Separation can be a challenging process that impacts emotional well-being and legal responsibilities. Understanding your rights and the steps involved helps ensure a smoother transition during this difficult time. Explore the rest of the article to learn essential tips for managing separation effectively.

Table of Comparison

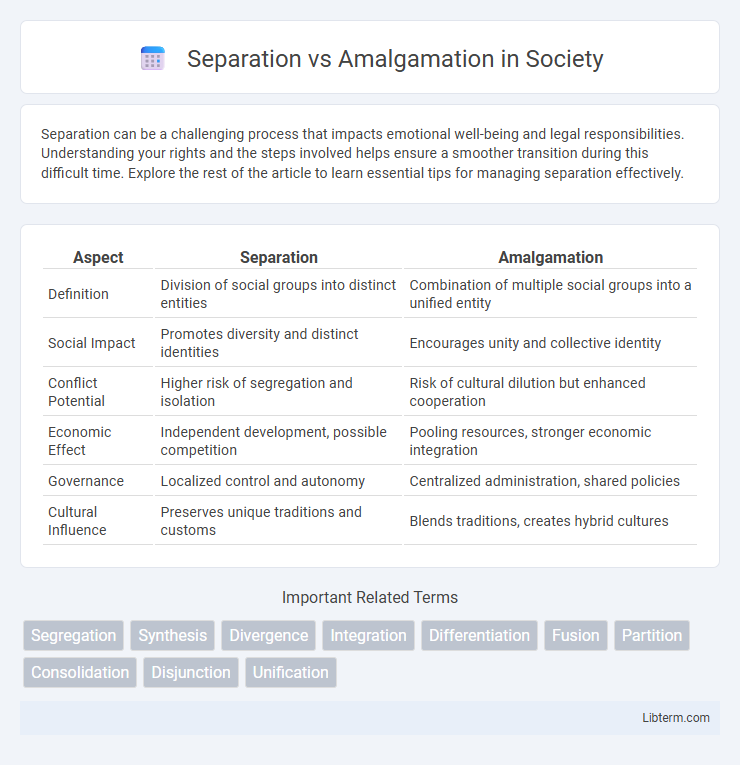

| Aspect | Separation | Amalgamation |

|---|---|---|

| Definition | Division of social groups into distinct entities | Combination of multiple social groups into a unified entity |

| Social Impact | Promotes diversity and distinct identities | Encourages unity and collective identity |

| Conflict Potential | Higher risk of segregation and isolation | Risk of cultural dilution but enhanced cooperation |

| Economic Effect | Independent development, possible competition | Pooling resources, stronger economic integration |

| Governance | Localized control and autonomy | Centralized administration, shared policies |

| Cultural Influence | Preserves unique traditions and customs | Blends traditions, creates hybrid cultures |

Introduction to Separation and Amalgamation

Separation and amalgamation are key corporate restructuring strategies used to optimize business efficiency and focus. Separation involves dividing a company into distinct entities, allowing each to operate independently with dedicated management and resources. Amalgamation refers to the merging of two or more companies into a single entity to enhance operational synergies and market presence.

Defining Separation: Concepts and Applications

Separation refers to the process of dividing or isolating components, substances, or entities based on distinct physical or chemical properties such as size, density, or solubility. It finds applications across various industries including chemical engineering for purifying compounds, environmental science for waste management, and manufacturing for material sorting. Effective separation techniques like filtration, centrifugation, and distillation enhance product quality, resource recovery, and process efficiency.

Understanding Amalgamation: Meaning and Benefits

Amalgamation refers to the process where two or more companies combine to form a single new entity, streamlining operations and enhancing market presence. This strategic consolidation often leads to increased financial strength, access to broader customer bases, and improved competitive advantage. Businesses pursuing amalgamation benefit from resource optimization, reduced redundancies, and potential tax advantages, fostering long-term growth and stability.

Key Differences Between Separation and Amalgamation

Separation involves dividing a single company into two or more independent entities, each operating separately with distinct assets and liabilities, whereas amalgamation refers to the merging of two or more companies into a single entity with combined resources and liabilities. In separation, the original company either ceases to exist or continues with reduced operations, while in amalgamation, all merging companies cease to exist and a new or existing company assumes control. Key differences lie in legal structure changes, asset distribution, liability allocation, and the impact on shareholder equity and corporate identity.

Historical Context and Evolution

Separation and amalgamation have historically shaped political and administrative boundaries, reflecting evolving governance models and societal needs. The 19th and 20th centuries saw notable shifts as emerging nation-states and colonial powers redefined territories through separation for localized control and amalgamation for centralized administration. Key examples include the partition of India in 1947, illustrating separation to address ethnic and religious divisions, and the amalgamation of Canadian provinces to improve administrative efficiency and economic development.

Advantages of Separation in Modern Organizations

Separation in modern organizations enhances specialization by allowing distinct departments to focus on core competencies, leading to increased efficiency and expertise. It improves risk management by isolating functions, which limits the impact of failures or disruptions within one area from affecting the entire organization. Furthermore, separation facilitates clearer accountability and performance measurement, enabling better decision-making and resource allocation.

Benefits and Challenges of Amalgamation

Amalgamation offers benefits such as economies of scale, enhanced market share, and diversified resources, leading to improved operational efficiency and competitive advantage. Challenges include cultural integration issues, regulatory compliance complexities, and potential redundancies causing employee dissatisfaction. Successfully managing these factors is crucial for realizing the full advantages of corporate amalgamation.

Case Studies: Separation vs. Amalgamation in Practice

Case studies comparing separation and amalgamation reveal distinct impacts on organizational efficiency and market competitiveness. Separation often enhances focus and agility by allowing entities to specialize, as seen in the 2015 eBay and PayPal split, which led to stronger strategic direction and growth in both companies. Conversely, amalgamation, exemplified by the 2020 merger of Fiat Chrysler and PSA Group forming Stellantis, achieves economies of scale and expanded market reach but requires complex integration efforts to harmonize operations and cultures.

Factors Influencing the Choice Between Separation and Amalgamation

Factors influencing the choice between separation and amalgamation include organizational goals, financial implications, and regulatory requirements. Separation is preferred when distinct business units seek autonomy or risk mitigation, while amalgamation suits companies aiming for operational synergies and cost efficiency. Market conditions, cultural compatibility, and stakeholder interests also play critical roles in shaping the decision-making process.

Conclusion: Which Approach is Best?

Separation offers clear operational boundaries and risk mitigation, ideal for businesses seeking focused management and regulatory compliance. Amalgamation provides streamlined processes and unified resource allocation, benefiting organizations aiming for integrated growth and cost efficiency. The best approach depends on specific business goals, industry context, and regulatory environment.

Separation Infographic

libterm.com

libterm.com