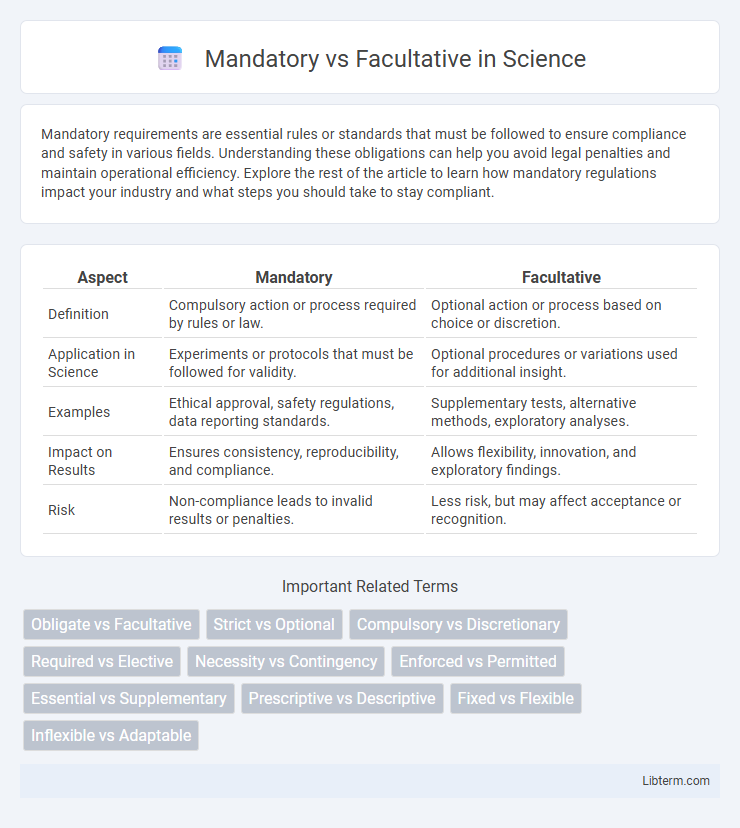

Mandatory requirements are essential rules or standards that must be followed to ensure compliance and safety in various fields. Understanding these obligations can help you avoid legal penalties and maintain operational efficiency. Explore the rest of the article to learn how mandatory regulations impact your industry and what steps you should take to stay compliant.

Table of Comparison

| Aspect | Mandatory | Facultative |

|---|---|---|

| Definition | Compulsory action or process required by rules or law. | Optional action or process based on choice or discretion. |

| Application in Science | Experiments or protocols that must be followed for validity. | Optional procedures or variations used for additional insight. |

| Examples | Ethical approval, safety regulations, data reporting standards. | Supplementary tests, alternative methods, exploratory analyses. |

| Impact on Results | Ensures consistency, reproducibility, and compliance. | Allows flexibility, innovation, and exploratory findings. |

| Risk | Non-compliance leads to invalid results or penalties. | Less risk, but may affect acceptance or recognition. |

Introduction to Mandatory vs Facultative

Mandatory insurance requires coverage by law, ensuring protection against specific risks, while facultative insurance offers optional, case-by-case coverage tailored to individual needs. In mandatory insurance, adherence is compulsory for all eligible parties, whereas facultative insurance allows insurers and insured parties to negotiate terms independently. These distinctions influence risk management strategies and regulatory compliance across various sectors.

Defining Mandatory: Key Characteristics

Mandatory insurance requires compulsory coverage by law, ensuring essential protection for individuals or entities against specific risks. Key characteristics include legal obligation, predefined coverage limits, and penalties for non-compliance, which guarantee widespread participation. This statutory framework contrasts with facultative insurance, where coverage choice and terms are negotiated individually.

Understanding Facultative: Main Features

Facultative insurance offers flexibility by allowing the insurer to evaluate risks on a case-by-case basis, unlike mandatory coverage that requires automatic acceptance of all risks within a portfolio. Its main features include selective risk assessment, negotiated terms, and tailored coverage, making it ideal for unique or high-risk exposures. This approach enables insurers to manage risk exposure more precisely while providing clients with customized protection options.

Historical Context: Origins and Evolution

The terms mandatory and facultative date back to Roman law, where mandatory obligations referred to duties imposed by legal authority, while facultative ones allowed personal discretion. In medieval legal systems, mandatory rules became foundational for public order, whereas facultative provisions offered flexibility in private contracts. Over time, these concepts evolved into distinct categories in modern legal and administrative contexts, differentiating between compulsory requirements and optional permissions.

Mandatory vs Facultative: Major Differences

Mandatory insurance requires policyholders to purchase coverage as mandated by law, ensuring universal protection in specific sectors such as auto liability and workers' compensation. Facultative insurance allows insurers to evaluate and accept or reject individual risks on a case-by-case basis, providing flexibility in underwriting unusual or high-risk exposures. The major difference lies in compulsory participation for mandatory insurance versus voluntary, selective acceptance in facultative insurance underwriting.

Advantages of Mandatory Systems

Mandatory systems ensure consistent compliance with regulatory standards, reducing risks of legal penalties and enhancing safety across industries. They provide a uniform framework that facilitates efficient monitoring and enforcement, leading to higher reliability and trust among stakeholders. Organizations benefit from predictable operational requirements, enabling better resource allocation and long-term planning.

Benefits of Facultative Approaches

Facultative reinsurance provides insurers with flexible risk management by allowing selective cession of specific risks, enhancing underwriting precision and financial control. This tailored approach supports improved capital allocation and risk diversification, reducing exposure to potentially catastrophic losses. Insurers benefit from facultative treaties through greater adaptability in volatile markets and optimized profitability.

Challenges Associated with Both Models

Mandatory insurance models face challenges related to regulatory compliance and ensuring universal coverage without excessive administrative costs, often leading to inflexibility for individual preferences. Facultative insurance, offering case-by-case underwriting, struggles with higher operational complexities and risk assessment demands, making it difficult to achieve consistent pricing and coverage. Both models must address the balance between risk pooling efficiency and tailored risk management to optimize financial sustainability and customer satisfaction.

Real-World Examples and Applications

Mandatory insurance policies, such as automobile liability insurance required by law in many countries, protect drivers and victims by ensuring compensation in accidents. Facultative reinsurance, commonly used by insurance companies to cover unique or high-risk policies like large commercial properties or specialized marine vessels, allows insurers to selectively cede risk. Real-world applications demonstrate how mandatory coverage guarantees baseline protection for the public, while facultative arrangements provide flexible, case-by-case risk management solutions for insurers.

Conclusion: Choosing the Right Approach

Mandatory insurance provides guaranteed coverage and financial protection, ensuring compliance with legal requirements and reducing risk exposure. Facultative insurance offers flexibility by allowing insurers to assess individual risks and tailor coverage, making it ideal for unique or high-risk situations. Selecting the right approach depends on the specific risk profile, regulatory environment, and coverage needs of the insured party.

Mandatory Infographic

libterm.com

libterm.com