Zakat is a fundamental pillar of Islam, requiring Muslims to donate a fixed portion of their wealth to those in need, promoting social equity and spiritual growth. Understanding the rules and calculation methods ensures you fulfill this obligation correctly and maximize its benefits. Explore this article to learn how zakat can impact your community and personal faith journey.

Table of Comparison

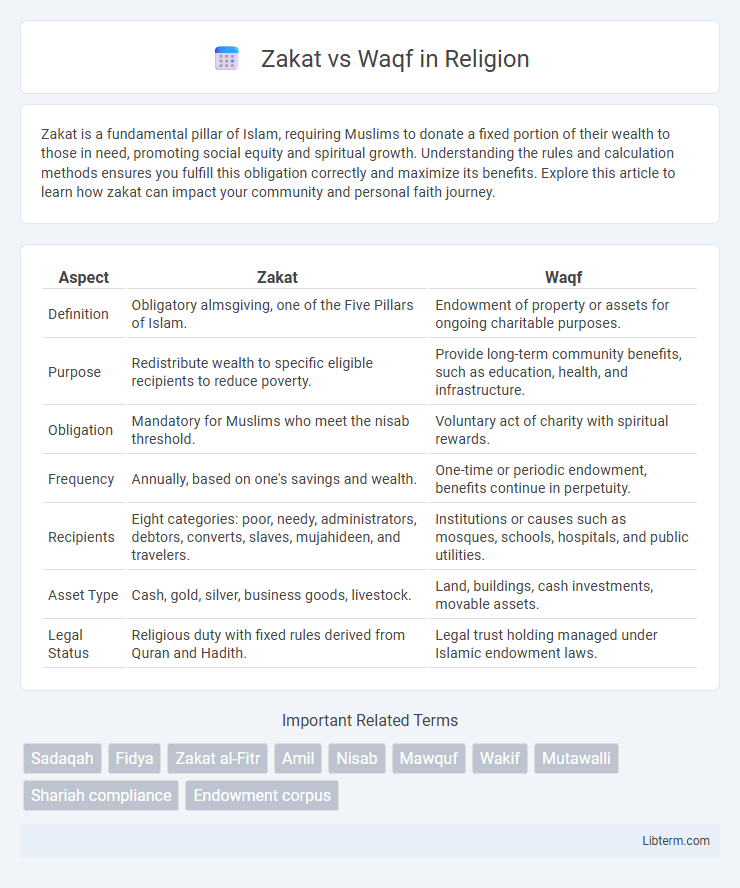

| Aspect | Zakat | Waqf |

|---|---|---|

| Definition | Obligatory almsgiving, one of the Five Pillars of Islam. | Endowment of property or assets for ongoing charitable purposes. |

| Purpose | Redistribute wealth to specific eligible recipients to reduce poverty. | Provide long-term community benefits, such as education, health, and infrastructure. |

| Obligation | Mandatory for Muslims who meet the nisab threshold. | Voluntary act of charity with spiritual rewards. |

| Frequency | Annually, based on one's savings and wealth. | One-time or periodic endowment, benefits continue in perpetuity. |

| Recipients | Eight categories: poor, needy, administrators, debtors, converts, slaves, mujahideen, and travelers. | Institutions or causes such as mosques, schools, hospitals, and public utilities. |

| Asset Type | Cash, gold, silver, business goods, livestock. | Land, buildings, cash investments, movable assets. |

| Legal Status | Religious duty with fixed rules derived from Quran and Hadith. | Legal trust holding managed under Islamic endowment laws. |

Introduction: Understanding Zakat and Waqf

Zakat is an obligatory Islamic almsgiving, calculated as a fixed percentage of a Muslim's qualifying wealth, primarily aimed at helping the poor and needy. Waqf refers to a voluntary, charitable endowment whereby assets or property are dedicated for religious, educational, or social welfare purposes in perpetuity. Both Zakat and Waqf are essential pillars of Islamic philanthropy, but while Zakat functions as a mandatory annual donation, Waqf serves as a long-term, sustainable investment in community development.

Defining Zakat: Concepts and Principles

Zakat is an obligatory form of almsgiving in Islam, mandated to purify wealth and support those in need, calculated as a fixed percentage, typically 2.5%, of a Muslim's qualifying assets annually. It is based on principles of social justice, wealth redistribution, and spiritual growth, ensuring the economic balance by assisting specific categories of recipients outlined in the Quran. Unlike voluntary charity, zakat is a mandatory pillar of Islam, emphasizing accountability and communal responsibility within the Muslim community.

Defining Waqf: Concepts and Principles

Waqf is an Islamic endowment granting a movable or immovable asset for religious or charitable purposes, perpetually benefiting the community without ownership transfer. Unlike Zakat, which is an obligatory almsgiving based on wealth purification and redistribution, Waqf functions as a long-term social welfare institution supporting education, healthcare, and infrastructure. The fundamental principle of Waqf emphasizes permanence (sadaqah jariyah), ensuring sustained public utility and economic development through preserved donated assets.

Historical Development of Zakat and Waqf

Zakat, established during the Prophetic era in the 7th century, serves as an obligatory almsgiving mechanism within Islamic finance, institutionalized to redistribute wealth and support social welfare. Waqf originated in the early Islamic centuries, evolving as a philanthropic endowment system that dedicates property or assets for religious, educational, or charitable purposes, ensuring perpetual community benefit. Both Zakat and Waqf have historically contributed to socio-economic development, with Zakat providing direct financial support to eligible recipients and Waqf fostering sustainable infrastructure and services.

Key Differences Between Zakat and Waqf

Zakat is an obligatory form of almsgiving in Islam, calculated as a fixed percentage (usually 2.5%) of a Muslim's accumulated wealth annually and distributed directly to specific eligible categories such as the poor, needy, and debt-ridden. Waqf refers to a voluntary, permanent endowment of property or assets dedicated for charitable purposes, where the principal remains intact, and the benefits or revenue generated support causes like education, healthcare, or religious institutions. The key difference lies in Zakat's mandatory nature with immediate distribution to beneficiaries versus Waqf's perpetual charitable investment aimed at generating long-term societal benefits.

Purposes and Objectives of Zakat

Zakat serves as an obligatory form of almsgiving in Islam aimed at redistributing wealth to support the poor, needy, and vulnerable groups, thereby promoting social equity and economic justice. It functions to purify a person's wealth and soul while fostering community solidarity by funding essential needs such as food, shelter, education, and healthcare. In contrast, Waqf is a voluntary endowment primarily established to provide long-term, sustainable benefits to the community, often through infrastructure, religious institutions, or educational facilities.

Purposes and Objectives of Waqf

Waqf serves as a long-term endowment aimed at generating continuous social, educational, and charitable benefits by dedicating property or assets for public welfare. Unlike Zakat, which functions as an obligatory almsgiving to provide immediate financial assistance to those in need, Waqf focuses on sustained community development through institutions like schools, hospitals, and mosques. The primary objective of Waqf is to create ongoing revenue streams that support various philanthropic activities, ensuring lasting impact and economic empowerment within society.

Methods of Implementation: Zakat vs Waqf

Zakat is implemented through compulsory annual almsgiving calculated based on specific assets and distributed directly to eligible recipients, as defined by Islamic law. Waqf involves the establishment of a permanent endowment, typically in the form of property or financial assets, managed by trustees to generate ongoing public welfare benefits. While Zakat emphasizes immediate financial support, Waqf focuses on long-term community development through sustainable resource management.

Impact on Society: Comparative Analysis

Zakat, as an obligatory almsgiving in Islam, directly alleviates poverty by redistributing wealth to the needy, fostering social equity and economic balance within society. Waqf, a voluntary endowment, sustains long-term community development projects such as schools, hospitals, and infrastructure, generating ongoing social and economic benefits. Both mechanisms complement each other, with Zakat addressing immediate welfare needs and Waqf promoting sustainable societal growth.

Conclusion: Integrating Zakat and Waqf for Community Welfare

Integrating Zakat and Waqf creates a sustainable financial framework that amplifies community welfare by addressing immediate needs and long-term development. Zakat provides essential relief to the vulnerable, while Waqf generates ongoing resources for education, healthcare, and infrastructure. Synergizing these Islamic financial instruments maximizes social impact and fosters economic empowerment within marginalized populations.

Zakat Infographic

libterm.com

libterm.com