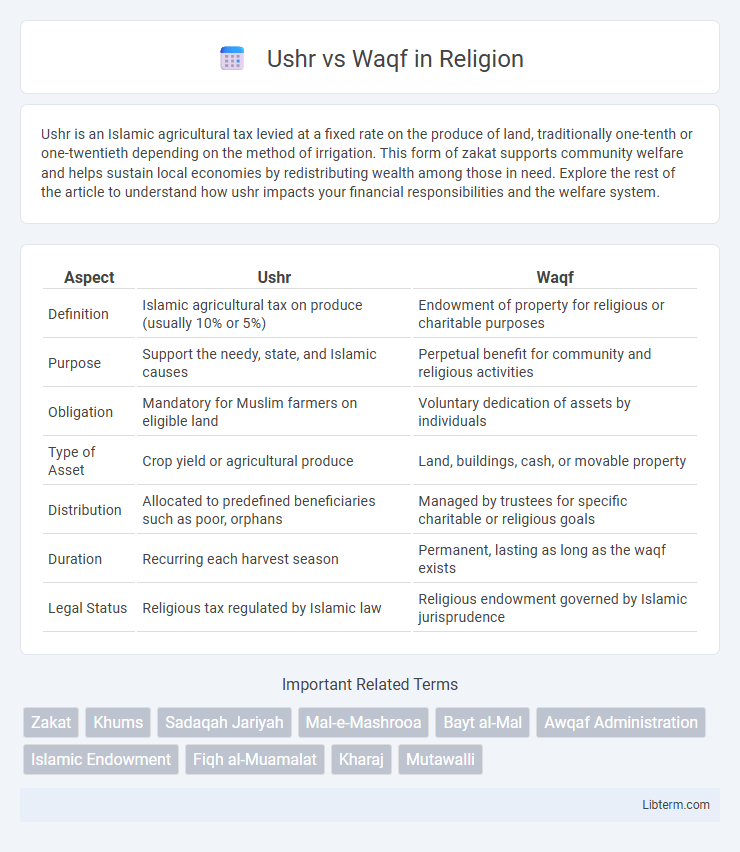

| Aspect | Ushr | Waqf |

|---|---|---|

| Definition | Islamic agricultural tax on produce (usually 10% or 5%) | Endowment of property for religious or charitable purposes |

| Purpose | Support the needy, state, and Islamic causes | Perpetual benefit for community and religious activities |

| Obligation | Mandatory for Muslim farmers on eligible land | Voluntary dedication of assets by individuals |

| Type of Asset | Crop yield or agricultural produce | Land, buildings, cash, or movable property |

| Distribution | Allocated to predefined beneficiaries such as poor, orphans | Managed by trustees for specific charitable or religious goals |

| Duration | Recurring each harvest season | Permanent, lasting as long as the waqf exists |

| Legal Status | Religious tax regulated by Islamic law | Religious endowment governed by Islamic jurisprudence |

Introduction to Ushr and Waqf

Ushr is an Islamic agricultural tax levied at a fixed rate, typically 10% or 5%, on produce from land owned by Muslims, aimed at wealth redistribution and supporting public welfare. Waqf refers to a voluntary endowment of property or assets dedicated to religious, educational, or charitable purposes, often managed by trustees to benefit the community perpetually. Both Ushr and Waqf play vital roles in Islamic finance by promoting social justice and economic sustainability within Muslim societies.

Defining Ushr: Meaning and Historical Roots

Ushr is an Islamic agricultural tax, historically set at one-tenth or one-twentieth of produce, rooted in Quranic injunctions to support the welfare of the Muslim community. It serves as a form of obligatory almsgiving tied directly to land cultivation and productivity, contrasting with waqf, which represents an endowment or charitable trust dedicated to long-term community benefits. Ushr's significance lies in its role as both a fiscal and spiritual duty, reinforcing social equity through redistribution of agricultural wealth.

Understanding Waqf: Concept and Development

Waqf is an Islamic endowment involving the donation of assets for religious or charitable purposes, which are preserved in perpetuity to benefit the community. Unlike Ushr, which is a form of agricultural tax, Waqf represents a long-term social welfare mechanism supporting education, healthcare, and public infrastructure through the income generated by endowed properties. Its development has played a crucial role in sustaining Islamic philanthropy and socio-economic stability across Muslim societies.

Key Differences Between Ushr and Waqf

Ushr is a mandatory Islamic tax on agricultural produce, typically set at 10% or 5% depending on irrigation method, collected annually to support public welfare. Waqf, on the other hand, is a voluntary, perpetual endowment of property or assets dedicated for charitable purposes, such as education, healthcare, or religious activities, managed by a trustee. The key difference lies in Ushr being a fixed obligatory levy for redistribution, whereas Waqf represents long-term, self-sustaining philanthropy aimed at ensuring ongoing community benefit.

Purposes and Objectives: Ushr vs Waqf

Ushr serves as an agricultural tax aimed at distributing wealth equitably by supporting the poor and needy, while waqf represents a charitable endowment designed to sustain community welfare projects such as schools, mosques, and hospitals. Ushr primarily focuses on social justice through wealth redistribution in agrarian economies, whereas waqf emphasizes long-term public benefit by funding and maintaining communal infrastructure. Both institutions operate within Islamic law but target distinct socioeconomic objectives to enhance societal well-being.

Legal Frameworks Governing Ushr and Waqf

The legal frameworks governing Ushr and Waqf are distinctly outlined within Islamic jurisprudence, where Ushr is regulated as a mandatory agricultural tax, typically fixed at 10% of produce from irrigated land, grounded in Sharia principles and often codified in national tax laws. Waqf involves endowment laws that ensure the preservation and dedicated use of donated property, governed by waqf-specific statutes which oversee administration, beneficiary rights, and asset perpetuity under Islamic charitable trust frameworks. Both frameworks are reinforced by contemporary legal systems in many Muslim-majority countries, integrating religious guidelines with statutory enforcement to maintain compliance, asset management, and socio-economic objectives.

Collection and Distribution Mechanisms

Ushr is a fixed agricultural tax collected at a rate of 10% on irrigated land produce and 5% on rain-fed crops, typically harvested annually by state-appointed tax collectors who then redistribute funds primarily to support specific charity categories like the poor and needy. Waqf involves the voluntary dedication of property or assets by an individual, managed by a mutawalli (trustee) to generate ongoing revenue, which is then distributed according to the donor's stipulations, often funding educational, religious, or social welfare institutions. The Ushr system emphasizes a standardized tax collection linked to agricultural output, whereas Waqf relies on private endowments with autonomous management focused on sustainable asset utilization for community benefits.

Socio-Economic Impact of Ushr and Waqf

Ushr serves as an Islamic agricultural tax that redistributes wealth by taxing produce, directly supporting poor farmers and fostering rural economic stability. Waqf, an endowment system, generates continuous socio-economic benefits through funding public goods like education, healthcare, and infrastructure, promoting long-term community development. Both mechanisms are pivotal in reducing poverty and enhancing social welfare by mobilizing resources within Islamic economic frameworks.

Contemporary Challenges and Reforms

The contemporary challenges surrounding Ushr and Waqf include issues of mismanagement, lack of transparency, and outdated legal frameworks that hinder their effective utilization in economic development. Reform efforts focus on modernizing regulatory policies, enhancing accountability mechanisms, and leveraging technology to improve collection, distribution, and monitoring processes. These reforms aim to revitalize Ushr and Waqf as sustainable financial instruments for poverty alleviation and social welfare in Muslim communities.

Conclusion: The Role of Ushr and Waqf in Modern Society

Ushr serves as a vital mechanism for wealth redistribution through agricultural taxation, promoting economic justice in Muslim communities, while Waqf functions as a sustainable endowment system supporting social welfare, education, and infrastructure development. Combined, Ushr and Waqf address contemporary challenges by fostering social equity and funding public goods, reinforcing community resilience and economic stability. Modern applications of both institutions highlight their adaptability and significance in enhancing socio-economic welfare within Islamic frameworks.

Ushr Infographic

libterm.com

libterm.com